Entergy Corp

Latest Entergy Corp News and Updates

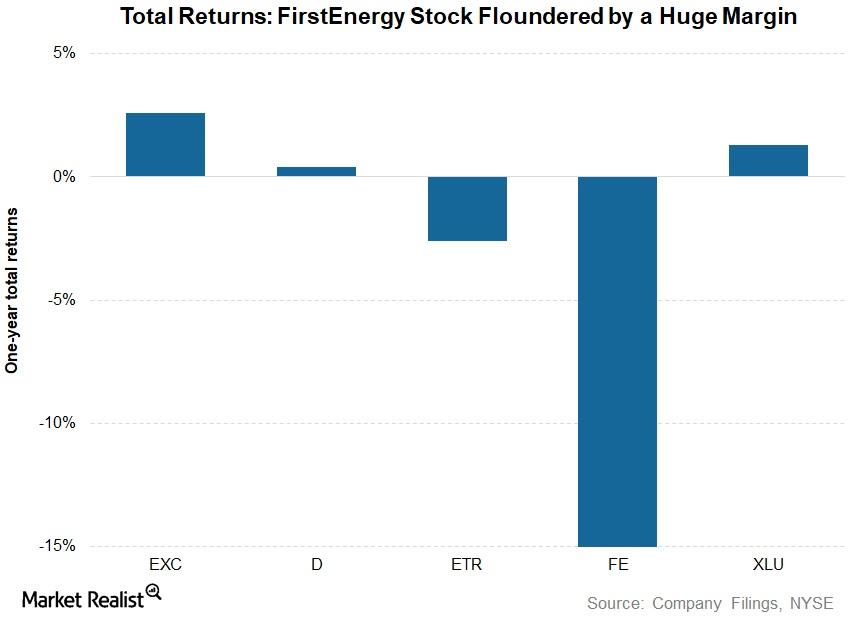

FE, D, EXC, or ETR: Which Utility Stock Stung Investors?

Exelon (EXC) stock has corrected nearly 2% in the last year. Including dividends, its returns have come in at ~3%.Energy & Utilities Must-know: Who owns Dominion?

Institutional investors hold most of Dominion Resources’ (D) outstanding shares. As of June 30, 2014, a total of 351.2 million shares were held by 1,069 institutions.