BlackRock Municipal 2020 Term Trust

Latest BlackRock Municipal 2020 Term Trust News and Updates

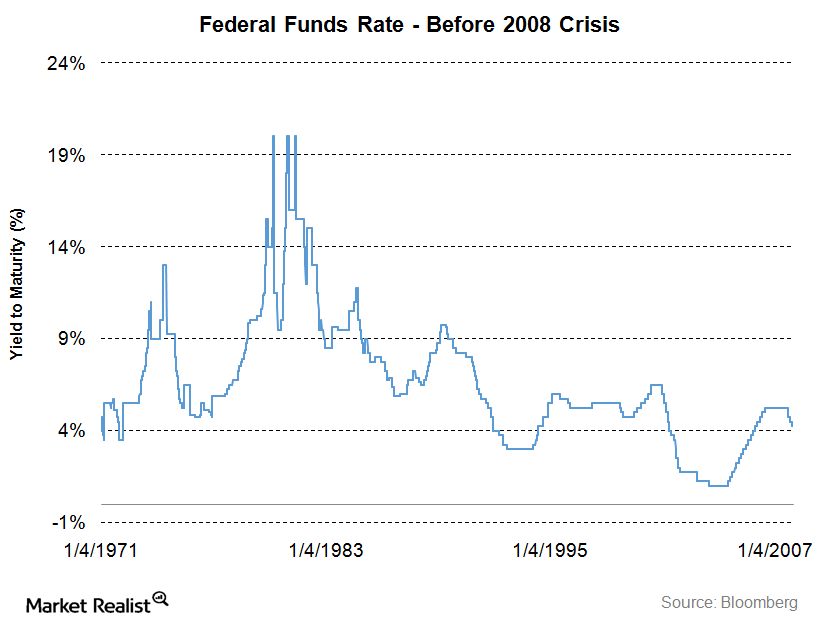

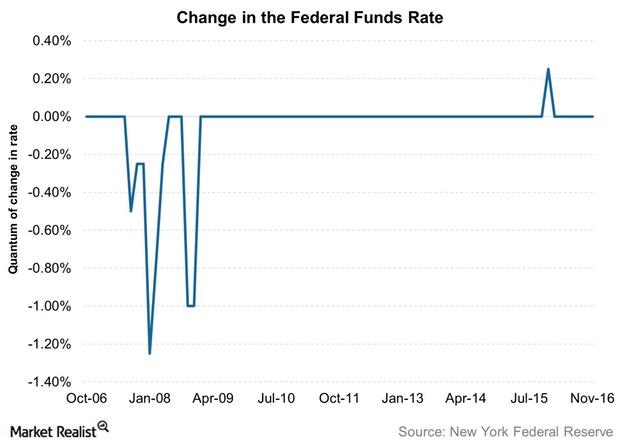

Pianalto’s take on the Fed funds rate before the financial crisis

When consumers can borrow at lower interest rates, they can afford to buy more goods and services, and the businesses that supply those goods and services can hire more people.

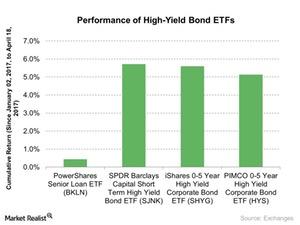

High-Yield Bonds Are Turning Out to Be the Real Winners

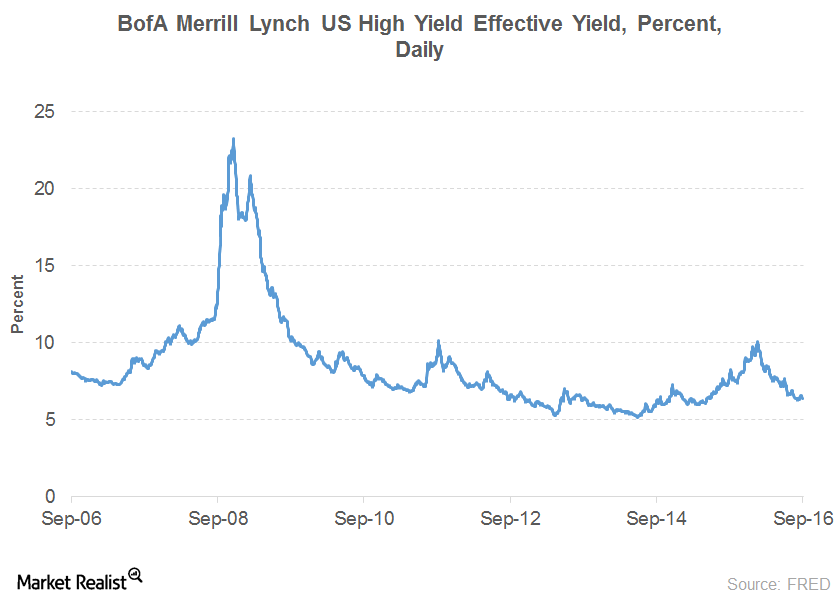

High-yield bonds gained popularity due to higher yields compared to Treasury bonds, whose yields were being pushed down by the Fed’s interest rate policy.Financials An investor’s guide to the US leveraged financial market

According to the Securities Industry and Financial Market Association, SIFMA, the total U.S. fixed income market size is about $38.6 trillion.

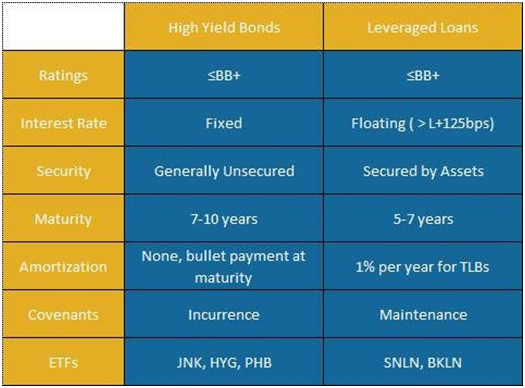

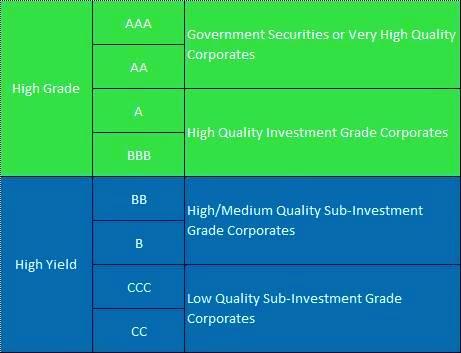

Comparing leveraged loans and high yield bonds: Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates.Financials Comparing leveraged loans and high yield bonds: Key distinctions

Leveraged loans (BKLN) are almost always secured or backed by a specific pledged asset or some form collateral. On the other hand, high yield bonds (JNK) may be secured or unsecured.Financials Comparing leveraged loans and high yield bonds: Debt terms

Another item that differentiates leveraged loans from high yield bonds is “covenants,” or the financial health metrics that issuers must adhere to.

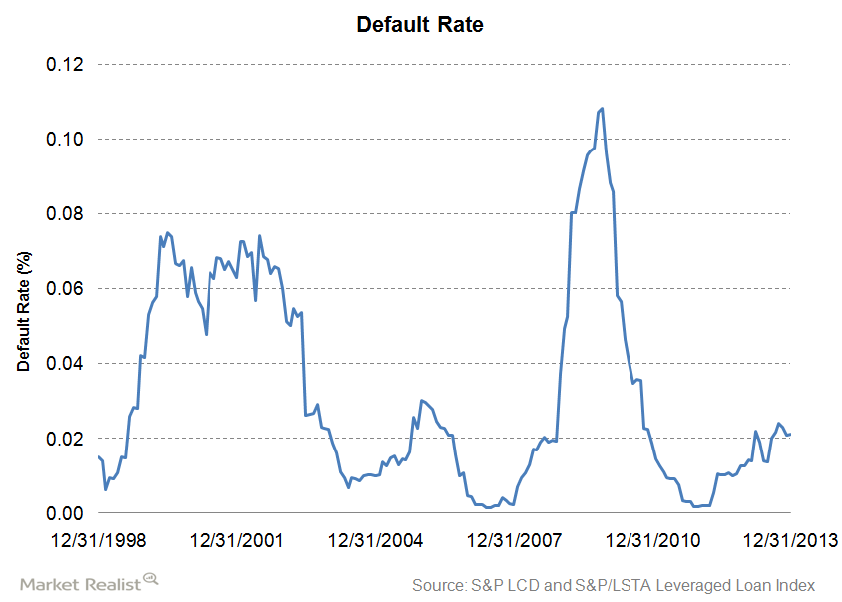

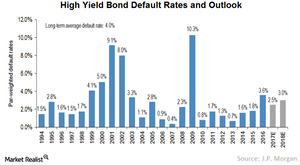

The default rate and its relation to bond and loan prices

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations.

Must know: How credit rating affects default rate and bond price

A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa.Financials Must-know: The difference between high-yield and leveraged loans

Historically, high-yield securities have outperformed investment grade securities in good times and vice versa in hard times.

Bill Gross and High-Yield Bonds: Priced for Too Much Growth

Investors generally invest in high-yield bonds (BND) when there are expectations for higher growth in the economy.

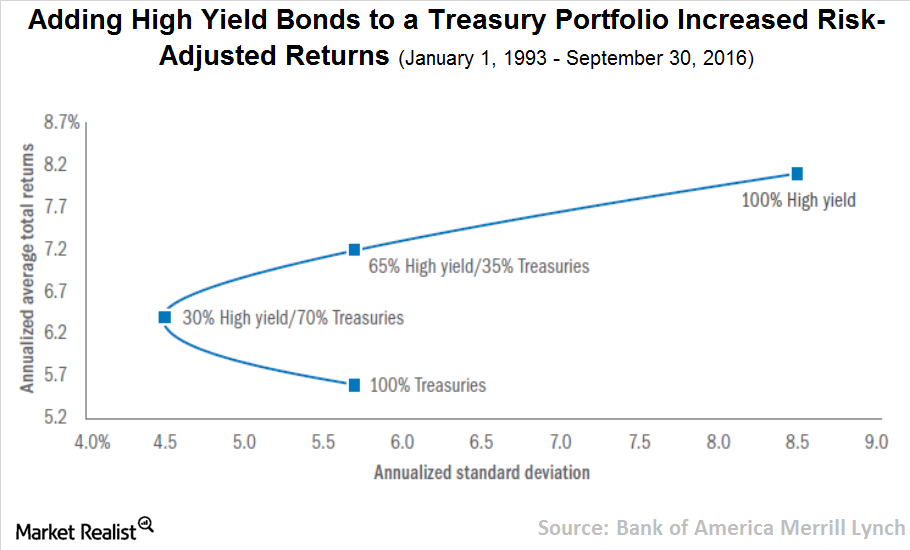

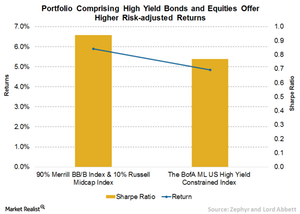

Why High-Yield Bonds Are Needed in a Portfolio

AB Summing It Up High-yield bonds present an alternative for investors at an uncertain crossroads. Equity valuations seem attractive based on some measures, but volatility has led many investors to search for ways to temper the risk in their portfolios. At the same time, bonds—a popular risk reducer—are less attractive than normal due to extremely […]

What Role Do High Yield Bonds Play in a Portfolio?

AB High Yield in the Portfolio Framework Given their higher risk levels, we’d expect that stocks would continue to outperform high yield over the long run. However, high-yield bonds have clearly demonstrated that they bring much to the table if they’re combined with stocks in a carefully designed and maintained portfolio. But not every investor […]

How Portfolio Rebalancing Boosts Overall Returns

AB Rebalancing in the Tails Because stocks have been so much more volatile than high yield, periodic portfolio rebalancing tends to occur during performance extremes—the “tails” in return distributions—when the gap between high-yield and equity returns is wide. This magnifies the “buy-low, sell-high” effect that rebalancing contributes to a portfolio’s performance. Of course, the gaps […]

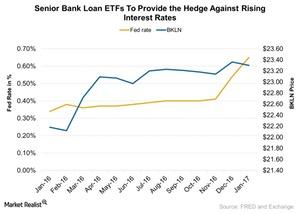

Do Senior Bank Loan ETFs Provide a Cushion?

Senior loans offer floating rate coupons and have low interest rate sensitivity. They provide the perfect hedge for rising interest rate environments.

How the Next President Could Shape US Monetary Policy

The Federal Reserve’s second last meeting of 2016 is now over, leaving only one meeting left in which the central bank can enact a rate hike.

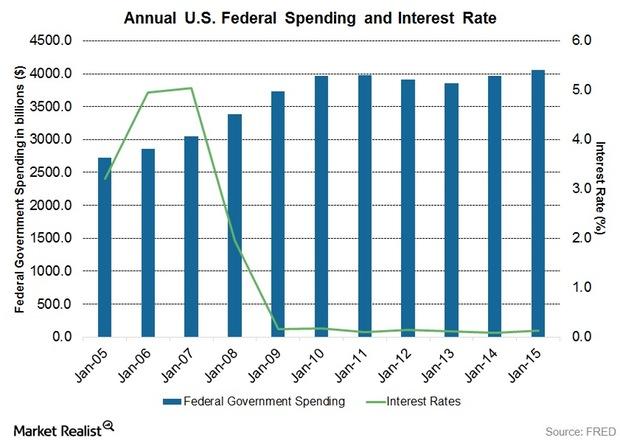

Federal Spending and Interest Rates: Analyzing the Connection

What about the impact on interest rates? Here again, there is no consistent relationship between spending and interest rates.

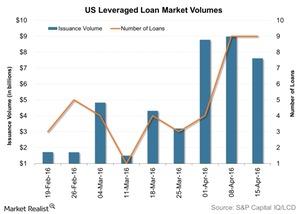

Why Did Leveraged Loans’ Issuance Fall?

The US leveraged loans market saw an allocation of $7.6 billion worth of dollar-denominated senior loans in the week to April 15.

What are alternative investments?

Alternative investments seek to provide a hedge against various market risks by following hedge fund-like strategies.Financials The relationship between interest rates and credit spreads

Examining credit spreads gives investors an idea of how cheap (a wide credit spread) or expensive (a narrow credit spread) the market for a particular bond category or a particular bond is.