What Does the Term 'Shilling' Mean in Crypto and Is It Legal?

The cryptosphere has a lot of terminology and little to no regulation. "Shilling" is a form of advertising for a crypto asset and the lines of legality are blurry.

July 29 2021, Published 11:00 a.m. ET

The world of Web3 and cryptocurrencies isn't the most straightforward. Beyond understanding the technical mechanism that enables these protocols, there's the whole verbiage that crypto natives use. Like many online communities, there's a culture that sustains, maintains, and grows the community and or project. In the cryptosphere, to "shill" is associated with the act of promoting something for a financial incentive.

When mentioning the word "crypto" many people already have preconceived notions about this technology and it's seen as space dominated by Bitcoin. Often seen in a negative light due to its volatility, lack of regulations, and risk of bad acting, cryptocurrency is a world of its own. Those who are looking to invest should familiarize themselves with the terminology that crypto natives use. Lacking the same rules and regulations as traditional financial systems, determining whether certain acts are illegal can get a bit blurry.

What is "shilling" and is it Illegal?

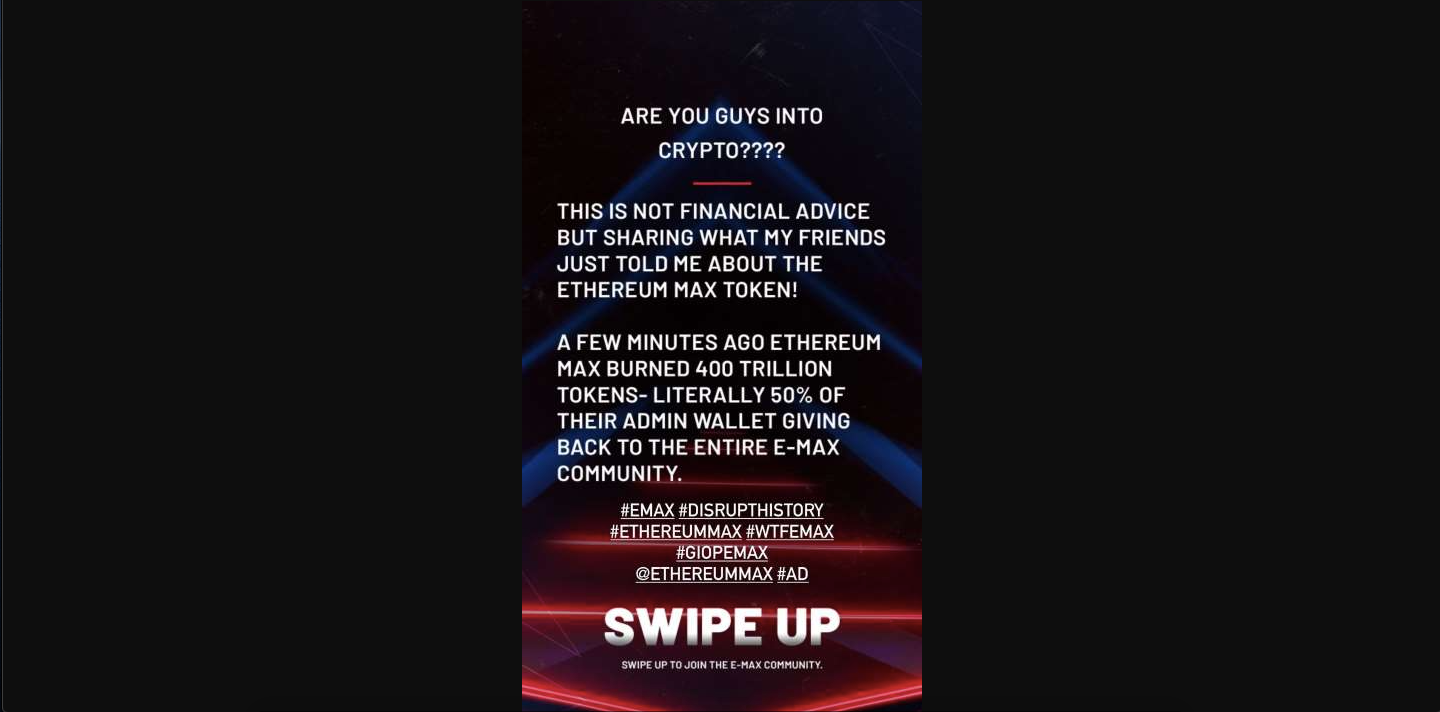

Shilling is when a person or group of people covertly or overtly promote a cryptocurrency. In attempts to create buzz, the person(s) publicly endorse the product. For example, Elon Musk's very suggestive tweets about Bitcoin and Dogecoin. Shilling enters murky waters since there aren't any regulations or rules against promoting a particular product. What happens when the person is getting paid? Many people question whether this act is even legal.

In traditional financial markets, it's illegal to "shill" a product due to the possibility of fraud for what the product might promise to do. However, it isn't as black and white as it might appear. Shilling activities must be proven to have placed the uninformed parties at risk for loss. Take a look at the buzz and confusion regarding Kim Kardashian's paid Instagram stories regarding Ethereum Max. While it carries a negative connotation, it's prevalent without any governing body regulating it since there isn't a law to abide by.

What to look out for with shilling and the risk of "pump and dumps"

Many of us have heard of the term "pump and dump," which refers to a group of individuals trying to profit off an asset. How it works is that the group organizes itself to buy large amounts of a digital asset. The group artificially increases the price and then sells it off at the top when the price point hits its peak. Taking advantage of the concept of "supply and demand," pumpers know that by buying in large quantities, the supply will go down and in turn, increase the demand.

When the demand for something increases, the value also increases. Usually targeting unpopular altcoins, pumpers understand that not a lot of investment capital is needed for manipulation. Many investors are scammed by this act since it takes about 30-seconds for the whole mechanism to go into effect. Experts suggest that one of the key signs to look out for in a pump and dump is the element to which the token is "shilled."

Another thing to consider is the tokenomics. Does it seem to claim massive gains out of thin air? Its important to do thorough research to determine certain fundamentals like: price volatility, mining and/or staking features, and most importantly, who the developers are and whether they are thinking beyond "get rich quick." Otherwise, there's the potential risk of being one shill away from being the victim of a pump and dump scheme led by some skillful shilling.