Restaurant Software Provider Toast Might Go Public in 2021

Restaurant software provider Toast Inc. is considering an IPO that could value it at $20 billion. When is the company's IPO date?

Feb. 22 2021, Published 9:55 a.m. ET

Toast Inc. is a technology company that provides payment-processing hardware and cloud-based software targeted to restaurants. JPMorgan Chase and Goldman Sachs might underwrite an IPO valuing the company at $20 billion this year, according to The Wall Street Journal.

Toast was founded in 2011 by MIT graduates Steve Fredette, Aman Narang, and Jonathan Grimm and launched in 2013 in Boston. Although it suffered due to the COVID-19 pandemic like most of the restaurant industry, the company started to bounce back in mid-2020 as restaurants shifted to more takeout and contactless services.

What Toast does as a company

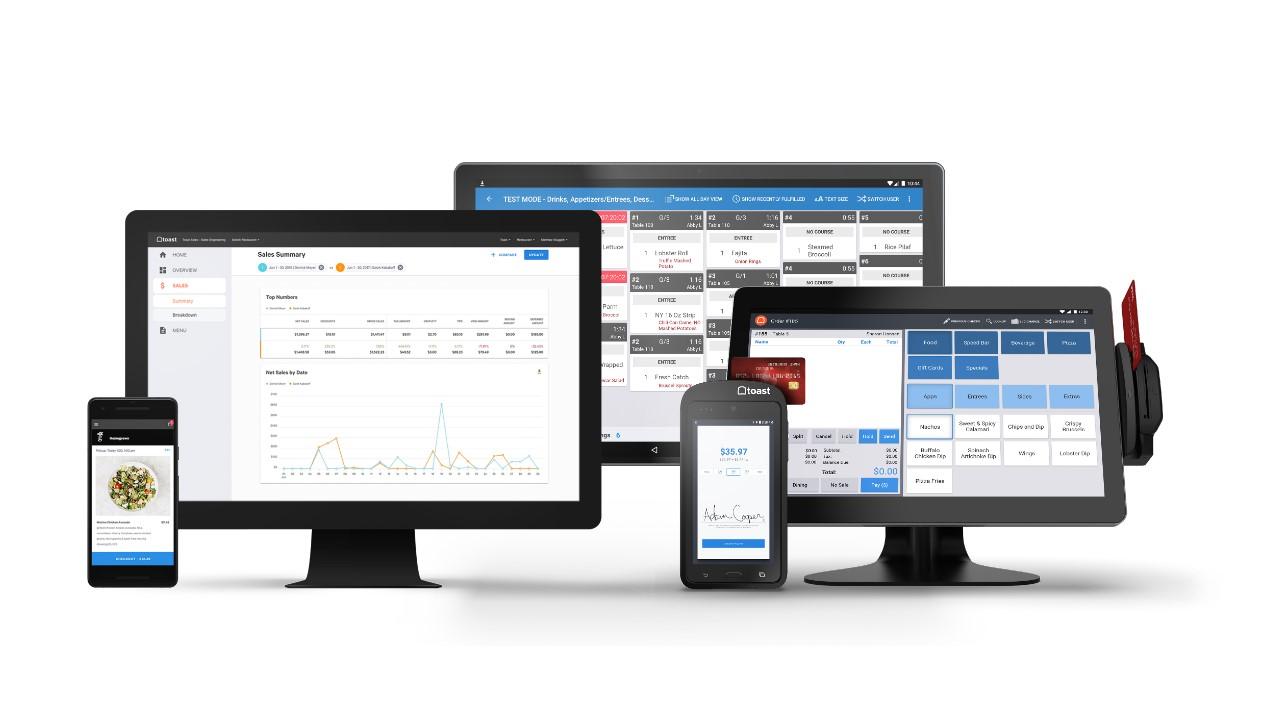

The founders started Toast Inc. as a consumer payment app for restaurants. In 2013, Toast launched its cloud-based POS (point-of-sale) offering for Android devices. The company's current software products include a POS platform, mobile ordering app Toast TakeOut, a delivery network, payroll, analytics, email marketing, and more.

Toast also provides hardware like a POS terminal and kiosks for restaurant use. The company offers loans to restaurants through Toast Capital.

Who owns Toast?

Toast is owned by the primary investors and shareholders.

Toast isn't a publicly-traded company

Toast isn't publicly traded at this time, but sources say that the company is considering various options to take it public in the coming year. An IPO underwritten by Goldman Sachs and JPMorgan Chase is one possibility. The company could also pursue an IPO through a merger with a SPAC (special purpose acquisition company).

Toast's IPO stock price

In November 2020, Toast held a share purchase where current and former employee shareholders could sell up to 25 percent of their vested shares at $75 each. In February 2020, the shares were $45.45. CNBC also reported at that time that Toast’s recovery during the COVID-19 pandemic was strong enough to lead investors to value the company at much more than $8 billion.

Toast's valuation

In February 2020, Toast raised $400 million in a round led by investors Bessemer Venture Partners, TPG, Greenoaks Capital, and Tiger Global Management. The funding round brought the company’s total funding to about $900 million at the time, which led to a valuation of $4.9 billion.

In April 2020, Toast reported plans to lay off as much as half its employees. Toast's business improved as more restaurants sought different payment and takeout services. The Wall Street Journal reported that if Toast pursues an IPO now, its valuation could be around $20 billion.

Toast's IPO plans

Toast is exploring options to go public in 2021. However, people familiar with the matter haven't given a definitive answer on an IPO date. The company hasn't settled on whether to go with a SPAC or a traditional IPO if it does go public.

How to buy Toast stock IPO

If Toast goes public on a stock exchange, investors will be able to buy the stock after the IPO. Pre-IPO shares might be available on platforms like SharesPost and EquityZen.