U.S. Steel Stock (X) Could Rise More Amid Commodity Supercycle

U.S. Steel stock has risen sharply in 2021. U.S Steel stock could rise more amid the commodity supercycle. What can investors expect?

May 12 2021, Published 2:03 p.m. ET

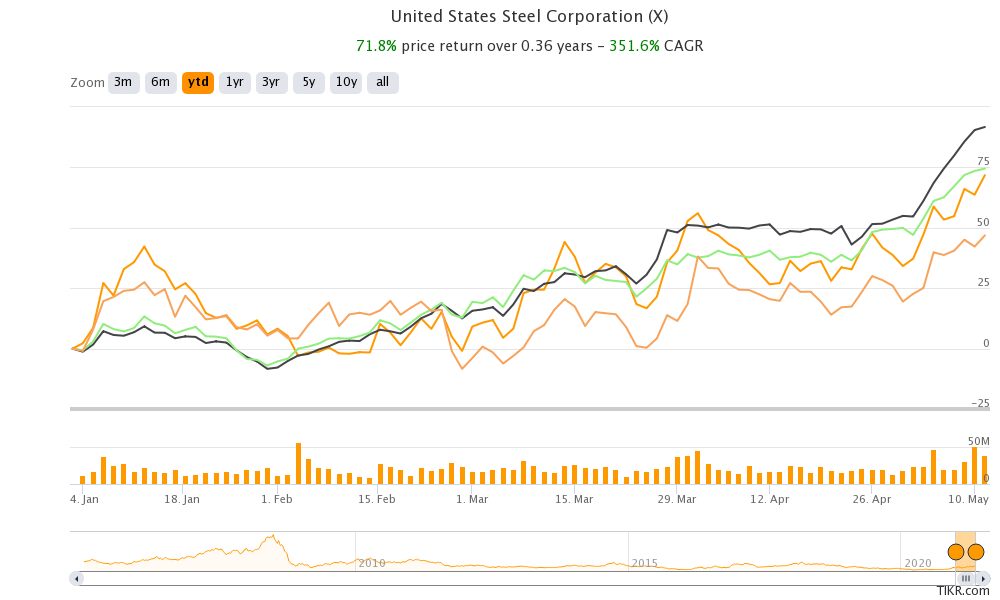

Commodity stocks are cyclical in nature. Currently, we are in what looks like another commodity supercycle. While the rise in commodities is fueling inflation concerns, they have also brought some investment opportunities. U.S. Steel Corporation (X) is up 72 percent YTD. Will the stock rise more amid the ongoing commodity supercycle?

First, we should understand that for steel companies, the earnings are a function of three key drivers. The first is the shipments or the amount of steel that they sell. The second is the input costs, which include iron ore, steel scrap, and coking coal. The third and most important earnings driver for steel companies is the price of finished goods.

U.S. steel prices are near their all-time highs.

U.S. steel prices are near their all-time highs. Several factors are supporting the rise in prices. First, the demand is strong from all the end markets amid a booming U.S. economy. Also, there isn't much supply-side pressure. Imports have seen a secular decline after the Section 232 tariffs.

US steel stocks have surged in 2021

Steelmaking raw materials, especially iron ore, are also trading at higher price levels due to strong demand in China, which is the largest importer of seaborne iron ore. Higher raw material prices are also supporting finished prices. Add the low supply chain inventories and we have a perfect bullish case for steel prices in 2021.

Why U.S. Steel stock is rising

U.S. Steel stock has risen sharply in 2021 and is outperforming Cleveland-Cliffs (CLF), which is its closest peer in the U.S. market. The rise in X stock isn't hard to comprehend looking at the uptrend in U.S. steel prices. The near-record prices would help lift X’s earnings along with other steel companies.

Target price for U.S. Steel stock

Several Wall Street analysts have turned bullish on X stock. On May 11, Morgan Stanley upgraded X stock from “equal weight” to “overweight” and increased the target price from $24 to $32. Morgan Stanley also increased its forecast for steel prices in 2021 and 2022. Analyst De Alba expects steel prices to remain higher for longer.

Morgan Stanley isn't the only brokerage getting good vibes from X stock. Earlier this month, Credit Suisse double upgraded the stock from “underperform” to “outperform” and more than doubled its target price to $35. Analyst Curt Woodworth pointed to the steel supercycle.

X stock looks undervalued

Despite the recent spike, X stock still looks undervalued considering the uptrend in U.S. steel prices. The stock trades at an NTM EV-to-EBITDA multiple of 3.9x, which looks attractive.

You should read the valuation multiples of commodity companies with caution since they tend to peak near the cyclical bottom in commodity prices and are the lowest near cyclical peaks. However, while we might be near a cyclical peak in prices, they might not fall much from these levels. The “stronger for longer” echo looks credible for most commodities stretching from copper to steel.

Will U.S. Steel stock rise more?

With the humongous rally over the last year, many investors wonder whether U.S. Steel stock will rise more from these levels. The estimates compiled by CNN Business show that X has a median target price of $27.50, which is 2.5 percent below the current prices. While the consensus estimates suggest a fall in X stock, I would expect the stock to rise more from these levels.

With steel prices showing no signs of fatigue despite rising sharply and robust end-user demand, X stock could increase more from these levels. The company’s acquisition of Big River Steel makes it a complete play on the steel industry with both blast furnaces and electric arc furnace operations.

One overlooked aspect about X is its captive iron ore operations, which would positively impact the earnings in the current environment where many of the peers are buying iron ore near record highs. Overall, the rally in X stock looks far from over as we herald into a new commodity supercycle.