Dover Corp

Latest Dover Corp News and Updates

Dover Corporation: Growing by Acquiring

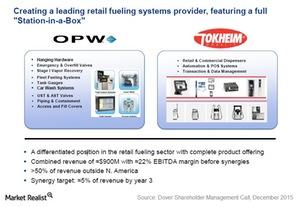

Since its inception, Dover Corporation (DOV) has followed an acquisition-based growth strategy. The company has acquired over 100 manufacturing companies since 1955, and it currently manages close to 30 independently operating companies under its umbrella.

Dover Refrigeration & Food Equipment: Keeping It Cool

The Dover Refrigeration & Food Equipment unit is a major provider of refrigerated display cases and kitchen equipment such as cookers, mixers, braising pans, and packaging and processing solutions for the meat and poultry business.

Dover Fluids: A Brief Overview

Dover Corporation’s (DOV) Fluids businesses include the Pump Solutions Group (or PSG), which provides pumping solutions to several end markets.

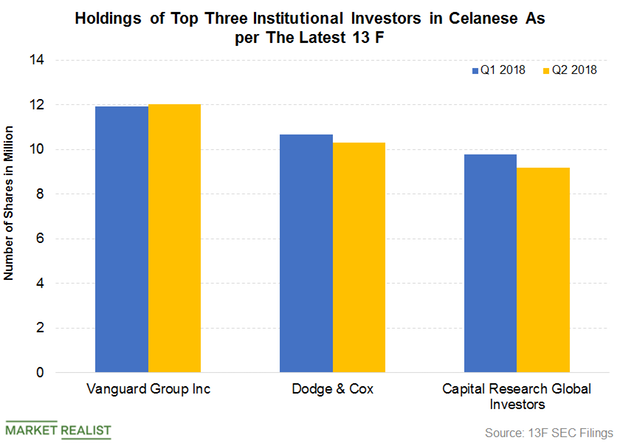

What Are Institutional Investors’ Positions on Celanese?

Second-quarter 13F SEC filings indicate that institutional investors own 95.3% of Celanese’s (CE) outstanding shares.

Understanding Dover Corporation’s Corporate Profile and History

Dover Corporation (DOV) is a machinery manufacturer that operates in four diverse segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment.

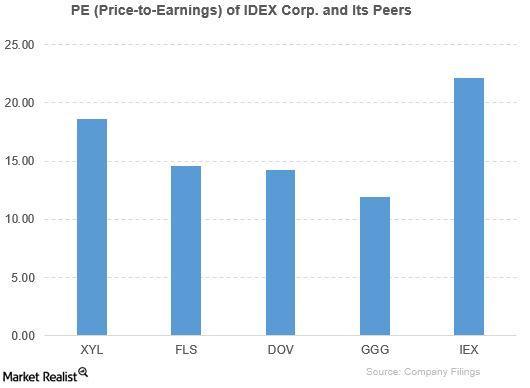

How Does IDEX Compare to Its Peers?

IDEX outperformed its peers based on the PE ratio and PBV ratio. The ETFs outperformed it based on the PE ratio. It’s ahead of its ETFs based on the PBV ratio.