Grupo Aeroportuario Del Sureste S.A.

Latest Grupo Aeroportuario Del Sureste S.A. News and Updates

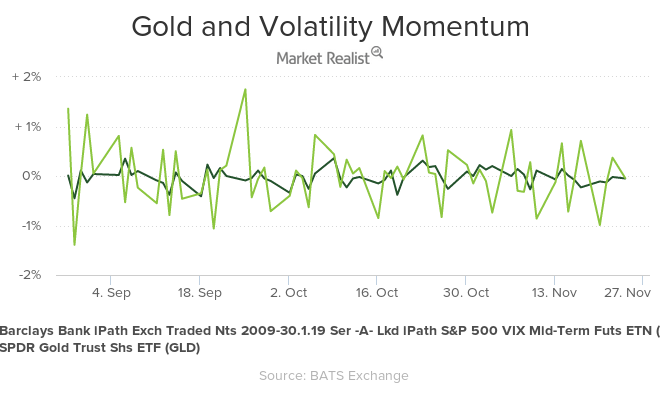

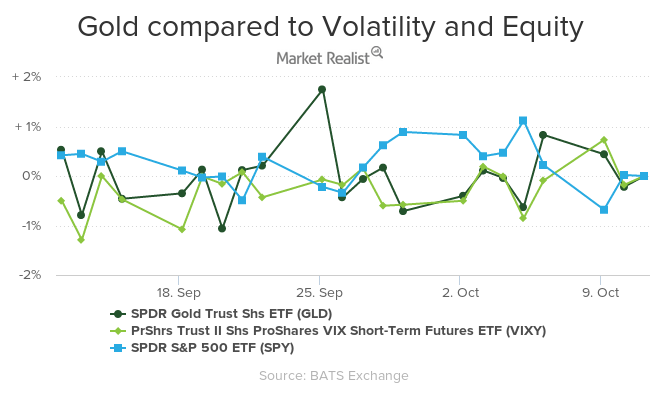

How Investor Appetite for Risk Impacts Precious Metals

Gold and silver have seen trailing-five-day losses of 0.9% and 2.7%, respectively. The reason behind the fall in the precious metals is the buoyancy of the equity markets and the gains in the US dollar.

How Do US Economic Numbers Play on Gold?

Economic data from the United States on Tuesday, July 21, 2016, on home starts and building permits affected gold and other precious metals to a certain extent.

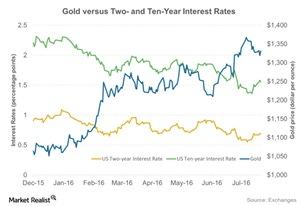

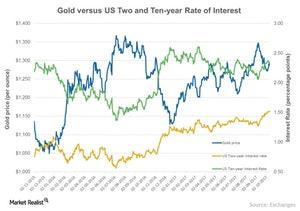

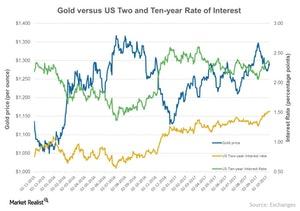

Is Gold Keeping Tabs on the US Interest Rate?

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver.

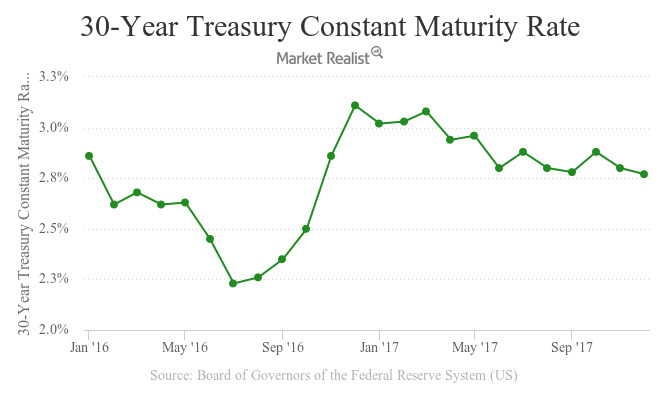

Interest Rate versus Gold: Interest Rate Wins Again

Gold is a non-yield bearing asset that reacts negatively to rises in the interest rate.

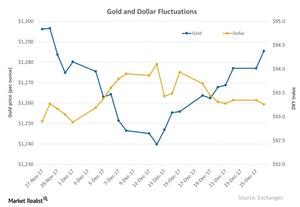

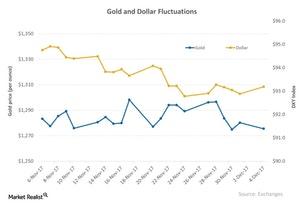

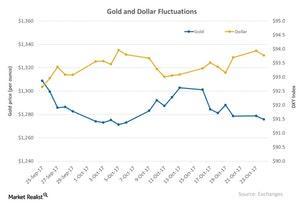

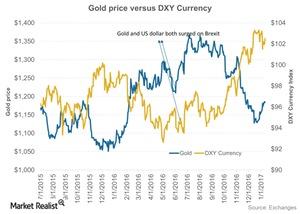

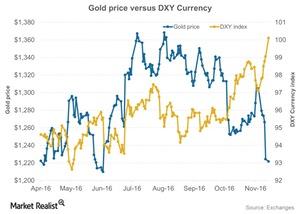

How the Dollar and Gold Moved in December

Gold and the US dollar are mostly inversely related to each other.

All 4 Precious Metals Rose on December 20, 2017

All four precious metals had an up day on December 20, 2017. Gold increased 0.43% on the day and closed at $1,267.80 per ounce.

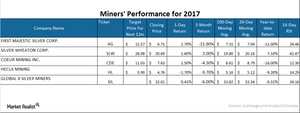

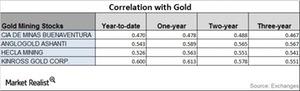

Correlation and Mining Stocks this Month

We’ll briefly analyze mining stocks’ correlation with gold. Gold is the most crucial of the precious metals, and mining stocks tend to increasingly take their price changes from gold.

A Correlation Study of Miners in December 2017

If we look at the YTD (year-to-date) correlations of the select mining shares to gold, there has been a reasonable fall.

The Tax Reform Bill’s Impact on Precious Metals

All four precious metals saw a down day on Monday, December 4, 2017, after the US dollar, in which the four metals are priced, rose $0.39%, propelled by the Senate passing its tax reform bill.

An Update on the Precious Metals as November Comes to an End

The US stock markets were closed on Thursday, November 23, 2017, for Thanksgiving, and the next day (Black Friday) was quite slow for precious metals. Gold played in a narrow range that day.

A Look at Mining Stocks’ Price Movement

Mining stocks’ reaction On Tuesday, October 31, precious metal mining stocks fell, following precious metals. In this part of our series, we’ll look at the moving averages and returns of four key mining stocks: Silver Wheaton (SLW), Hecla Mining (HL), Alacer Gold (ASR), and IAMGOLD (IAG). Hecla Mining and Alacer Gold have fallen 9.9% and 10.3%, respectively, YTD […]

These Factors Are Affecting Gold

Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively.

How Global Indicators Are Affecting Precious Metals

Gold reached its two-week high price of $1,294.5 an ounce on Tuesday, October 10, and ended the day at $1292.1 per ounce.

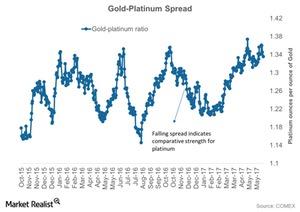

Gold-Platinum Ratio: Is Platinum a Long-Term ‘Buy’?

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread.

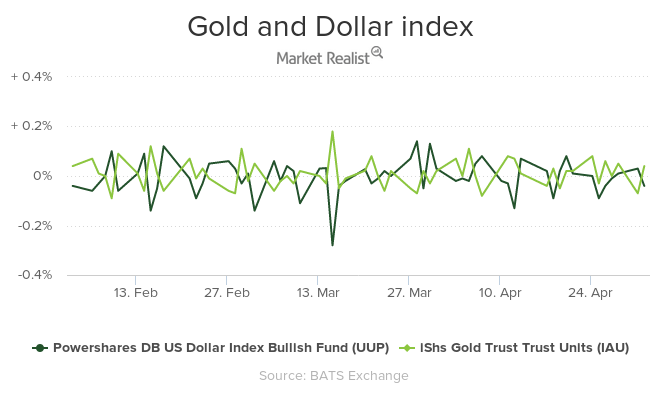

Global Tremors, the Dollar, and Gold in Early May

Geopolitical risks had been playing on haven bids for precious metals, but now, we may be seeing to be a temporary respite—however brief—from global worries.

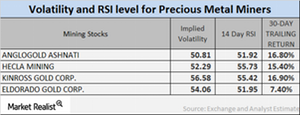

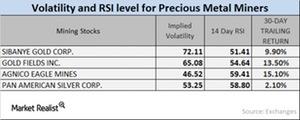

What the Latest Volatility and RSI Numbers Indicate

It’s important to monitor the implied volatilities of large mining stocks as well as their RSI levels, particularly after changes in precious metal prices.

How GDP Numbers Impacted Gold and the Dollar

The reason behind the fall of the dollar on Friday, January 27, 2017, was lower-than-expected GDP numbers. The DXY ended the day 0.10% higher.

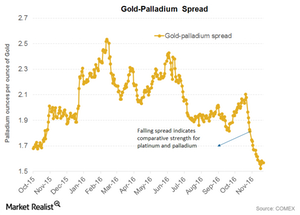

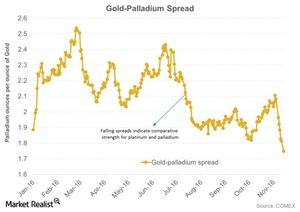

Reading the Movement in the Gold-Palladium Spread

The gold-platinum spread was approximately 1.6 on January 11, 2017. Its RSI (relative strength index) was as low as 40.

Why Mining Stocks Are Seeing Rising RSI Levels

In this part, we’ll look at the implied volatilities of large mining stocks and their RSI levels in the wake of precious metal prices.

What’s the Correlation between Mining Stocks and Gold?

Mining companies that have high correlations with gold include Agnico Eagle Mines (AEM), Alacer Gold (ASR), Alamos Gold (AGI), and AngloGold Ashanti (AU).

Analyzing Silver’s January Technicals

Among the other precious metals trading on the COMEX, silver shares for March expiration maintained an almost flat end to the day on January 11, 2017.

US Dollar Played on Gold in 2016

The correlation between gold and the US Dollar Index is -0.36. It means that about 36.0% of the time, gold and the dollar move in opposite directions.

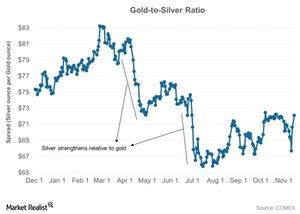

How Has the Gold-Silver Ratio Trended in 2016?

Gold and silver have been strong for the past few days. However, silver has substantially outperformed gold year-to-date.

Why the Gold-Palladium Spread Is Falling Drastically

Palladium has seen a YTD rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.