Vanguard Total International Bond ETF

Latest Vanguard Total International Bond ETF News and Updates

Financials Risks you should know before investing in international bond funds

In this article, we’ll discuss some of the risks an investor must consider before investing in international bonds. Some of these risks are unique to this asset class.Financials Must-know variants in developed market international bond funds

International bond funds like the Vanguard Total International Bond Index ETF (BNDX) can have various investment styles determined by their stated choice of bond investments.

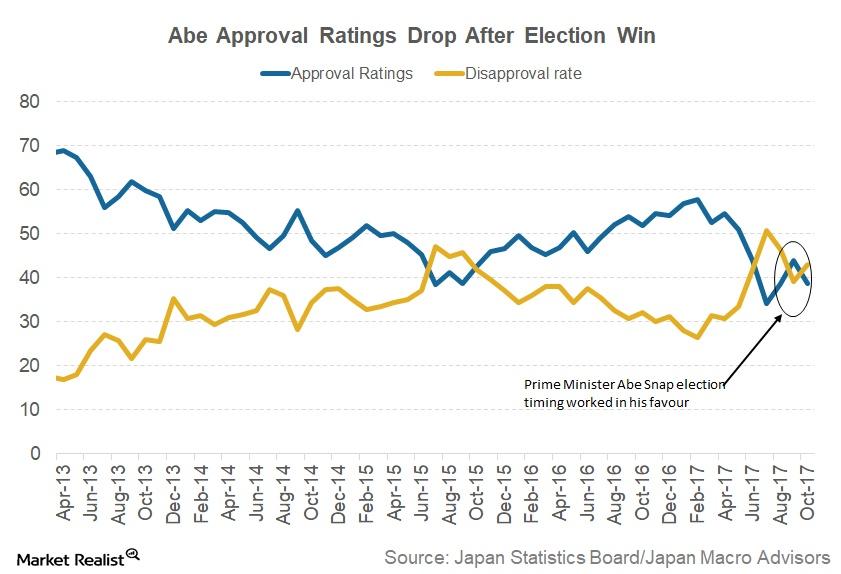

Why the Recent Election Results Are Positive for Japan

Japanese Prime Minister Shinzo Abe’s call for an early election worked in his favor. He called for a snap election to take advantage of his high ratings.

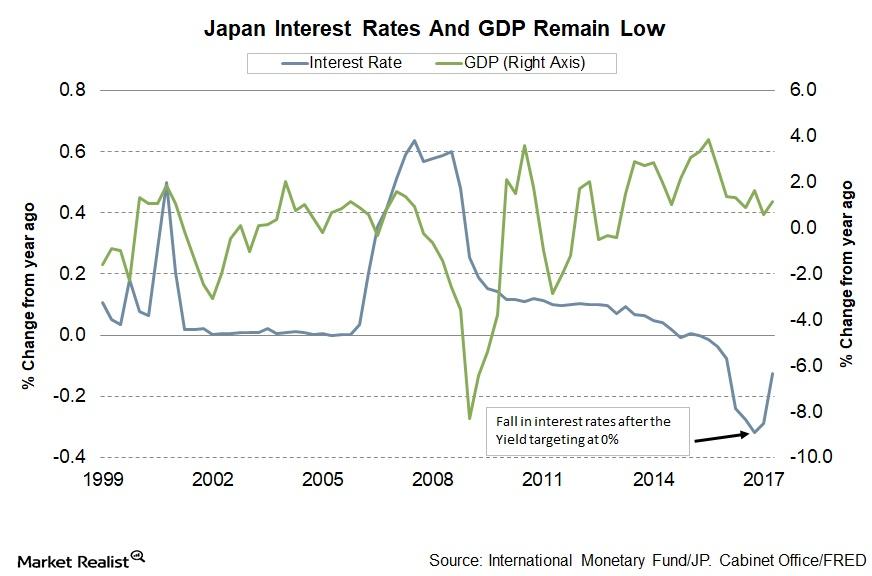

Bank of Japan Thinks the Inflation Target Can Be Achieved by 2019

For Japan’s economy, the main struggle has been the low level of inflation. Japan’s inflation has been low for the past three decades.

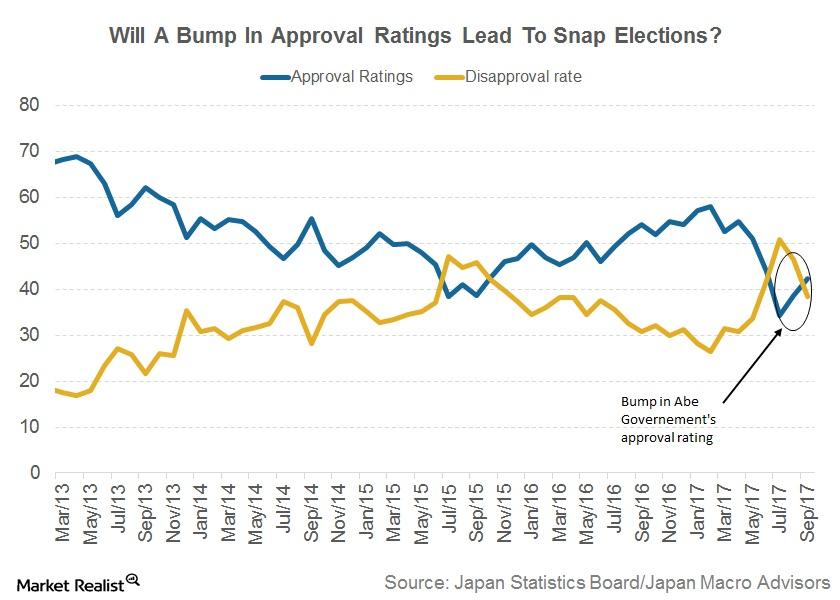

Bank of Japan Sees Rising Political Uncertainty as a Risk

According to news reports, Japanese Prime Minister Shinzo Abe could be calling for a snap election next month to capitalize on the increased approval ratings in August.

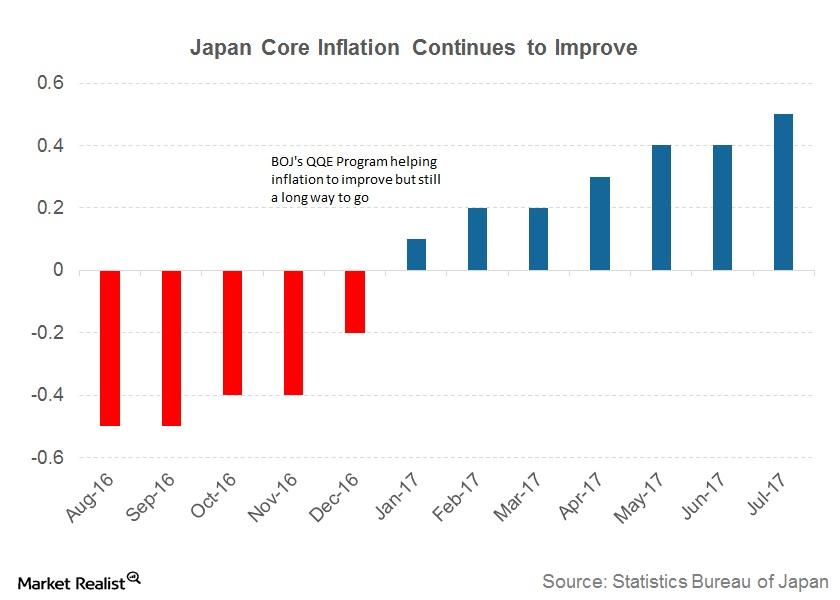

Why Rising Japanese Inflation Isn’t Good Enough for Bank of Japan

The BOJ’s (Bank of Japan’s) qualitative and quantitative easing (or QQE) programs and a negative interest rate are helping to slowly revive Japanese inflation.

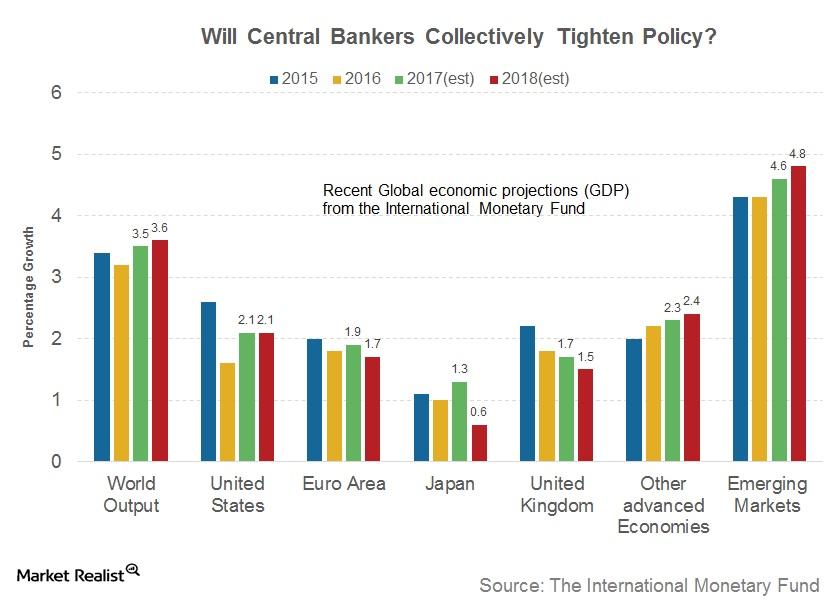

Will Jackson Hole in 2017 Be the Beginning of the End of Monetary Accommodation?

This year’s theme for the annual Jackson Hole Symposium is “Fostering a Dynamic Global Economy.”

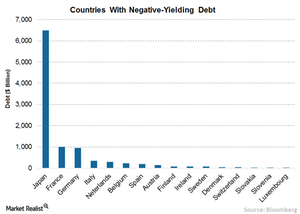

How Negative Rates Intensify the Hunt for Yield

By early July, some $11.5 trillion in bonds were trading at negative rates, with 58% of the Barclays US Aggregate Bond Index1 trading below 1%.