AutoNation Inc.

Latest AutoNation Inc. News and Updates

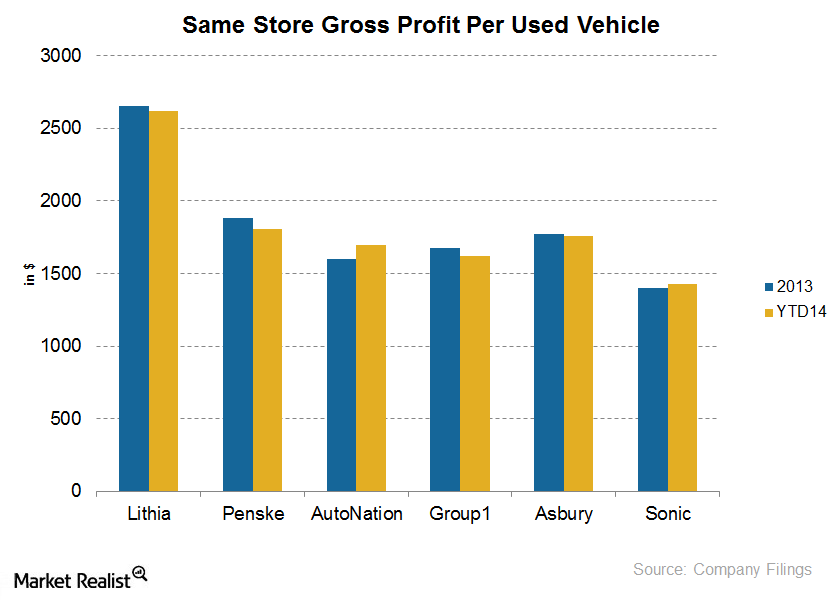

Key analysis of Lithia’s used vehicle operations

The larger share of CPOs and core vehicles in its sales mix drives Lithia’s significant lead in same-store gross profit per vehicle.

Is Alphabet’s Waymo Preparing for an IPO?

This week, Alphabet’s (NASDAQ:GOOGL) Waymo disclosed that it raised $2.25 billion from a group of outside investors. Will there be a Waymo IPO?