Allegion PLC

Latest Allegion PLC News and Updates

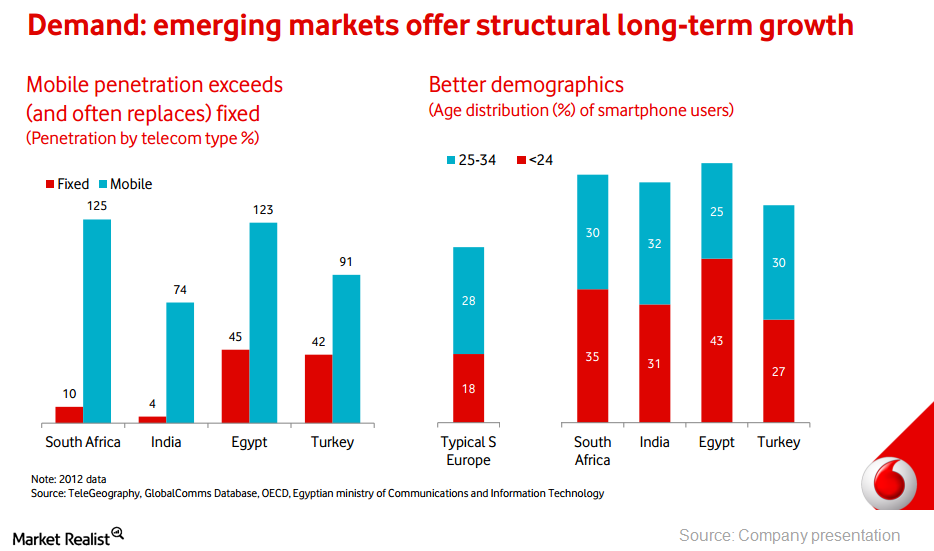

Why AQR Capital Management chose to open a position in Vodafone

AQR Capital started a new position in Vodafone Group plc that accounts for 0.44% of the fund’s 4Q portfolio.

Why did JANA Partners boost its position in General Motors?

JANA Partners enhanced its position in from 0.17% to 4.23% last quarter General Motors.

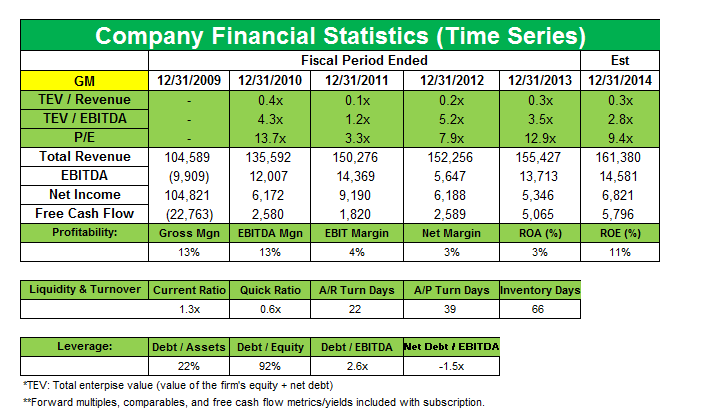

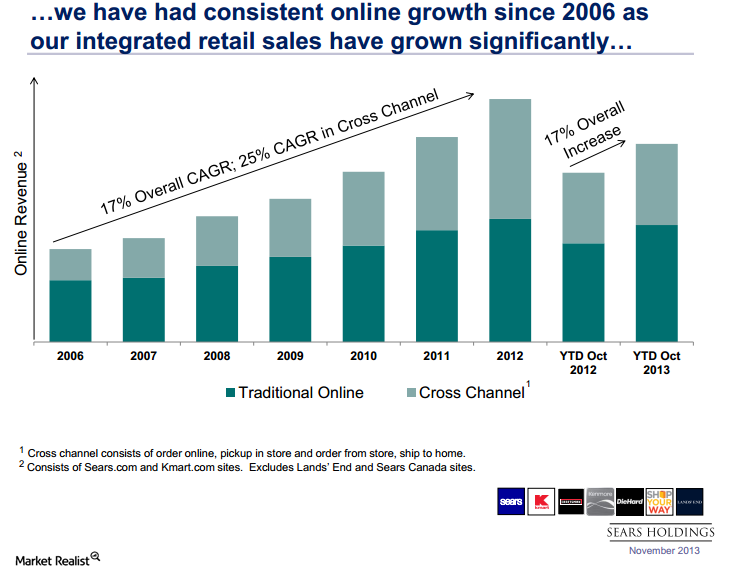

Must-know update: DE Shaw increases its position in Sears Holdings

DE Shaw increased its position in specialty retailer Sears Holdings (SHLD) from 0.01% to 0.07% in 4Q 2013.

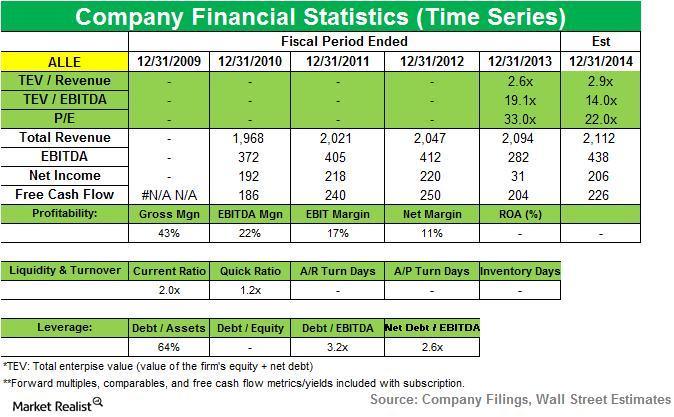

Trian Fund lowers its position in Allegion

Allegion provides security solutions for homes and businesses, employing more than 8,000 people and selling products in more than 120 countries across the world. Allegion reported third-quarter 2014 net revenues of $546.7 million, up 3.3% compared to the previous year.