Some States Mandate Personal Finance Education, Sparking Debate

Financial education in grade school could leave students better prepared for success in young adulthood and beyond, research suggests. Some states are mandating financial literacy.

Oct. 21 2022, Published 12:15 p.m. ET

Financial education in grade school could leave students better prepared for success in young adulthood and beyond, research suggests. From managing debt better to improving budgeting practices, financial literacy has a real ripple effect.

Some states mandate personal finance education, but many leave it up to parents and other support systems to teach them — leaving many young people trapped in a cycle of disadvantage.

Should financial literacy be taught in schools? Keep reading for all the details.

Should financial literacy be taught in schools? California is one state that supports it.

California Superintendent of Public Instruction Tony Thurmond

California is taking part in a $3.6 billion grant that, in part, will help strengthen personal finance education in schools. Schools can use the grant money to add finance courses, train educators, and even higher personal finance experts.

The California Department of Education will give a $500 stipend to the first 1,000 public high school teachers who complete 20 hours of professional development.

To be clear, California as a state doesn't mandate personal finance education, but state leaders hope the grant program will help incorporate financial education as a standard nonetheless.

Where does financial literacy education stands in the U.S.?

In the last few decades, financial literacy has become an increasingly important topic in public education. In 2015, only five states mandated a personal finance course. Now, 23 states require a personal finance course to graduate, according to the Council for Economic Education (CEE).

However, only nine of those states require students to take a standalone course that the school offers. Others allow for integrated education in other courses, meaning the education may not go as deep.

The benefits of financial literacy are increasingly obvious.

“If we are going to make sure everyone in this country has food to eat and a roof over their heads, we have to teach them how to manage their money,” president and CEO of the CEE Nan Morrison told reporters.

Naturally, the issue of a lack of financial education isn't so simple. The responsibility for financial disadvantage doesn't fall solely on the disadvantaged individual. The evidence is clear: the U.S. has systemic, deeply rooted financial inequities that continue to impact people of color, the poor and working class, women, neurodivergent and disabled individuals, veterans, and more.

However, bringing that power back into the hands of individuals by educating youth is a powerful tool, and the research supports it.

Research suggests financial education decreases the use of payday loans in young people and increases the likelihood of wealth generation by age 25.

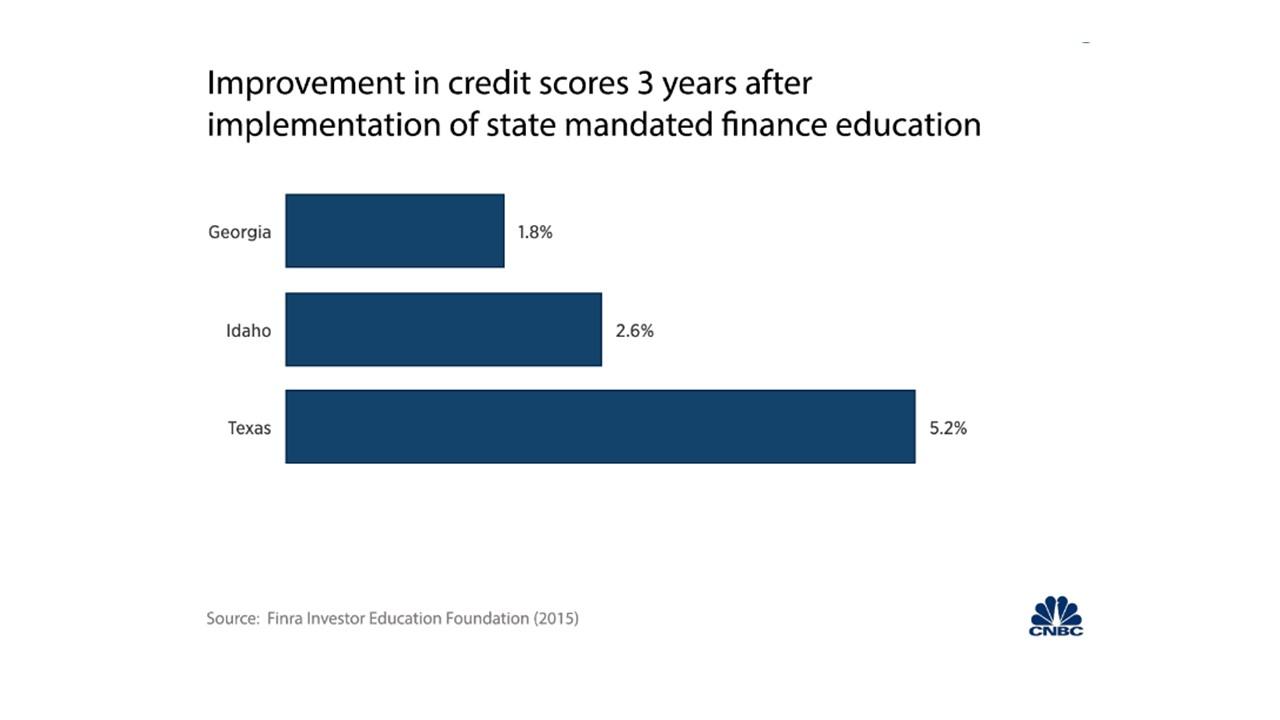

It also increases the use of financial aid in college, lowers private loan balances, and increases credit scores. Young adults’ credit scores in Texas jumped 5.2 percent within three years of implementing personal finance education.

Here's how to push for financial literacy in your state.

With the benefits of financial literacy as school education so obvious, the question remains: How do you push for these standards in your own state? The CEE says you can request a course in your school or district, make a point to call for necessary professional development for educators and push for state-level standards.

You can also find your local CEE affiliates.