Businessman Yasir Al-Rumayyan Holds a Power Position in Saudi Arabia

What is Yasir Al-Rumayyan's net worth? The powerful Saudi businessman controls enormous wealth for his country. How has he accumulated his wealth?

Oct. 8 2021, Published 11:47 a.m. ET

Yasir Al-Rumayyan, the leader of two of the most powerful and valuable entities of Saudi Arabia, has just bought soccer club Newcastle United. As the governor of the Saudi Public Investment Fund and the chairman of valuable oil company Saudi Aramco, Al-Rumayyan has control over significant wealth.

The Saudi Public Investment Fund manages assets worth about $430 billion, according to Reuters, while Saudi Aramco is worth $1.85 trillion.

Yasir Al-Rumayyan’s career path

Prior to taking over as governor of the Saudi PFI (Public Investment Fund), Al-Rumayyan graduated from Harvard Business School and worked as an investment banker. In the past six years with the Saudi PIF, he has been focused on implementing Saudi Vision 2030.

Saudi Vision 2030 is Saudi Arabia’s initiative to diversify its economy to be less dependent on the oil industry by branching into other areas, including tourism and Premier League football (hence the purchase of Newcastle United by the Public Investment Fund).

Although Al-Rumayyan's exact net worth isn't known, his positions of power in the Saudi financial world undoubtedly set him up for extreme wealth.

Saudi Public Investment Fund

Al-Rumayyan governs the Saudi PIF, which was founded in 1971 as a national economic tributary to establish vital local companies to stimulate the Saudi economy. It has 35 PIF-established companies including Cruise Saudi, Neom Project, and the Red Sea Development Company.

The Saudi PIF invests in six primary investment pools—the international diversified pool, international strategic investments, Saudi giga-projects, Saudi real estate and infrastructure projects, Saudi sector development, and Saudi equity holdings.

Al-Rumayyan isn't the owner but the governor of the Saudi Public Investment Fund. The Saudi Crown Prince Mohammad bin Salman Al-Saud serves as the chairman of the board of the Saudi PIF.

Saudi PIF also invested $3.5 billion in Uber in 2016, which makes Al-Rumayyan a board member as part of the agreement. Other notable PIF investments include $45 billion in the SoftBank Vision Fund and $20 billion in a joint U.S. infrastructure fund with Blackstone.

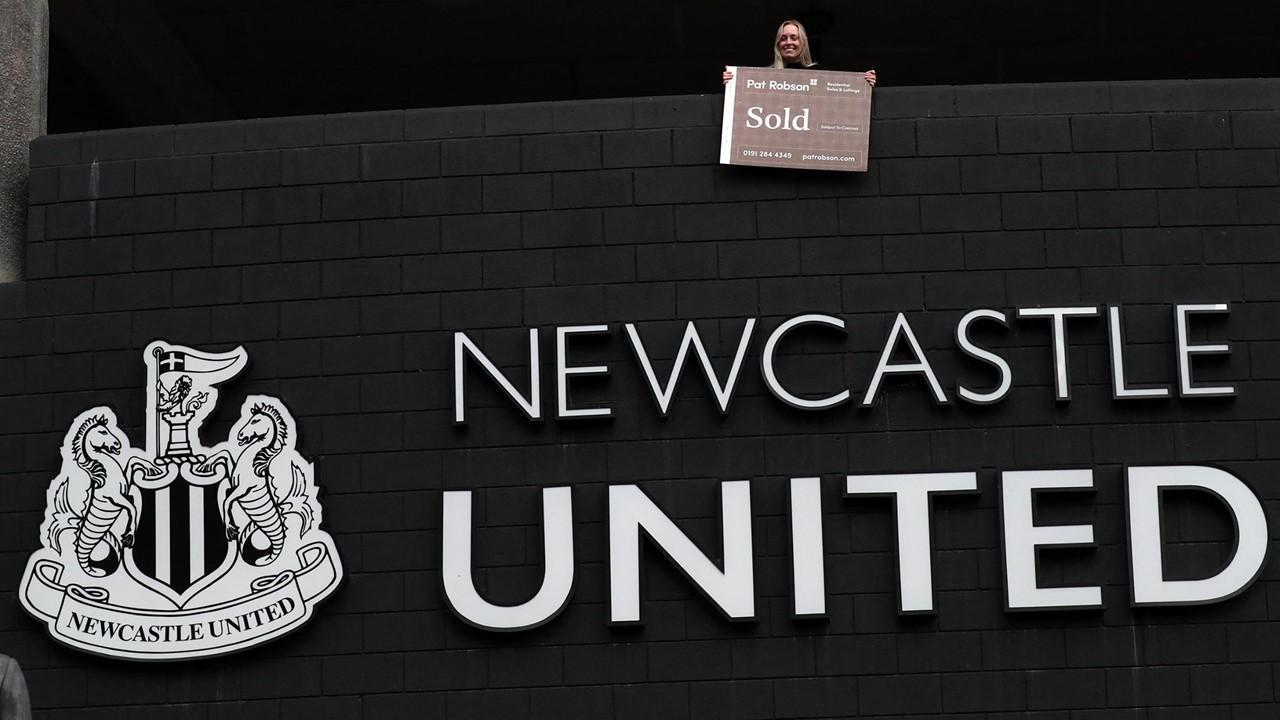

Saudi PIF purchase of Newcastle United

The Saudi PIF, which made a bid of 305 million pounds about fourteen months ago to buy the soccer club Newcastle United, has finally reached a deal with Newcastle. The agreement consists of a consortium of PIF, PCP Capital Partners, and RB Sports & Media taking over Newcastle United.

Following the purchase of the soccer club, Al-Rumayyan will serve as the non-executive chairman of Newcastle United. He will hold the majority of power for the team. In addition, Amanda Staveley of PCP Capital Partners is taking a 10 percent stake, while brothers Simon and David Reuben are taking a 10 percent stake as well, according to The Guardian.

The chief executive of Amnesty UK, Sacha Deshmukh, said of the deal with Saudi PIF that the Saudi authorities were "sportwashing their appalling human rights record with the glamour of top-flight football,” according to Reuters. Saudi government leaders have denied allegations of human rights abuses.

Al-Ramayyan and Saudi Aramco

Also included in Al-Ramayyan’s financial leadership is the top oil producer in the world, Saudi Aramco. Fortune magazine reported that although the oil giant is worth a jaw-dropping $1.85 trillion, its stock performance since its then-record-breaking IPO of 2019 has been lackluster.