Calpine Corp

Latest Calpine Corp News and Updates

Oaktree Capital Sheds Nearly Half Its Holdings in NRG Energy

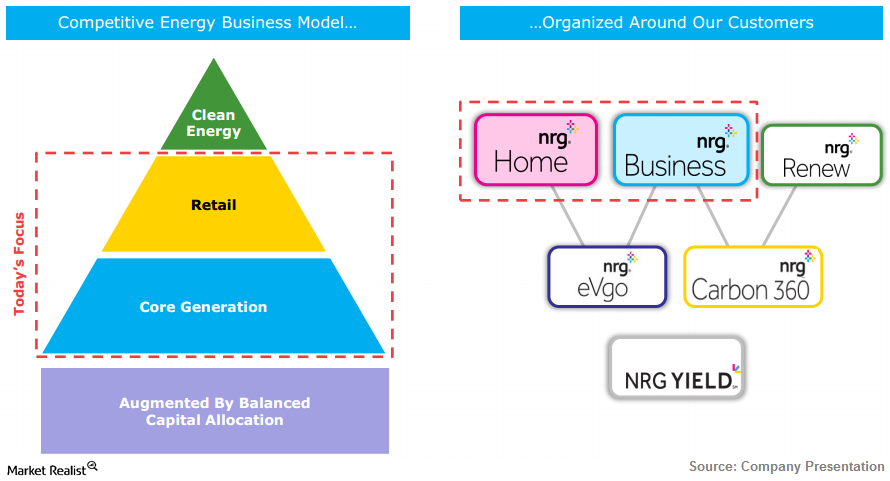

NRG Energy is a US-based integrated retail electricity and wholesale power-generation firm. The company has 2.5 million residential customers across the US.Energy & Utilities Why did the market punish Exelon?

Exelon Corporation’s (EXC) stock has been hammered in the last six years. In 2008, the stock was trading at ~$90 per share. Early this year, the stock was available at less than $27 per share.Energy & Utilities Must-know: Understanding Duke’s strategy

In recent years, Duke Energy (DUK) made its intent very clear. It concentrates on its regulated utilities—its core business—instead of other areas. The regulated utilities business is Duke’s strength.

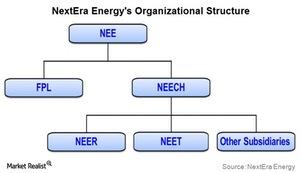

NextEra Energy plays in regulated and unregulated utility markets

NextEra Energy is a Florida-based power company. Its subsidiaries are Florida Light & Power and NextEra Energy Resources.