Cricut, Maker of DIY Crafting Machines, Is Going Public Soon

Cricut, which makes precision cutting machines for DIY crafting projects, is going public with a $4.7 billion valuation.

March 24 2021, Updated 8:12 a.m. ET

Cricut, which makes several popular machines for precision cutting for craft projects, plans to go public very soon. Cricut has filed a registration statement with the SEC and intends to list on the Nasdaq exchange under the ticker symbol "CRCT."

The target price range of the Class A common shares is set at $20 to $22 per share. The company intends to sell 15.3 million shares in its IPO and raise $322 million in total. The midpoint price range would give the company a fully diluted market value of $4.7 billion.

Who owns Cricut?

Cricut was founded in 1969 as the Provo Craft and Novelty Inc. and is based in Utah. The president and CEO is Ashish Arora, the EVP of Product, Brand & Design is Chuck Sieber, and the CFO is Marty Petersen.

Cricut isn't publicly traded

Cricut isn't a publicly-traded company yet, but after it has its IPO on the Nasdaq, it will be available for public trading. With millions of Americans staying home due to the COVID-19 pandemic in 2020, the interest in crafting and DIY projects increased, which boosted the sales for companies like Cricut.

Is Cricut profitable?

Cricut operates based on the belief that DIY artistic projects can be enriching for people’s lives. Its mission is “to unleash the creative potential of consumers with innovations that bring ideas to life in the form of professional looking, personalized handmade projects.”

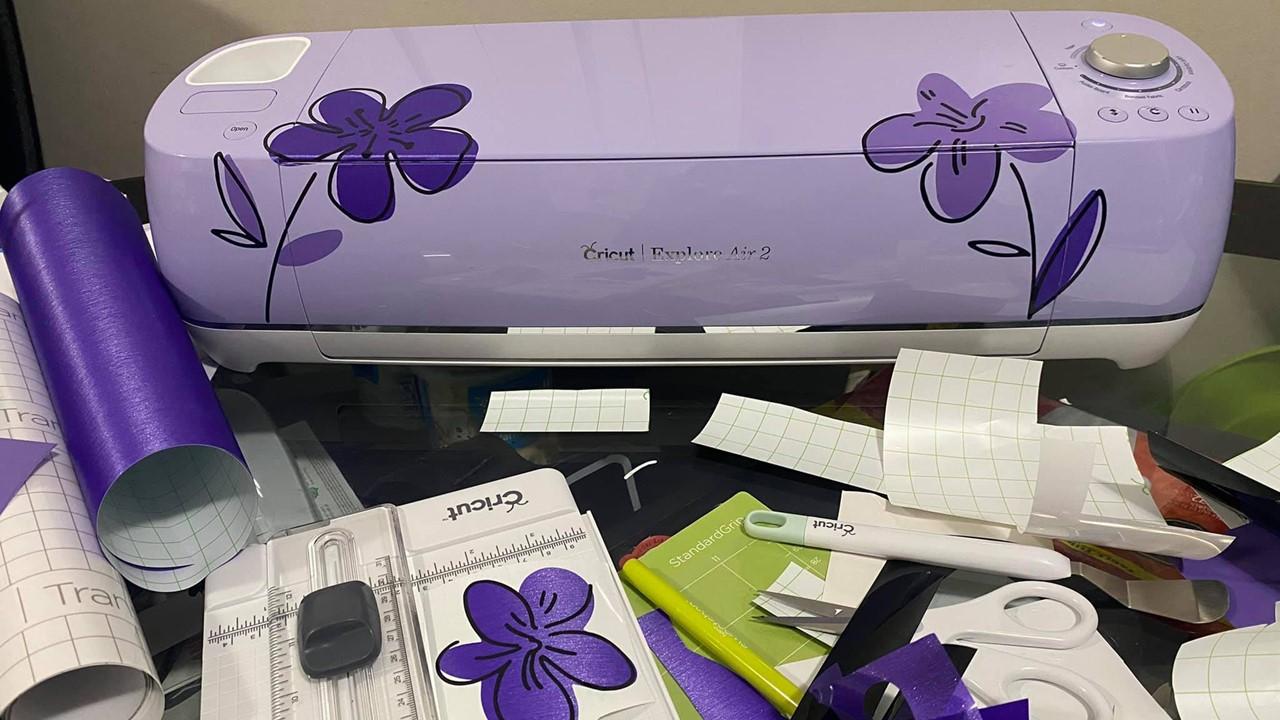

In addition to Cricut's cutting machines for craft use, it also offers two paid subscriptions for its users—Cricut Access and Cricut Access Premium. As of September 30, 2020, the company had nearly 1.2 million paid subscribers.

Cricut's sales in the 12 months ending December 31, 2020, were $959 million. Some of its key products are the Cricut Maker, Cricut Explore family, and the Cricut Joy. The company also sells accessories to complement its cutting machines.

Cricut machines also come with the company’s free software, Design Space. The cloud-based software is accessible at any time from any type of device. The software even offers a mobile app for iOS and Android devices.

Cricut's valuation

The proposed target price range is $20 to $22 per share of common stock. At the midpoint of the price range, Cricut will have a fully diluted market value of $4.7 billion. The proposed IPO will raise $322 million for the company.

Cricut's stock price

The proposed price range for Cricut is set at $20 to $22 per share. The lead underwriters for the proposed stock offering are Morgan Stanley and Goldman Sachs. The joint book-running managers on the IPO are Citigroup Global Markets and Barclays Capital Inc.

Cricut's upcoming dates and plans

In the process of going public, Cricut expects to price during the week of March 22. It filed to go public the same day as competitor Jo-Ann Stores did in February. However, Michael’s is being acquired to go private.

Crunchbase reported that both companies are likely pursuing their IPOs now partly because “the IPO market is hot and public markets have been enthusiastic about new companies.”