bluebird bio Inc

Latest bluebird bio Inc News and Updates

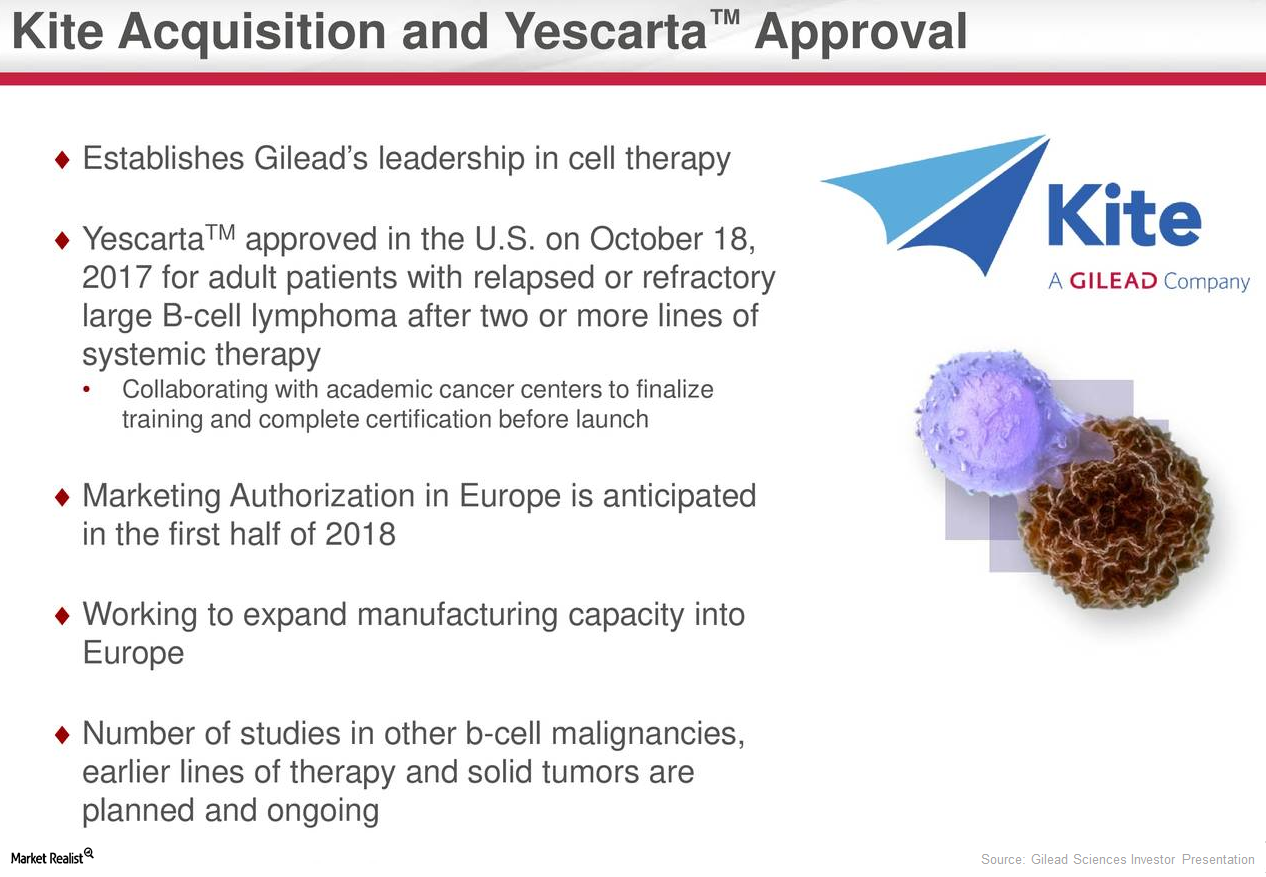

What Else Could Drive Gilead’s Long-Term Growth?

In December 2017, Kite, a Gilead Sciences (GILD) company, presented long-term follow-up data from its pivotal ZUMA-1 trial of Yescarta.

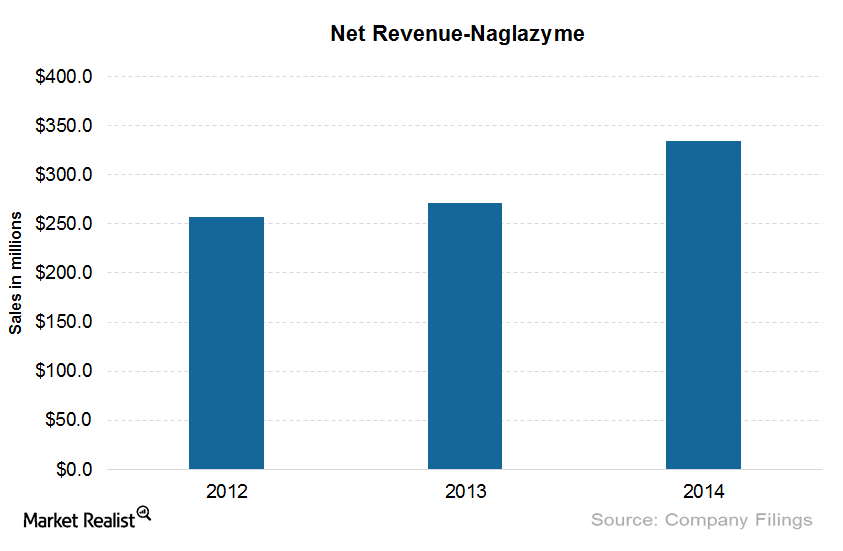

Naglazyme: One of the Costliest Drugs in the United States

The wholesale cost per patient for Naglazyme is around $485,747 per year. The drug has been effective in improving walking and stair-climbing capacity.