Astellas Pharma, Inc.

Latest Astellas Pharma, Inc. News and Updates

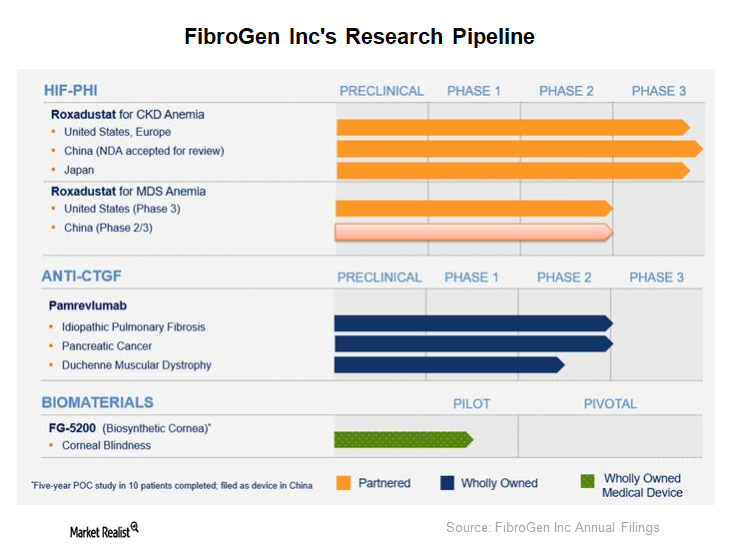

Understanding FibroGen’s Research Pipeline

Apart from Roxadustat, other products in FibroGen’s pipeline include Pamrevlumab (or FG-3019) and FG-5200.

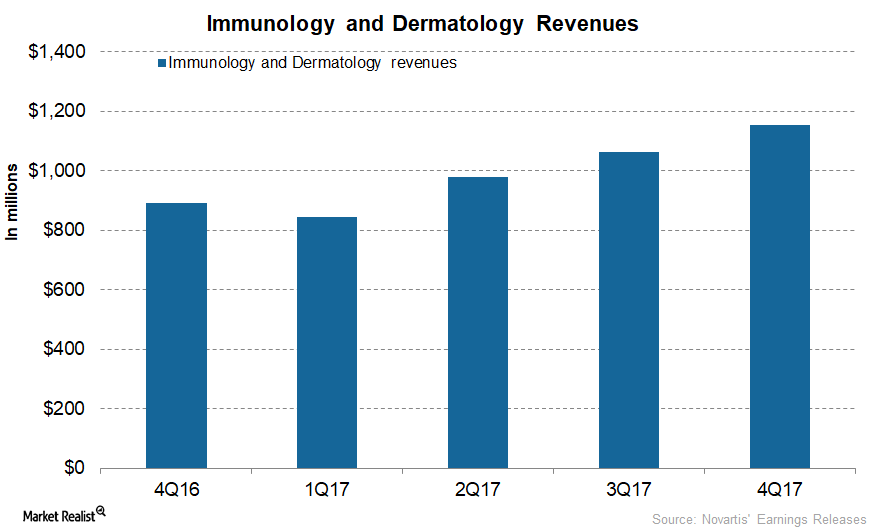

A Look at Novartis’s Immunology and Dermatology Segment’s Performance

In 4Q17, Novartis’s Immunology and Dermatology segment generated revenues of $1.2 billion, ~30% growth on a year-over-year (or YoY) basis and ~9% growth quarter-over-quarter.

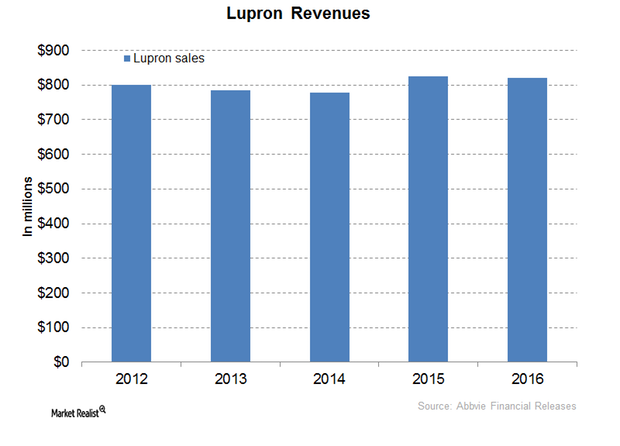

Why Lupron Could Continue to Generate Steady Revenue

In 2016, AbbVie’s (ABBV) Lupron generated revenue of $821 million, a slight fall of 0.6% year-over-year (or YoY). In 1Q17, Lupron reported revenue of ~$194 million.

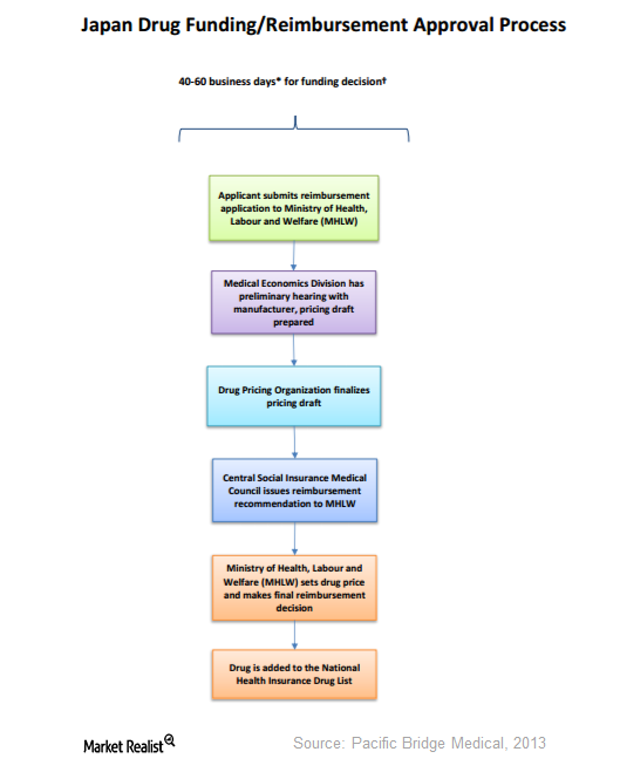

How Are Drugs Priced in Japan?

The NHI revises drug prices every two years. During fiscal 2016, a 6.8% reduction in drug prices is expected.

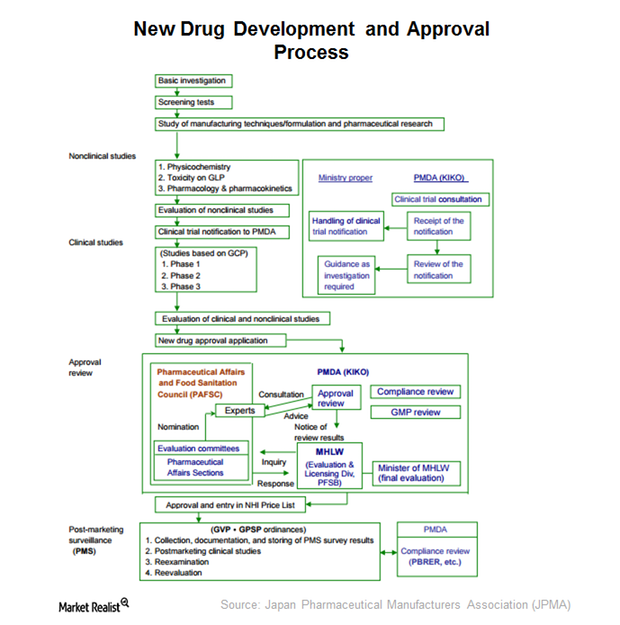

What’s the Drug Approval Process in Japan?

The drug approval process in Japan includes a sequence of non-clinical studies, clinical studies followed by approval review, and post-marketing surveillance.

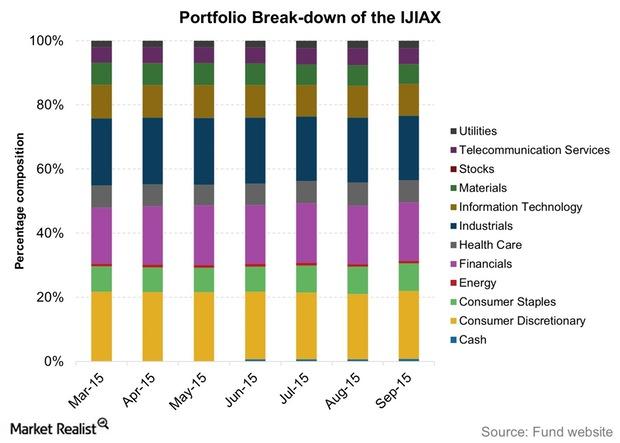

The Voya Japan TOPIX Index Portfolio Class A (IJIAX): Historical Overview

The Voya Japan TOPIX Index Portfolio Class A is an index fund, not an actively managed mutual fund, so it necessarily tracks its benchmark index.