Ambev S.A.

Latest Ambev S.A. News and Updates

Financials Why Brazil seeks diversification

Given the declining competitiveness of its commodity exports, Brazil’s economy is attempting to diversify away from its economic model.Consumer A guide to Cantillon Capital Management’s investment strategy

The New York–based Cantillon Capital Management is a hedge fund manager founded in 2003 by William von Mueffling.

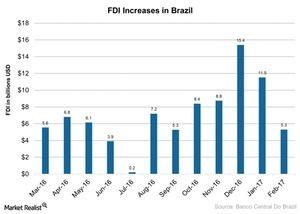

Will Rising FDI in Brazil Help 2017 Market Performance?

FDI (foreign direct investments) in Brazil picked up in the second half of 2016 in spite of a slow economy, impeachment of the president, political crises, and corruption scandals.

Brazilian Real Nears All-Time Lows in 2015

The Brazilian real has been trading on a weaker note against the US dollar in the last year after depreciating by more than 40% against the US dollar.