Compass Minerals International Inc

Latest Compass Minerals International Inc News and Updates

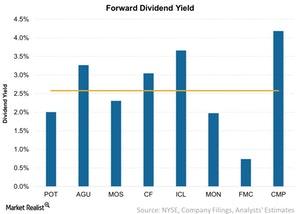

Screening for Dividend Stocks in the Agriculture Sector

Perhaps dividend yield is one of the most common starting points when screening for dividend stocks.

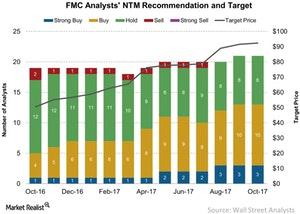

October Update: What Analysts Think about FMC

FMC (FMC) stock has risen 6.0% over the past month. The stock has significantly outperformed the benchmarks (SPY) (MOO) YTD with a 68.0% rise.

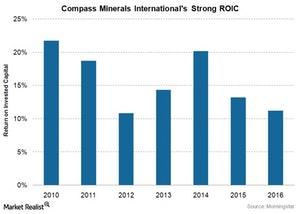

What’s Compass Minerals Doing to Gain a Cost Advantage?

Led by its superior assets, location, and geological advantages, Compass Minerals holds a competitive position with a wide economic moat rating.