AIRBUS GROUP

Latest AIRBUS GROUP News and Updates

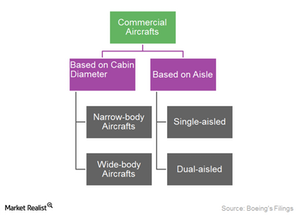

Boeing’s Commercial Aircraft Classifications

Boeing’s commercial aircraft carry 100–500 passengers, including dual-aisle wide-body aircraft and narrow-body planes with four- to seven-across seating.

Delta Air Lines Is Waiting for the 797—Is Boeing Ready?

Last week, Delta Air Lines’ CEO told Bloomberg that the carrier is still hoping Boeing will build a new midmarket airplane, dubbed the Boeing 797.

Boeing 777X Failed a Stress Test, More 737 MAX Concerns

In another setback, Boeing’s (BA) long-haul and wide-body 777X variant failed a stress test. The test was part of the FAA’s certification process.

Dow Jones, Boeing, and GE Fall: Hard Landing Ahead?

On Wednesday, US stock indexes fell due to recession signals. The Dow Jones Industrial Average (DIA) was the worst performer with a 3.05% fall.

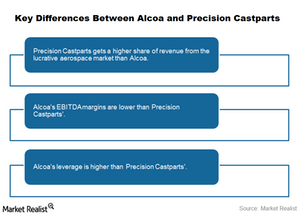

Arconic Isn’t Precision Castparts, and the Market Knows That!

Market participants who are bullish on Alcoa (AA) point to Berkshire Hathaway’s (BRK-B) acquisition of Precision Castparts.

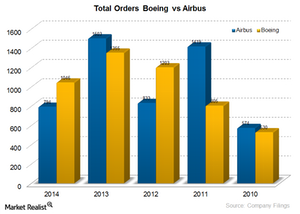

Boeing’s global competitors

Boeing’s global competitors include Airbus, Embraer, and Bombardier.