What Is Robinhood Gold and How Does It Work?

Robinhood’s new Gold product promises to give investors more power over their finances, but does it live up to all that it offers?

Oct. 2 2020, Updated 2:38 p.m. ET

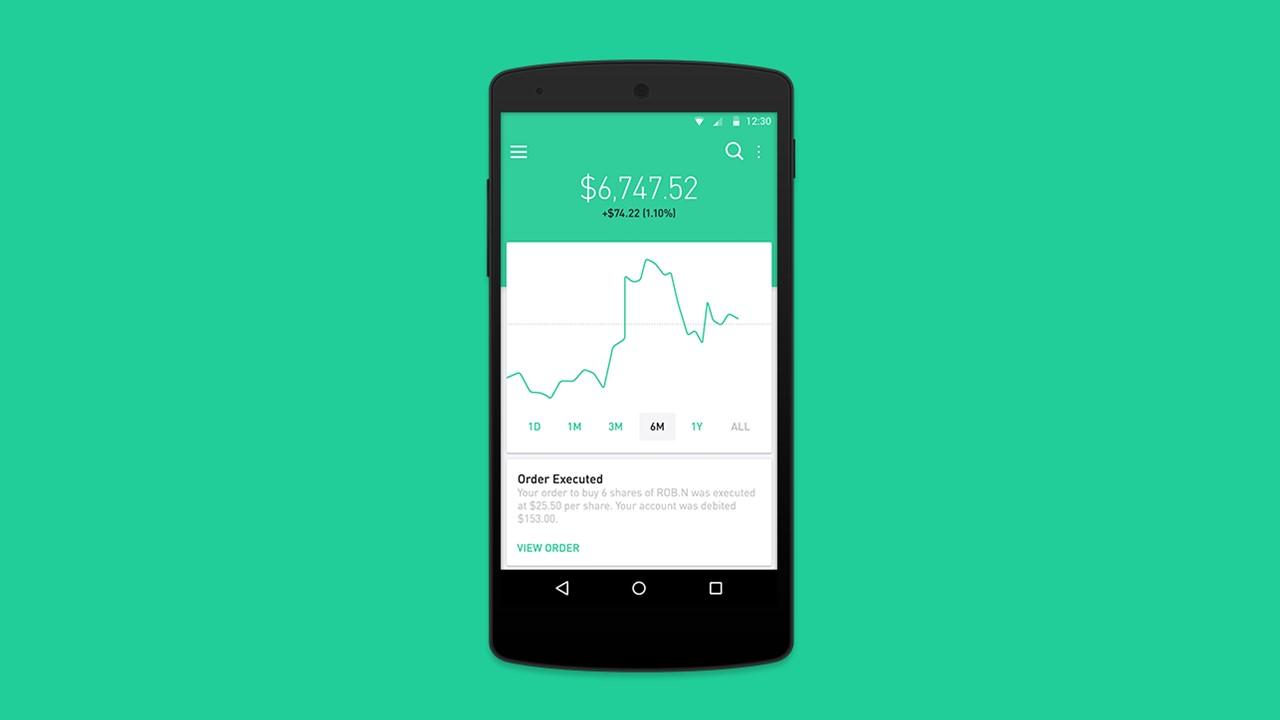

Robinhood is one of the most trusted and popular web-based financial services companies on the market today. The company's robust mobile app and website give more than 13 million users the ability to invest in stocks, ETFs, cryptocurrency, and more. Robinhood Gold is the perfect tool for any investor looking to delve into the market themselves. It seems that the new Robinhood Gold product is set to give users even more financial power.

Is there a difference between Robinhood and Robinhood Gold?

Robinhood, as an entity, specializes in commission-free investing. The company makes up for the lack of commissions through fees. However, the overall concept hinges on the idea that individuals can make their own determinations about how they invest. Robinhood allows users to invest any amount they want, build a portfolio, and diversify into a number of different areas; all on their easy-to-use platform.

Robinhood Gold offers just a little bit extra. Like Robinhood Financial (the flagship product) and Robinhood Crypto (the cryptocurrency-aligned product), Robinhood Gold is a new facet of the company's already robust investment offerings. With Robinhood Gold, investors will be able to trade on margin. They are trading in money borrowed from a broker. Trading on margin isn't for beginners. You can lose more than you invest in the long run, but the rewards can be substantial.

How does investing on margin work?

A margin account amplifies an investors' buying power by allowing them to borrow money to buy stocks. For example, an investor wants to purchase 200 shares of a company that’s currently trading for $30 per share. However, the investor doesn't have enough money in their brokerage account. They can use the amount they have to pay for a portion of the shares and borrow the remainder from the brokerage firm.

If the stocks win and the share price goes up, the margin allows the investor to pay just 50 percent of the purchase price of the stock and keep 100 percent of the profits after paying back the borrowed money, which is a win-win. In contrast, losses can be catastrophic. A losing scenario might mean that the stocks fall and the shares are worth less than they were when the investor bought them. The investor lost the money they already put in as well as the money they borrowed, which they still have to pay back.

Margin trading is a high-risk and high-reward form of investing. Robinhood Gold makes it easier for novice investors to understand, even if it doesn’t make it any less risky.

What do you get through Robinhood Gold?

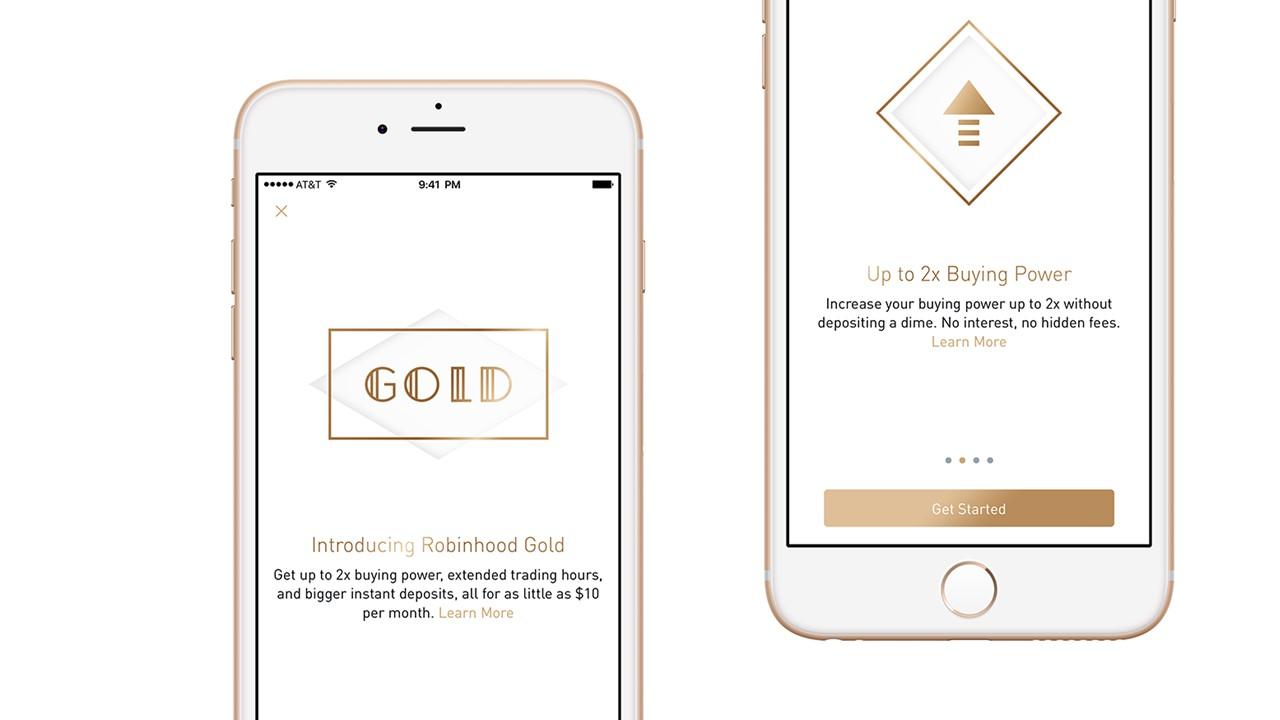

Investing on margin, specifically through Robinhood Gold, gives users more flexibility, extra buying power, and quicker access to deposited funds. Robinhood Gold gives users instant access to between $5 and $50,000 when making a deposit. The amount depends entirely on your account balance. Robinhood Gold also offers unlimited access to in-depth stock research reports on over 1,700 stocks through a partnership with Morningstar.

Does Robinhood Gold allow day trading or after-hours trading?

Robinhood Gold includes all of the day trading options of the Robinhood flagship offerings as well as after-hours trading. Robinhood Gold facilitates after-hours trading by extending the trading day by 30 minutes before the market opens and two hours after it closes. Robinhood Gold offers 2.5 extra hours of trading per day. For margin stocks, the access could be very helpful.