Are Realtors Good at Making Money, but Bad at Keeping it? TikTok Weighs in

Is it true that realtors are good at making money but bad at keeping it? A TikToker discusses a family's financial disaster, which has got people talking.

May 8 2023, Published 10:40 a.m. ET

Whether you’re just starting out in real estate or looking to make a career change, there’s lots to love about being a realtor. You’re in an industry with no financial ceiling and unlimited earning potential, and you meet new people all the time, but there are many expenses you need to prepare for like taxes, marketing and living expenses.

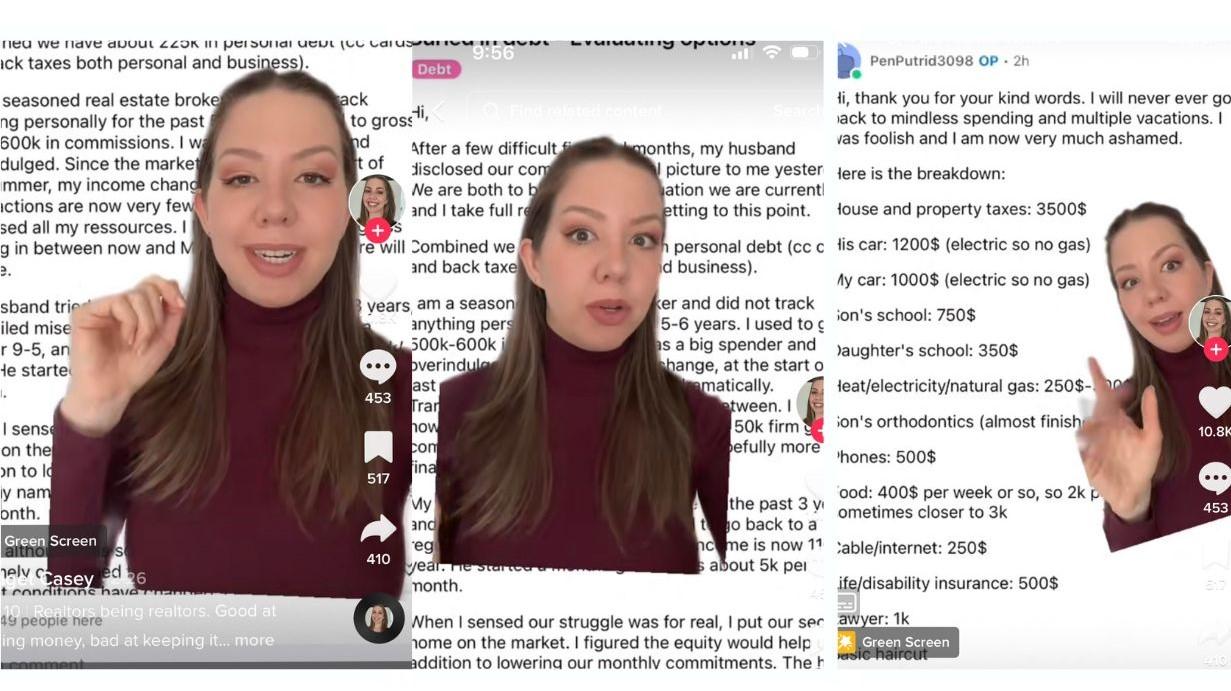

One realtor family recently became a hot topic of discussion after a TikTok video by @bridgiecasey went viral. According to the video, a Redditor real estate agent who claimed to make $500,000 to $600,000 per year admitted that they didn’t pay taxes and racked up over $225,000 in debt.

The video had over 237,700 views as of May 4, 2023, and 443 comments from flabbergasted viewers who couldn’t comprehend not paying taxes or spending that much money per month.

A realtor shares expensive budgets on TikTok

In the video, which is about 2.5 minutes long, @bridgiecasey discusses a post she found on Reddit where a foolish realtor confesses they have absolutely nothing to show for their salary. No investments or savings, but they do have $225,000 in debt, which is mostly from back taxes and credit cards.

She dissects their monthly expenses, including their two kids schooling, cable and internet, groceries, cars, and houses, and says their budget isn’t too bad, but many of their choices are "dumb".

Since they’re apparently not very good at managing money and living well beyond their means, the family has considered a consumer proposal to pay a reduced number of debts to creditors, or they might sell their second house where they hope to make $175,000.

One commenter said, “They later clarified their income was $250k-$300k a year after the agency cut. Still ATROCIOUS management.” Another posted, “They’re not just spending their income, they’re spending PAST their income. That is insane.”

Helpful budgeting tips every real estate agent should follow

If becoming a realtor seems like a dream job for you, there are some things you should know first about budgeting and finances. It’s really easy to get caught up in the thrill of receiving a large paycheck, but just like freelancers, you need to take out your own taxes or else you’ll get hosed at the end of the year.

Real estate agents face periods of low (or no) earnings, and sometimes sales are through the roof. And other times you may find it difficult to make ends meet and may have a hard time paying for everyday expenses when no income is coming in.

Here are a few considerations to make sure you’re financially prepared in the long run:

Taxes: This job isn’t like other full-time jobs where your taxes have already been taken out – you are responsible for your own taxes, and you must calculate and save so you don’t owe the government money at the end of the year.

You should find a good accountant and figure out an amount you can dedicate from each paycheck to cover taxes, and automatically transfer that amount to savings each month.

Living expenses: After you’ve set money aside for taxes, figure out how much you’ll need for everyday living expenses. Calculate what you’ll need for rent or mortgage, groceries, transportation and other essentials.

Business expenses: You’ll have to pay business fees and expenses, which includes professional dues, state license fees, and real estate courses. Also make sure you’re up to date on industry trends, so subscribe to publications like The Real Deal.

Marketing: You'll need to advertise and market your business, so people know you exist and that's why you need to set aside extra money for things like flyers, social media, a website, create a blog, use SEO to optimize your website, buy ads on Google, and more.