ProShares Ultra Oil & Gas

Latest ProShares Ultra Oil & Gas News and Updates

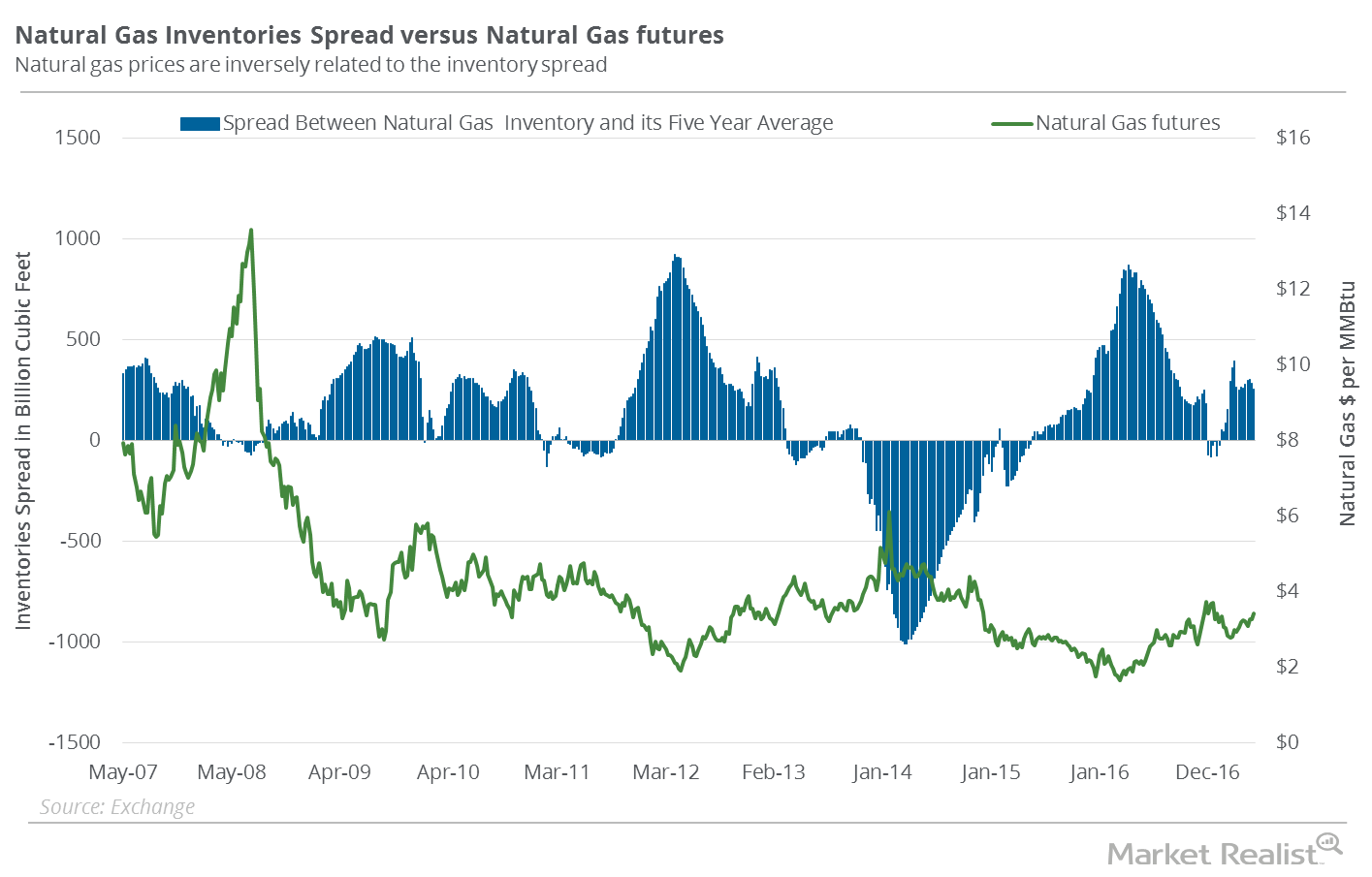

Natural Gas Inventories Spread: Savior for Natural Gas Bulls?

The EIA reported that natural gas inventories rose by 78 Bcf (billion cubic feet) to 2,709 Bcf in the week ending June 9, 2017.

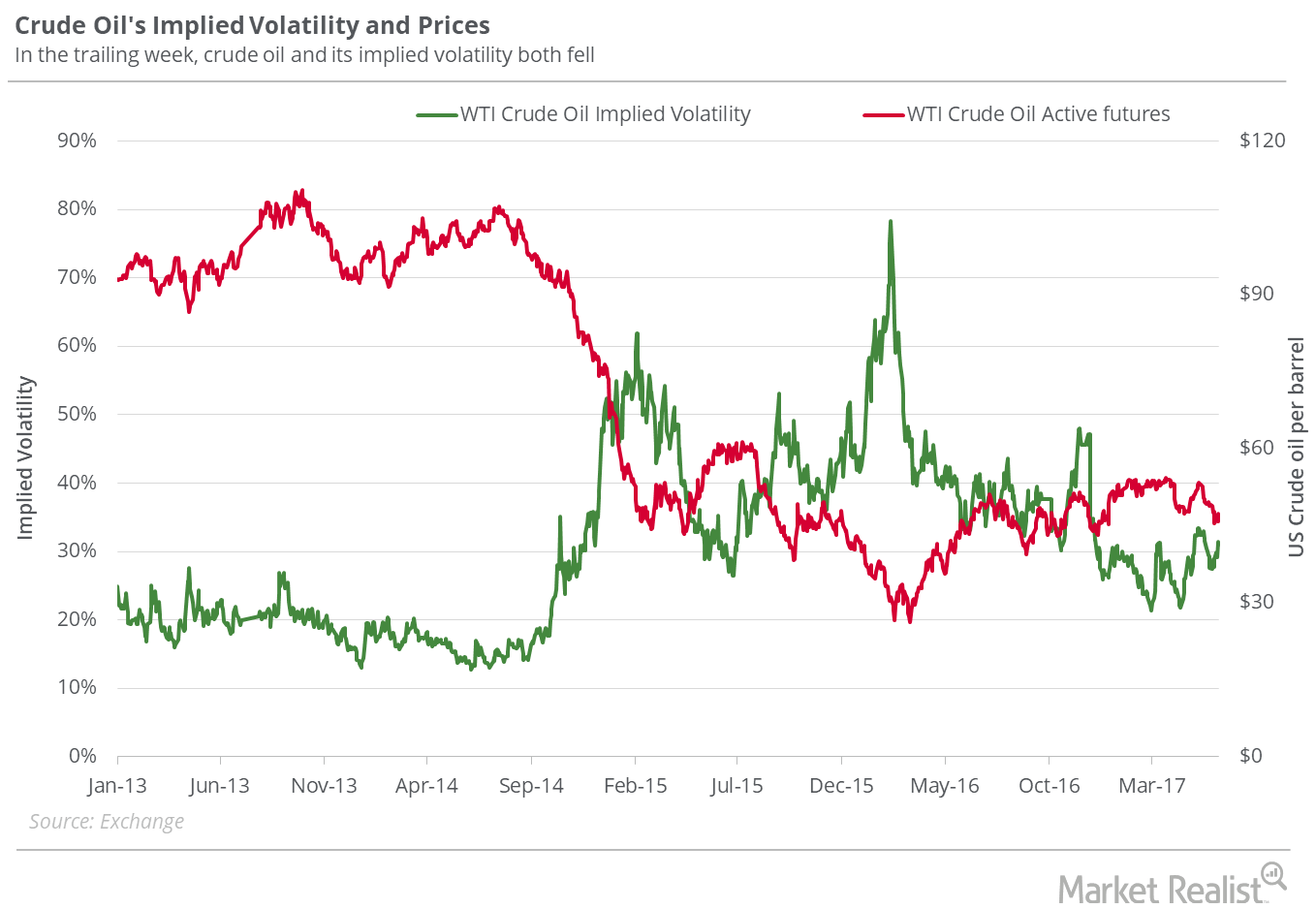

Where Will US Crude Prices Settle?

On June 15, 2017, US crude oil active futures’ implied volatility was 27.9%.

What’s in the Natural Gas Inventory Spread—Bears?

In the week ended June 2, 2017, natural gas inventories rose by 106 Bcf.

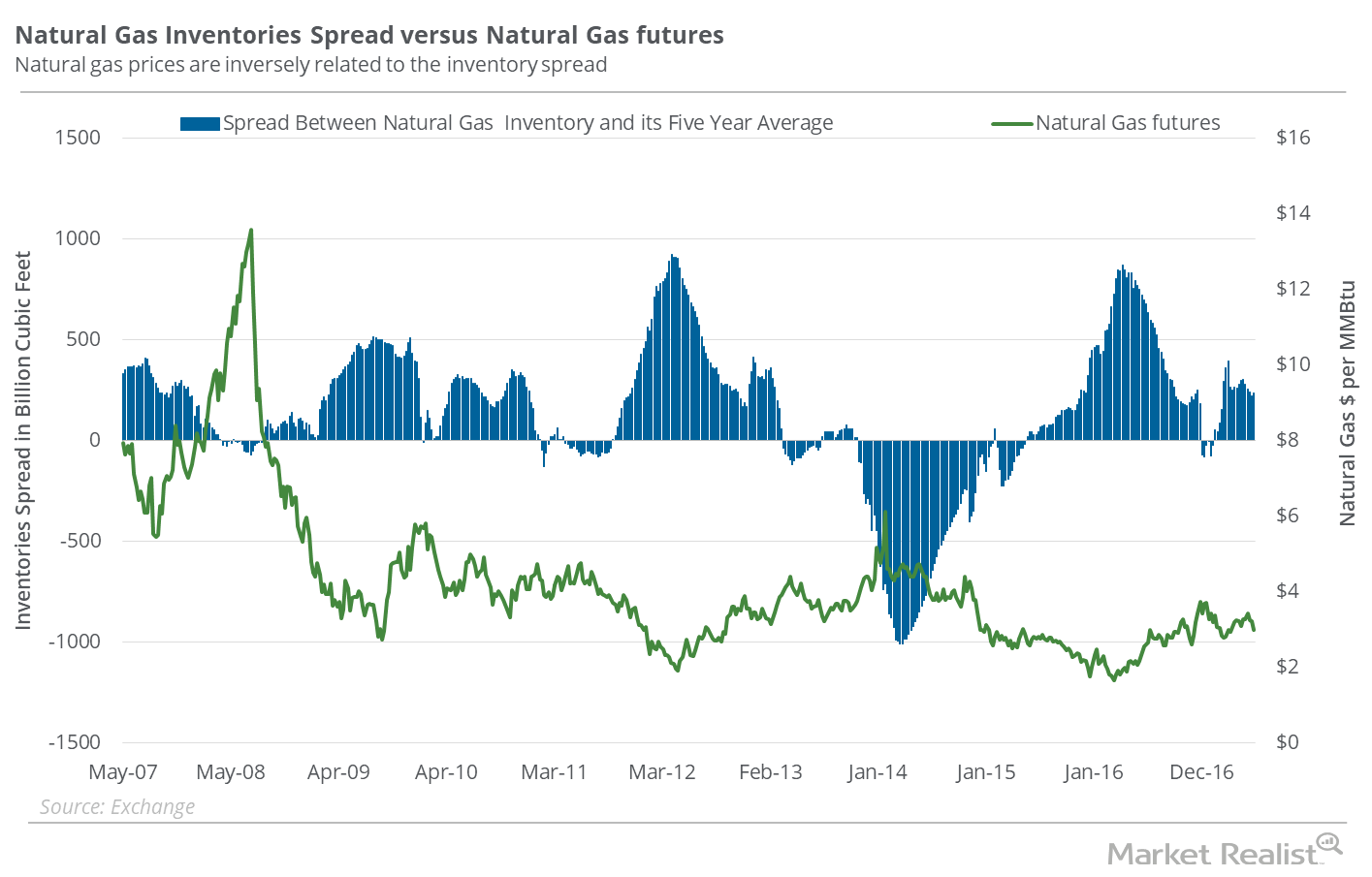

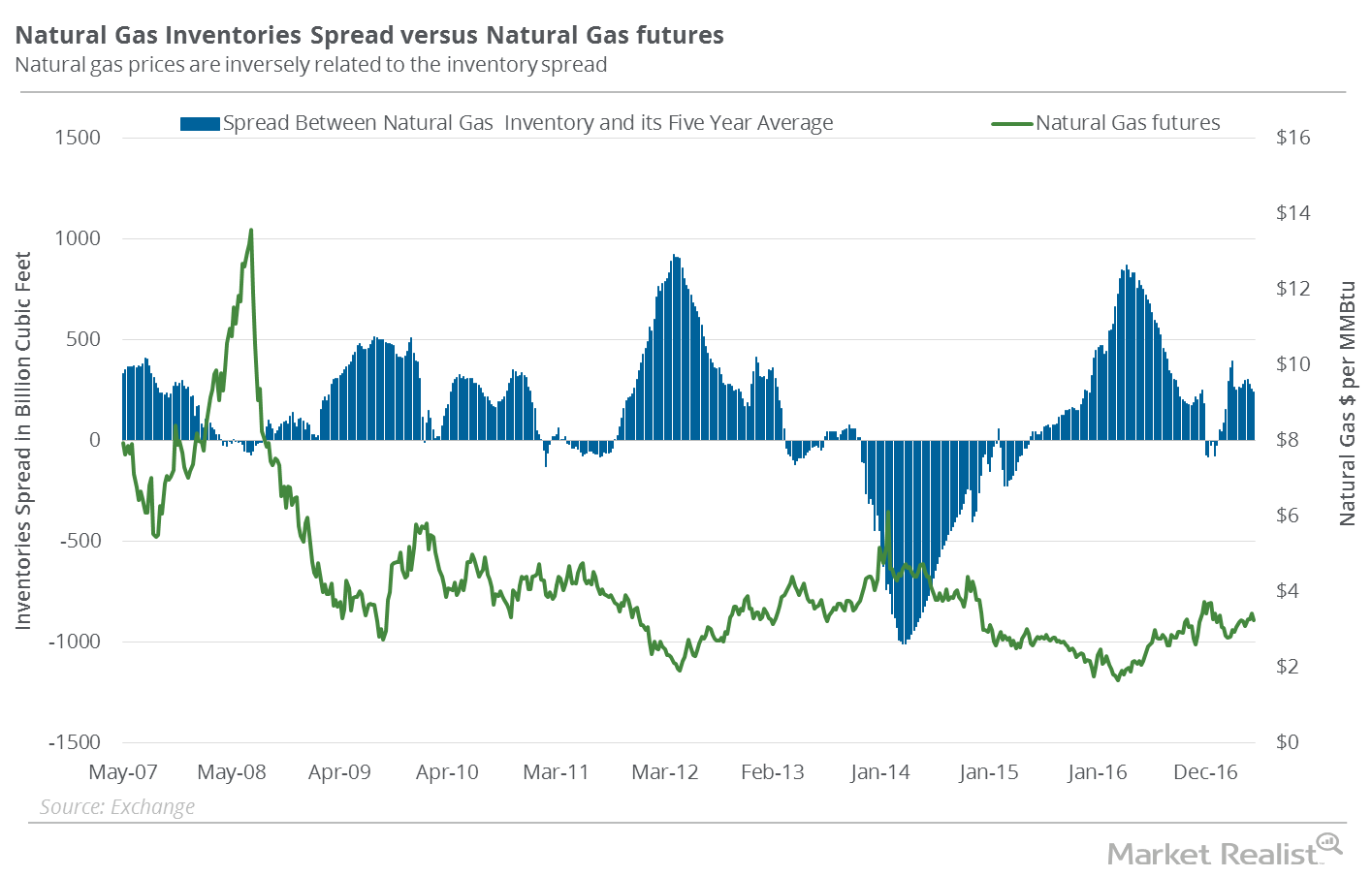

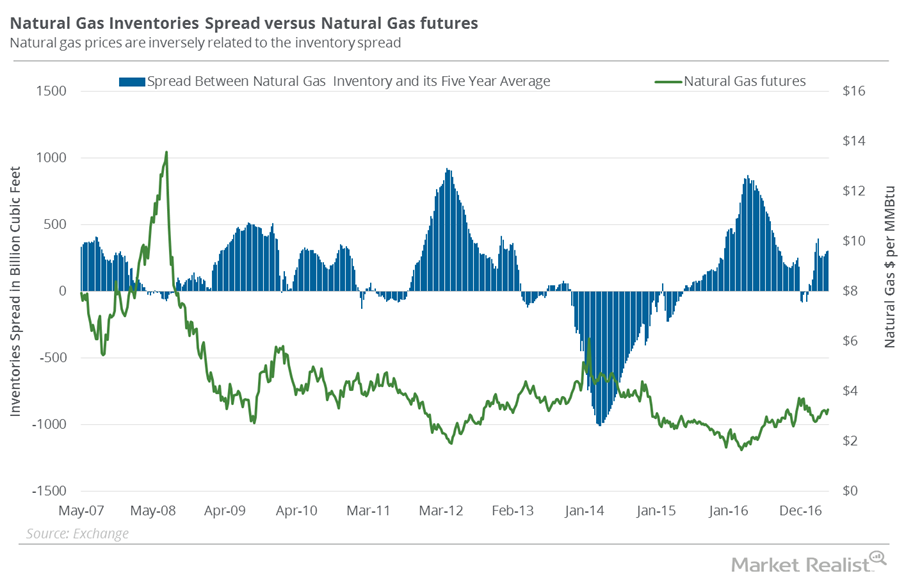

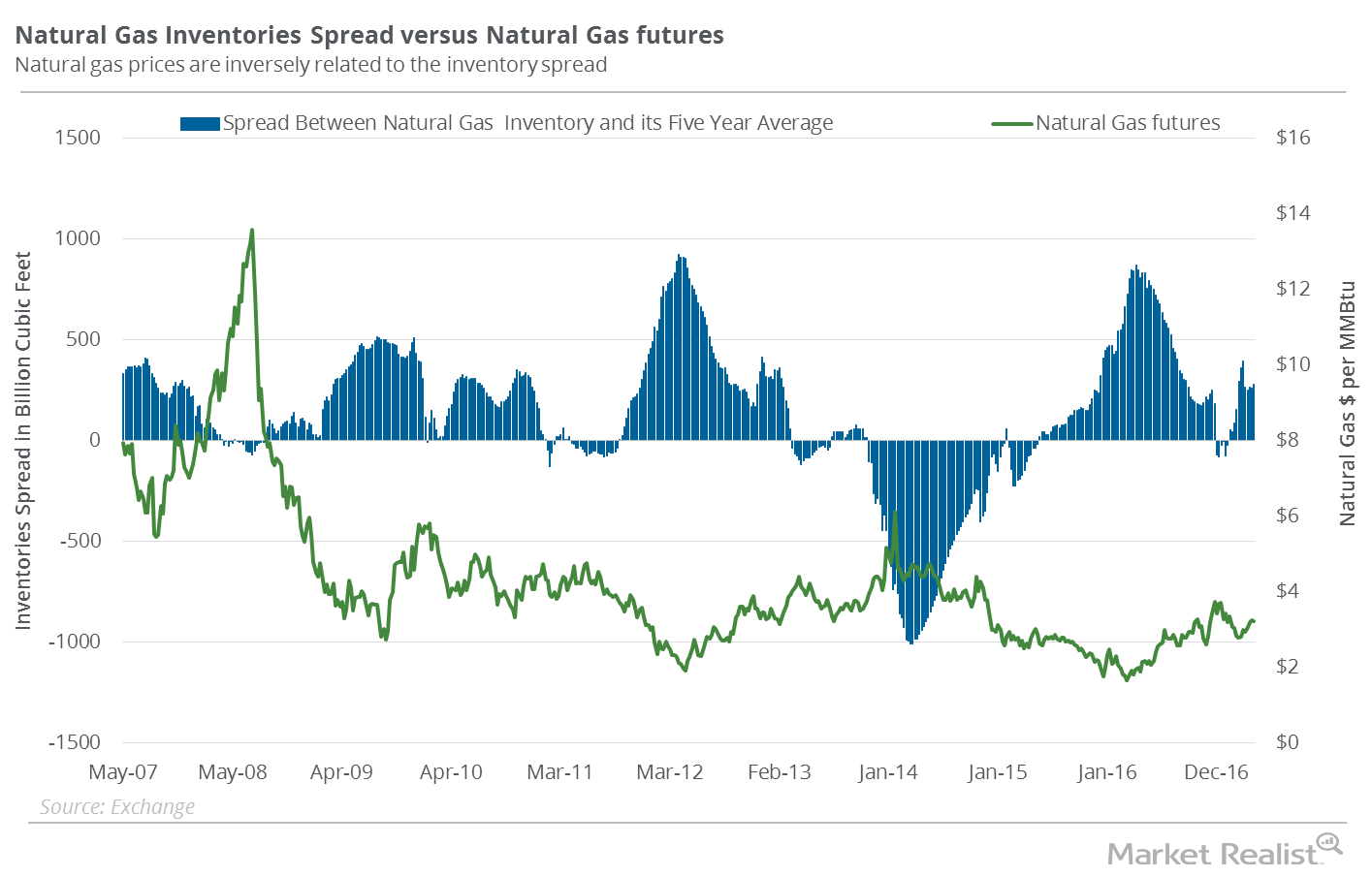

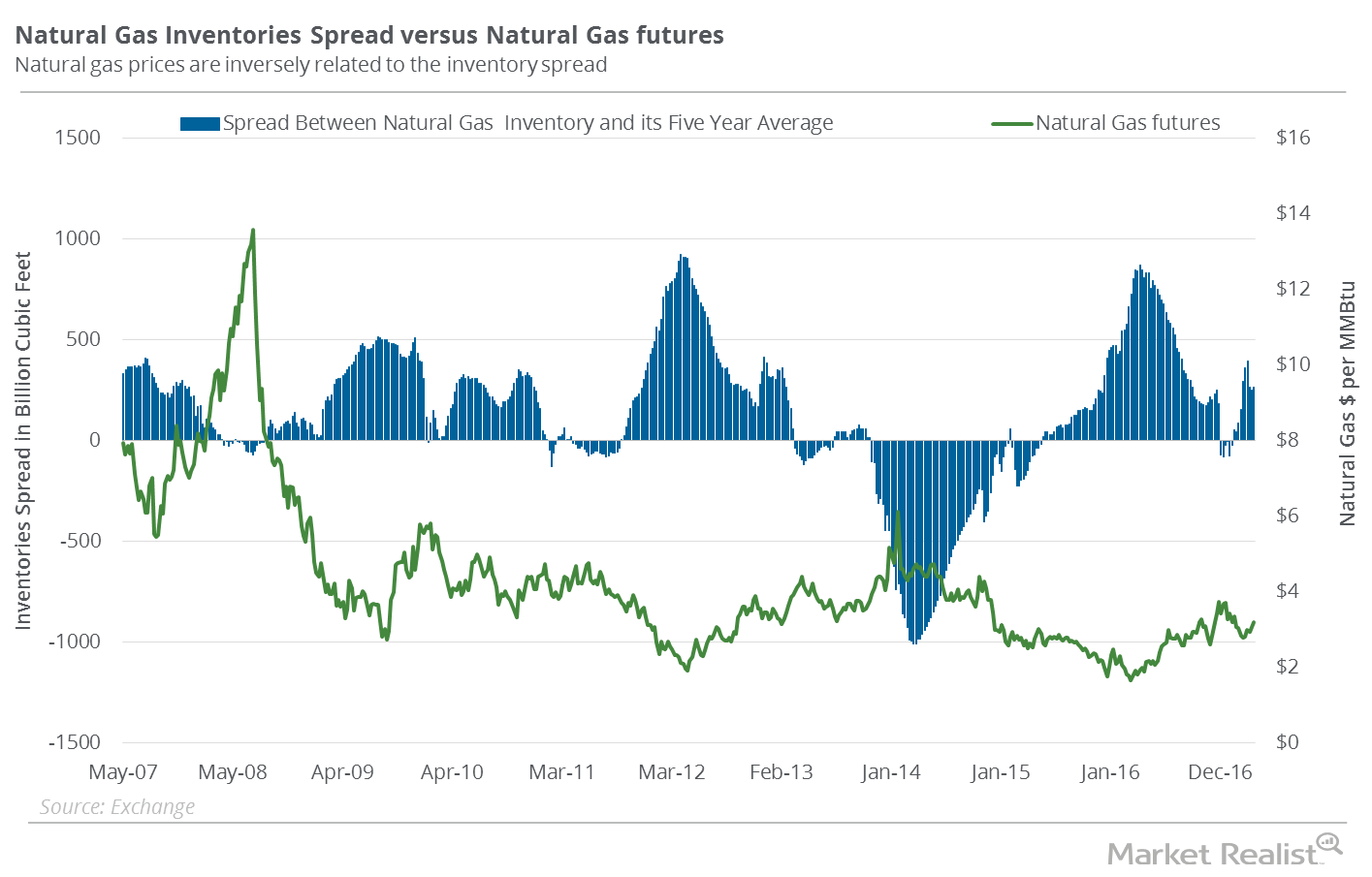

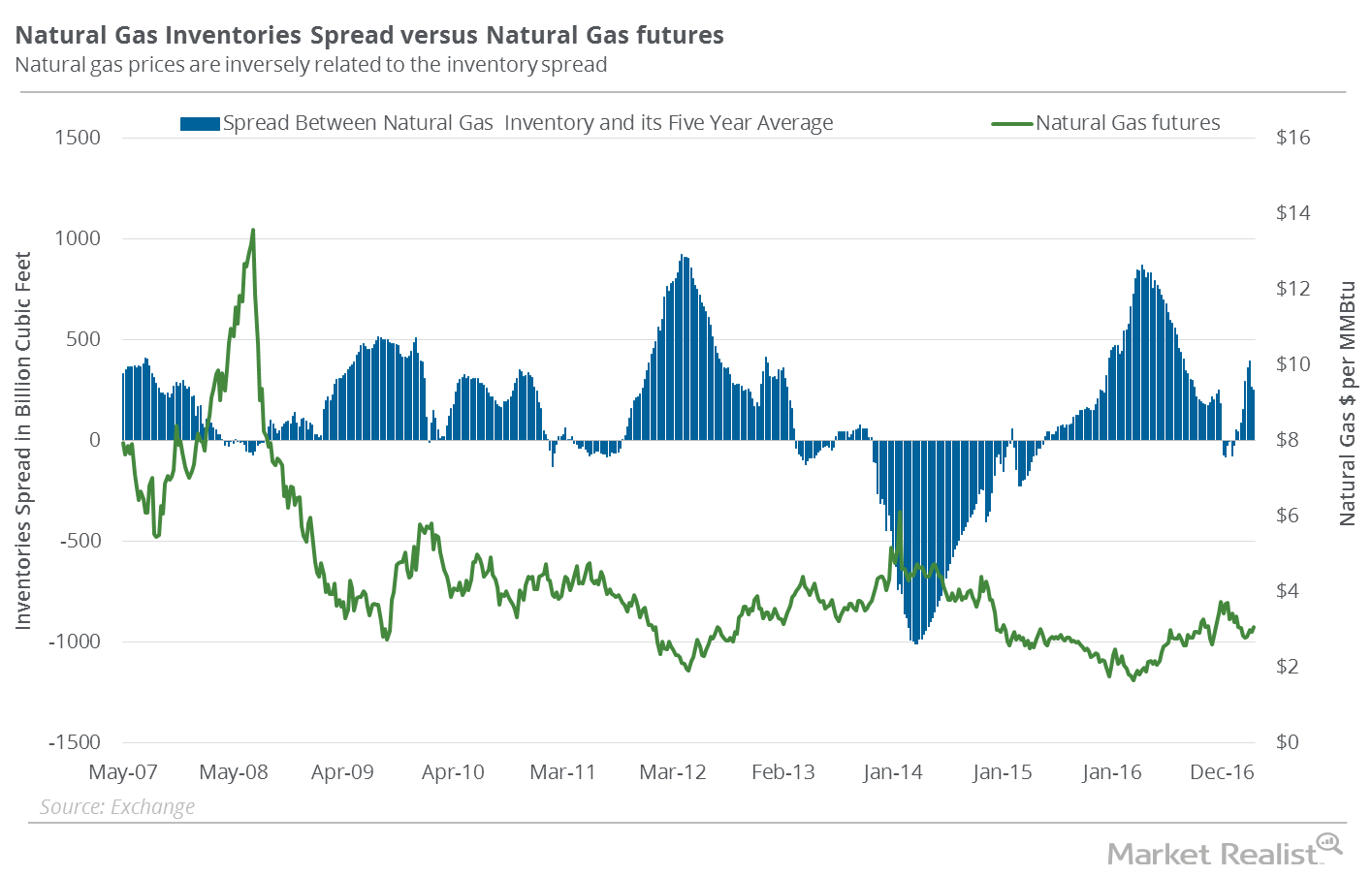

Chart in Focus: The Natural Gas Inventory Spread

Between January 27–June 7, 2017, natural gas active futures fell 10.9%. Natural gas inventories moved above their five-year average in the week ended January 27, 2017.

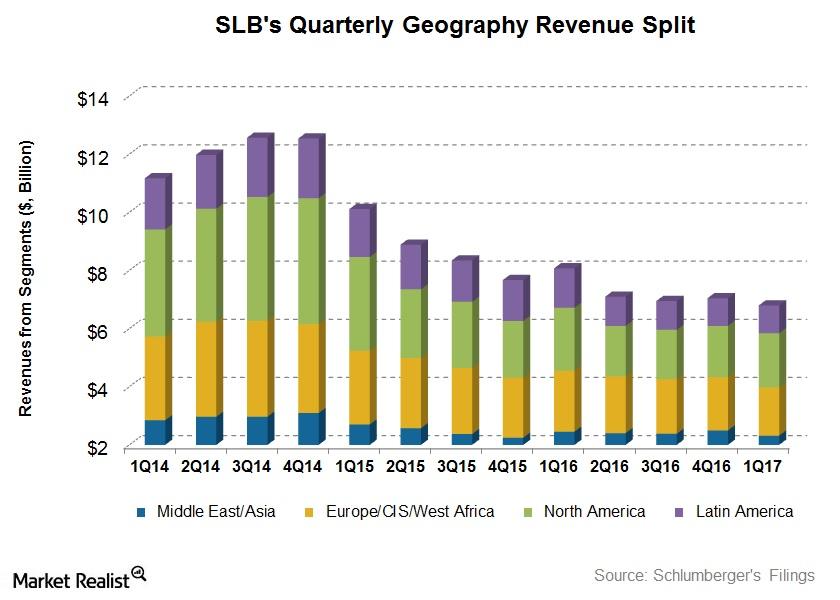

What Were Schlumberger’s Drivers in 1Q17?

Schlumberger’s (SLB) Latin America region witnessed the highest revenue decline (30% fall) in 1Q17—compared to 1Q16.

Why the Inventory Spread Could Make Natural Gas Bulls Happy

On a week-over-week basis, natural gas inventories rose by 75 Bcf (billion cubic feet) and were at 2,444 Bcf for the week ended May 19, 2017.

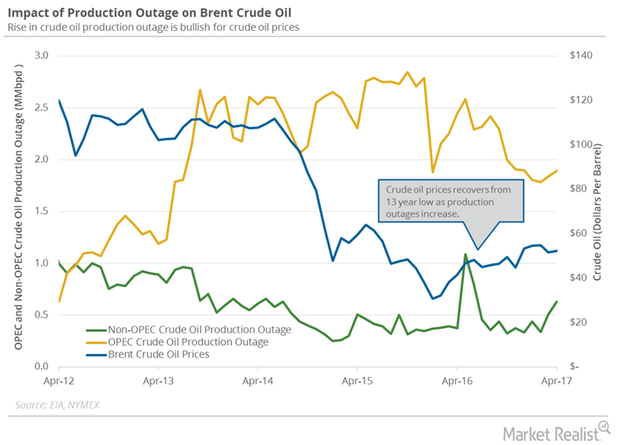

Global Crude Oil Supply Outages Could Help Crude Oil Bulls

The EIA estimated that global crude oil supply outages rose by 181,000 bpd (barrels per day) to 2.52 MMbpd in April 2017—compared to March 2017.

Natural Gas Inventory Spread Is Falling: Will Gas Prices Soar?

According to EIA data announced on May 18, there was an addition of 68 Bcf to natural gas (GASX) (FCG) (GASL) inventories for the week ending May 12, 2017.

Is the Natural Gas Inventory Spread Optimistic?

According to data from the EIA on May 4, natural gas (GASX) (FCG) (GASL) inventories rose by 67 Bcf (billion cubic feet) during the week ending April 28.

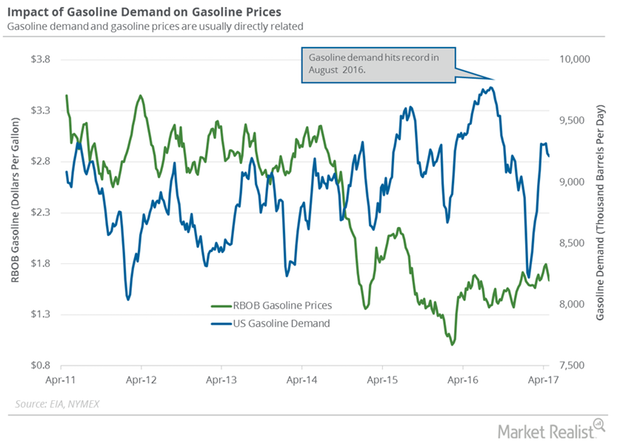

Is US Gasoline Demand Turning Bearish?

The EIA estimated that four-week average US gasoline demand fell by 22,000 bpd (barrels per day) to 9,215,000 bpd on April 21–28, 2017.

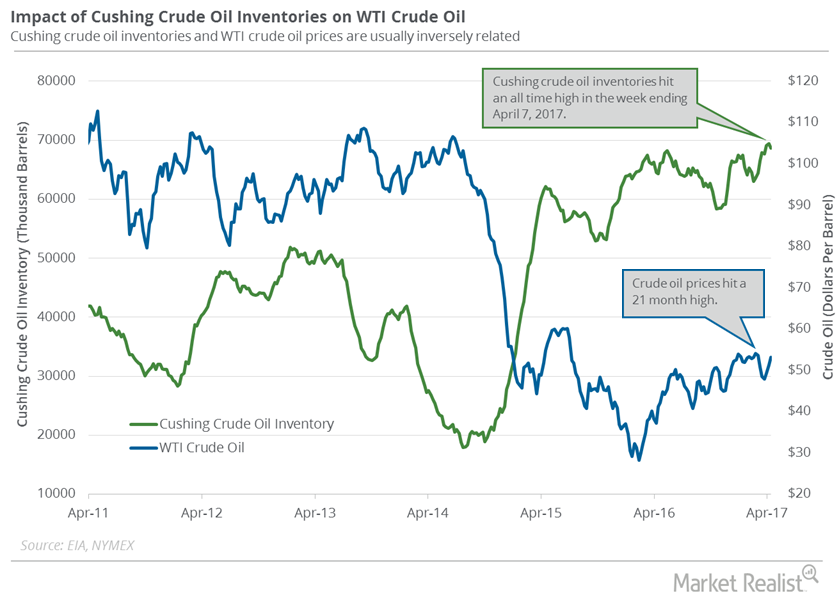

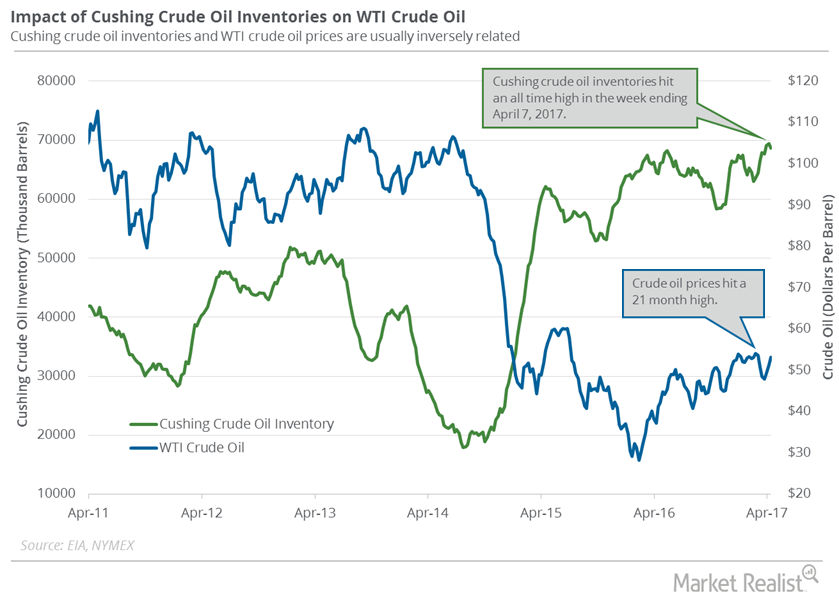

Cushing Crude Oil Inventories Fell for 3rd Consecutive Week

Market surveys estimate that Cushing crude oil inventories rose between April 28 and May 5, 2017.

The Natural Gas Inventory Spread: Another Bearish Indicator?

According to data from the EIA released on April 27, 2017, natural gas inventories rose 74 Bcf (billion cubic feet) during the week ended April 21, 2017.

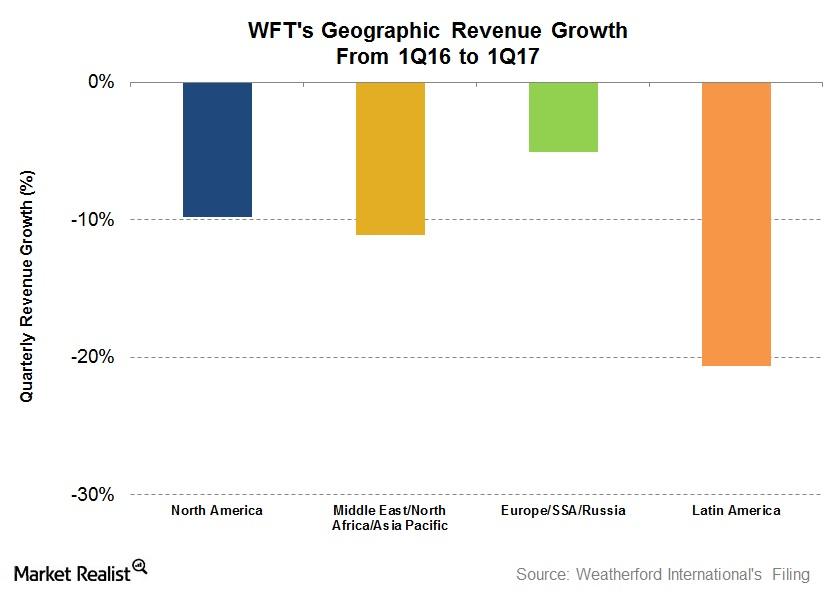

What Impacted Weatherford’s 1Q17 Performance?

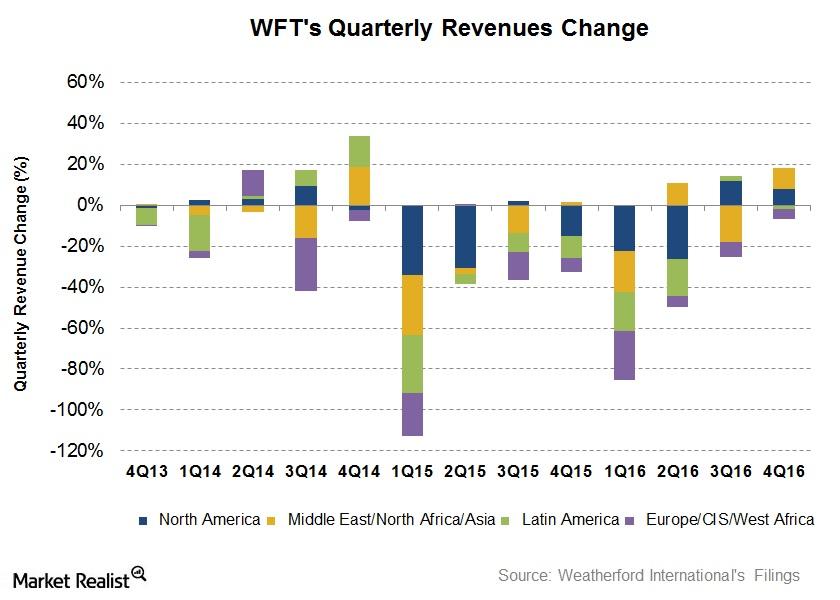

Weatherford’s North America region’s 1Q17 operating loss improved to $18 million—compared its operating loss of $128 million last year.

Natural Gas Inventories Spread: What Investors Should Know

According to data from the EIA released on April 20, 2017, natural gas (GASX) (FCG) (GASL) inventories rose by 54 Bcf during the week ending April 14, 2017.

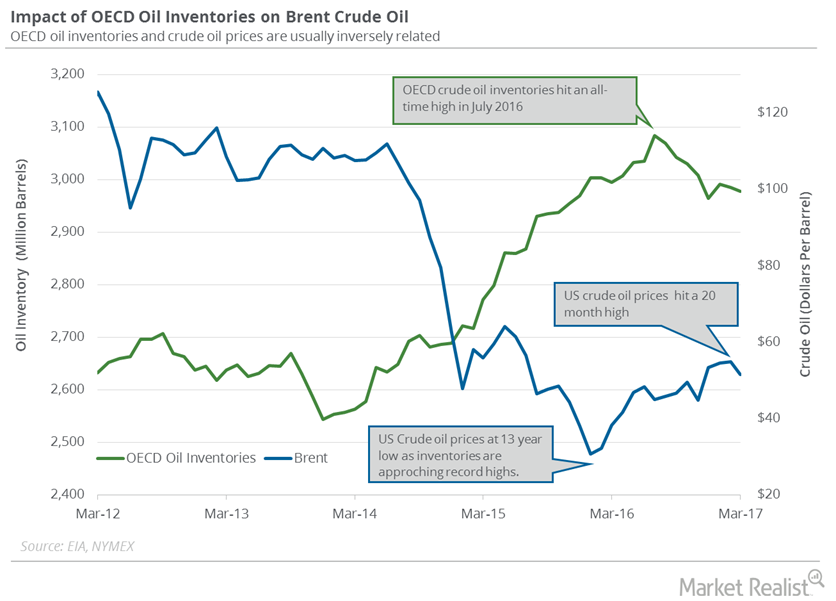

OECD’s Crude Oil Inventories Impact Crude Oil Futures

The EIA estimates that OECD’s crude oil inventories fell by 7.69 MMbbls (million barrels) to 2,977 MMbbls in March 2017—compared to the previous month.

Cushing Crude Oil Inventories Fell from an All-Time High

For the week ending April 14, 2017, the EIA reported that Cushing crude oil inventories fell by 0.8 MMbbls (million barrels) to 68.6 MMbbls.

Inventories Spread: Will Natural Gas Prices Fall Again?

Natural gas (GASX) (FCG) (GASL) inventories rose by ten Bcf (billion cubic feet) during the week ending April 7, 2017.

Analyzing Weatherford International’s Growth Drivers in 4Q16

Revenues from Weatherford International’s (WFT) Europe/Sub Saharan Africa/Russia region fell the most with a 36.5% fall from 4Q15 to 4Q16.

Inventories Spread: Why Natural Gas Uptrend Could Be at Risk

According to data from the EIA (U.S. Energy Information Administration) released on March 30, 2017, natural gas inventories fell by 43 Bcf (billion cubic feet) during the week ending March 24, 2017.

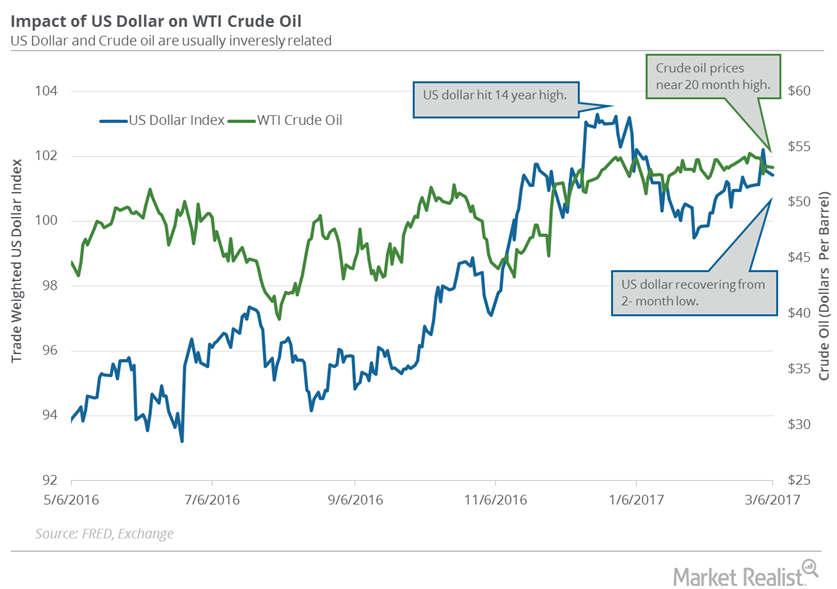

Janet Yellen and the US Dollar Impacted Crude Oil Prices

The US dollar and crude oil (ERY) (ERX) (DIG) (XES) are usually inversely related. A weaker US dollar makes crude oil more affordable for oil importers.

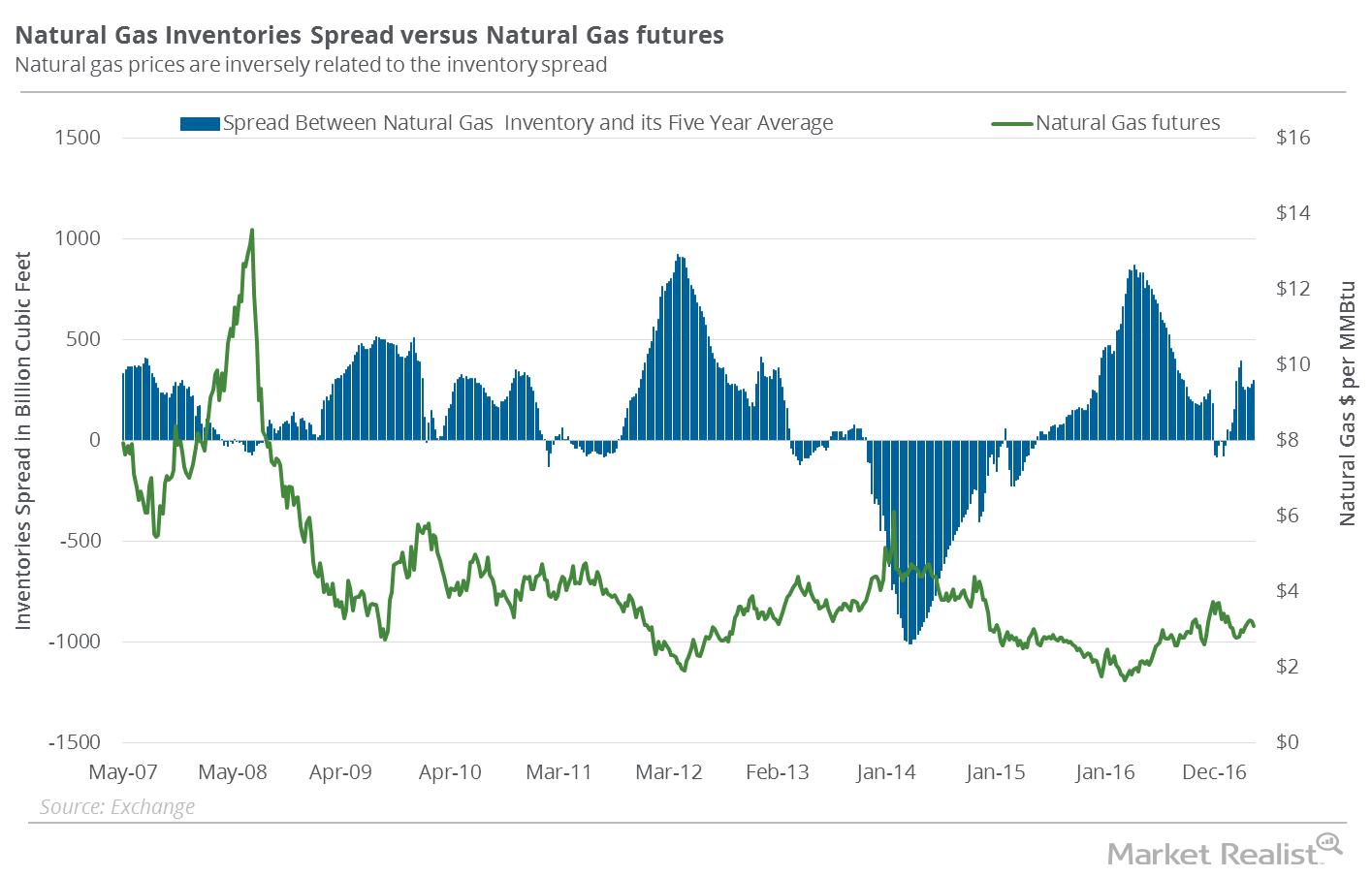

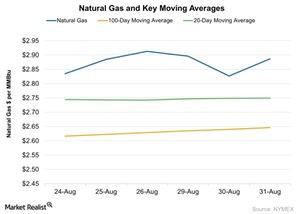

What Does The Price Action in Natural Gas Indicate?

In the last five trading sessions, natural gas October futures have risen by 1.8%. They closed at ~$2.89 per MMBtu on August 31, 2016.

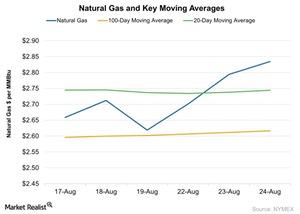

What’s Driving Natural Gas Prices Higher?

Natural gas prices broke above the 20-day moving average on August 23. This indicates short-term bullishness in natural gas prices.