S&P 500 Is a Solid Long-Term Investment No Matter What It Does in 2021

Ever since the markets started to rally from their 2020 lows, investors have been worried about another crash. Will the S&P 500 crash in 2021?

Feb. 5 2021, Published 2:21 p.m. ET

Ever since the U.S. stock markets started to rally from their March 2020 lows, there have been lingering concerns that there will be another crash. Many pundits forecasted that markets are overvalued and would come down. However, none of these predictions have come true. Many investors wonder if the S&P 500 will crash in 2021 or if there will be record highs.

The S&P 500 is the world's most popular index with over $4 trillion worth of assets indexed to it. For many people, the S&P 500 is synonymous with the stock market.

Why the S&P 500 is always going up long term

To understand why the S&P 500 is always going up in the long term, it's important to know that two things drive stock prices. One is corporate earnings and the second is the valuation multiple that investors are willing to pay for those earnings. Valuation multiples can be volatile and are a reflection of market sentiments. In a bull market, investors are willing to pay a higher premium for stocks, while it's the other way around in a bear market.

However, in the long term, valuation multiples are mean-reverting. Corporate earnings are the long-term driver of stock markets and they aren't as volatile as the valuation multiples. The S&P 500 earnings is an upwards trending slope line.

There certainly are years like 2008 and 2020 when the earnings of S&P 500 companies have fallen. However, they are followed by a sharp rise in earnings in subsequent years, which we might see in 2021.

Will the S&P 500 crash in 2021?

There isn't a set definition of a market crash unlike say a correction or bear market, which is a fall of 10 percent and 20 percent, respectively, in asset prices. A market crash is a sudden fall in asset prices spread across the markets. We saw one in the first quarter of 2020 and in the third quarter of 2018.

It isn't easy to forecast when the S&P 500 will crash but most crashes have been preceded by high valuation multiples. This holds for 2020, 2018, and 2008. The S&P 500's current valuation multiples aren't cheap by any standards. According to FactSet, the S&P 500’s NTM PE multiple is 21.8x, which is above the five-year average of 17.6x and the 10-year average of 15.8x.

What we need to forecast are the likely triggers for an S&P 500 crash in 2021. Looking at the windscreen, geopolitical tensions, especially between the U.S. and China, Biden’s proposed tax hikes, a return of inflation, and uncertainty about the COVID-19 pandemic could be the triggers for a market crash.

Do analysts usually overestimate the S&P 500?

Analysts can overestimate or underestimate the S&P 500. For example, analysts underestimated the S&P 500 in 2019 and the index soared above its median target. For 2021, FactSet reported in December 2020 that analysts expect the S&P 500 to close above 4,000 in 2021. The S&P 500 is currently near 3,900 and if the positive momentum continues, it might close above the median price target in 2021 also.

Is the S&P 500 a good investment?

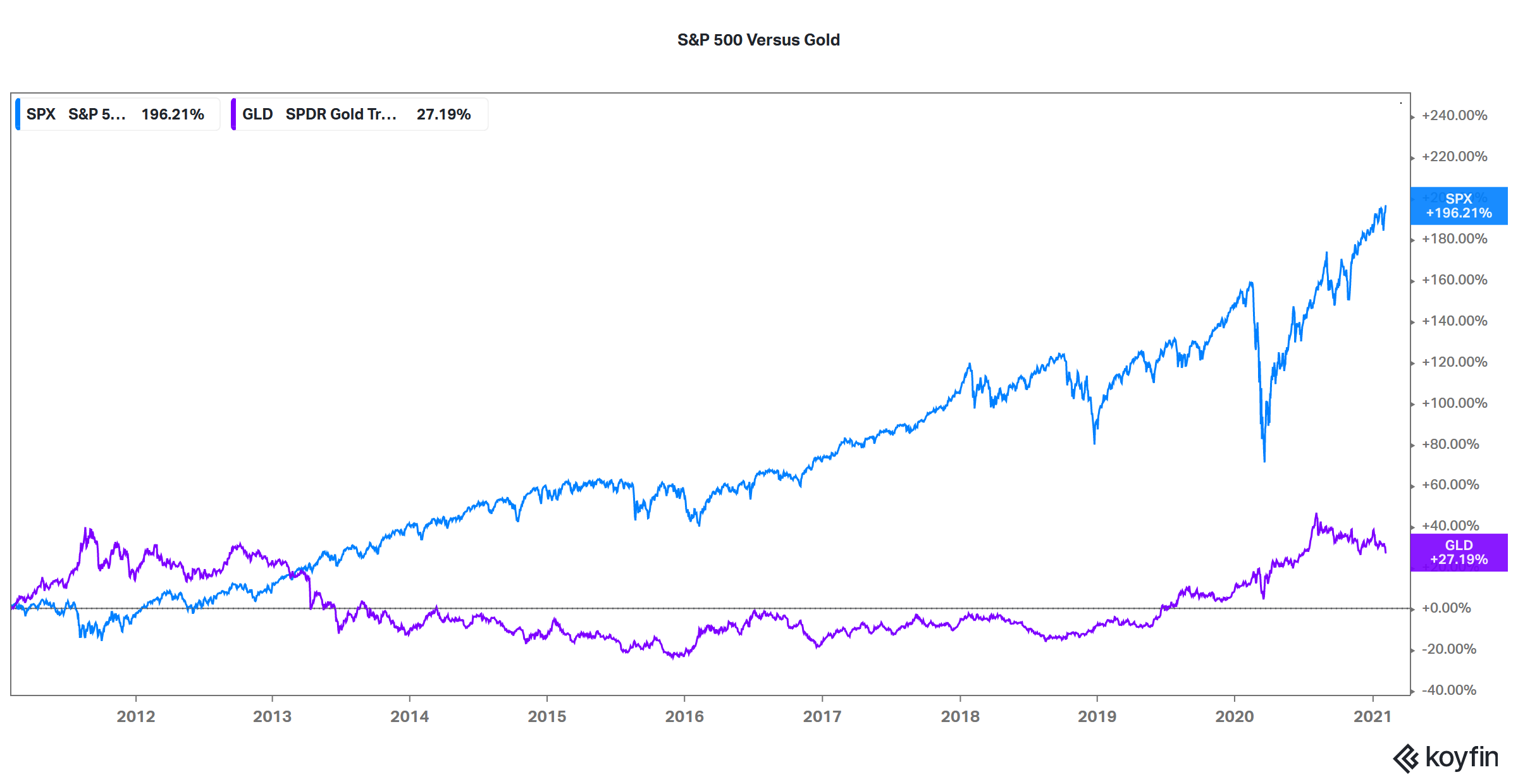

In the long term, stock markets deliver higher returns compared to other assets like gold and debt. Berkshire Hathaway’s chairman, Warren Buffett, has most of his assets in stocks. He has highlighted many times how investing in stocks is better than gold and debt. The S&P 500 outperformed gold by a wide margin over the last 10 years, which you can see in the graph above.

Last year, Buffett advocated investing in the S&P 500 for those who might not be comfortable investing directly in stocks. He said, “Get a cross-section. And in my view, for most people, the best thing to do is to own the S&P 500 index fund.”

To sum it up, the S&P 500 may or may not crash in 2021. However, over the next decade, it could crash many times as it has in the last decade. At the end of this decade, the S&P 500 might end up outperforming most other assets unless we have a crash towards the end of the decade.