Consolidated Edison Inc

Latest Consolidated Edison Inc News and Updates

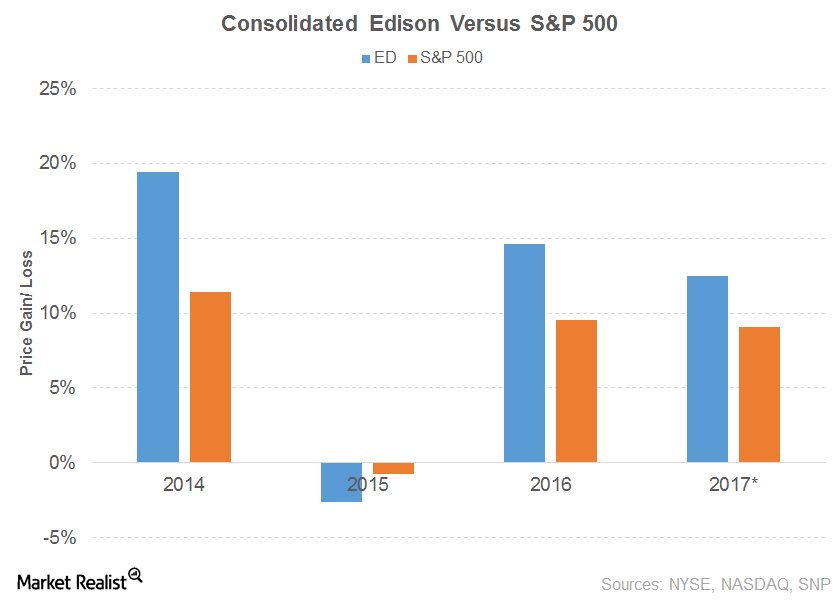

These Utilities Have Increased Dividends for 45+ Years

Investors take shelter under relatively safe utility stocks amid market turmoil due to their stable dividend payment abilities.

Consolidated Edison’s Dividend Trajectory

Consolidated Edison’s (ED) 2016 operating revenues fell 4.0% due to a decline in every segment; namely, electric, gas, steam, and non-utility.

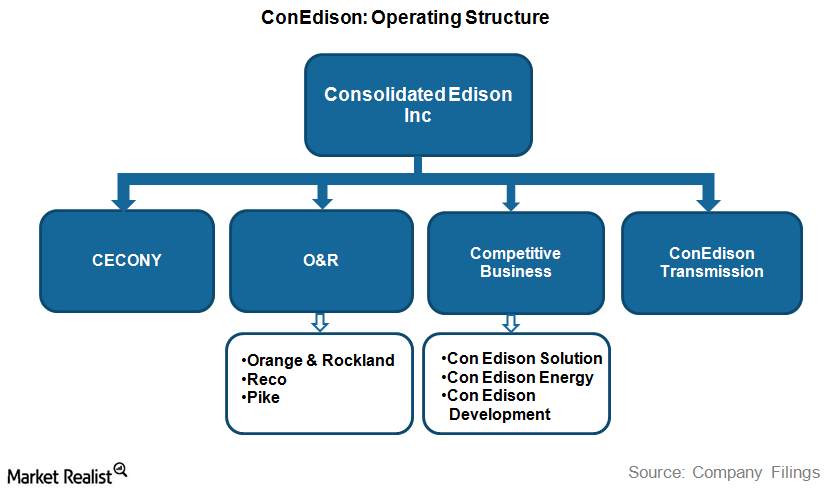

What You Should Know about Con Edison’s Operating Structure

Con Edison handles its competitive energy business through its three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy, and Con Edison Development.

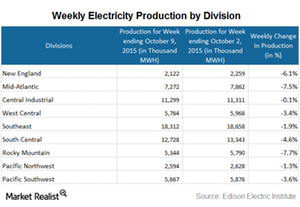

Electricity Generation Falls in All Census Divisions

the electricity generation in the US fell by 3.5% to 71.1 million mWh. Electricity generation fell in all of the nine census divisions during the week ended October 9.