Sotheby`s

Latest Sotheby`s News and Updates

CryptoPunks Sotheby’s Auction Canceled, NFT Owner Trolls Auction House

Sotheby’s was prepared to launch the largest NFT auction ever with 104 CryptoPunks, but it was canceled. What happened?

ConstitutionDAO Bidders Lost Millions in Fees Amid Failed Bid

ConstitutionDAO, a well-meaning decentralized crypto group, is out millions of dollars in fees after returning money for the failed bid.

What’s a Crypto DAO? Decentralized Autonomous Organizations, Explained

A crypto DAO may be buying a rare copy of the U.S. constitution. What's a crypto DAO?

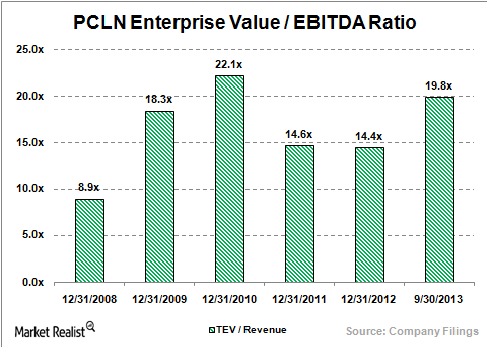

Eton Park Capital opens new positions in FDO, STZ, BID, EQIX, Sells NLSN, PCLN – 13F Flash

In this six-part series, we will go through some of the main positions Eton Park Capital traded this past quarter Eton Park Capital Management is a multi-strategy hedge fund founded in November 2004 by former Goldman Sachs partner Eric Mindich. The firm started new positions in Family Dollar Stores (FDO) , Constellation Brands (STZ), […]

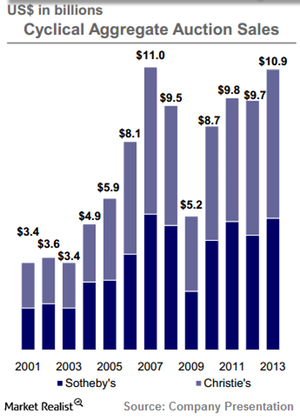

Christie’s Maintains Lead over Sotheby’s

While Sotheby’s was facing Daniel Loeb’s activist pressure, the new management team at Christie’s was implementing a global strategy.