Plug Power Stock Fell This Week—What to Expect Moving Forward

A recent reversal of fate for Plug Power stock has investors wondering what's going on. Why has Plug Power stock fallen lately?

July 13 2021, Published 11:41 a.m. ET

In early 2021, zealous investors propped up stock for Plug Power, Inc. (NASDAQ:PLUG) amid meme stock excitement. The shares more than doubled over the course of the month. Lately, Plug Power's fate has reversed with a noticeable drop in share value.

What happened to Plug Power to cause this reversal of fate? What can investors expect from Plug Power stock moving forward? Here's what we know so far.

An analysis of Plug Power stock pricing year-to-date

Posted by Plug Power Inc. on Monday, January 5, 2015

Currently, PLUG stock reps a share value at a rate of 12 percent lower than the beginning of the year. The shares experienced major growth during the first month of the year, but that success soon turned bearish.

From its high point of $73.18 in January, Plug Power has lost more than 61 percent of its value. The shares are currently trading at $28.32 with about 17 percent of the value lost in the last two weeks.

Since the market opened on July 12, the stock has fallen more than 4 percent.

Why is PLUG stock lacking?

The latest downturn for Plug Power doesn't actually have to do with the company itself. Instead, it's a shift in the competitive landscape.

A few months ago, a company called Hyzon Motors announced that it's going public via a SPAC. Hyzon is continuing with those plans in partnership with blank-check firm Decarbonization Plus Acquisition.

Now, Hyzon has struck a deal with a company called TotalEnergies. As Green Car Congress puts it, Hyzon "signed a memorandum of understanding (MoU) with TotalEnergies that reinforces the two companies' shared commitment to evaluate and develop hydrogen refueling and vehicle supply solutions for long-haul transport to customers across Europe."

This is big news and it impacts Plug Power's shareholder sentiment. Plug Power offers hydrogen fuel cell solutions. A strong competitor foundation could mean less backing for the publicly traded company.

An optimistic forecast for Plug Power stock

According to analysts, Plug Power's YTD bearish behavior means the stock has room to grow. While shares could stay stagnant or decrease marginally over the next 12 months, more experts are in consensus that investors will see growth between 48.5 percent and 175.7 percent.

As an investor, be aware that movements for Plug Power stock might often be sentiment-based rather than rooted in fundamentals. The latest EPS was $0.07 in the red for Plug Power. However, sales growth is on the upswing, which could be where Plug Power shines in the months and years to come.

What investors are saying about PLUG

The sentiment for PLUG stock is down in the interim. However, downward movement won't phase all investors.

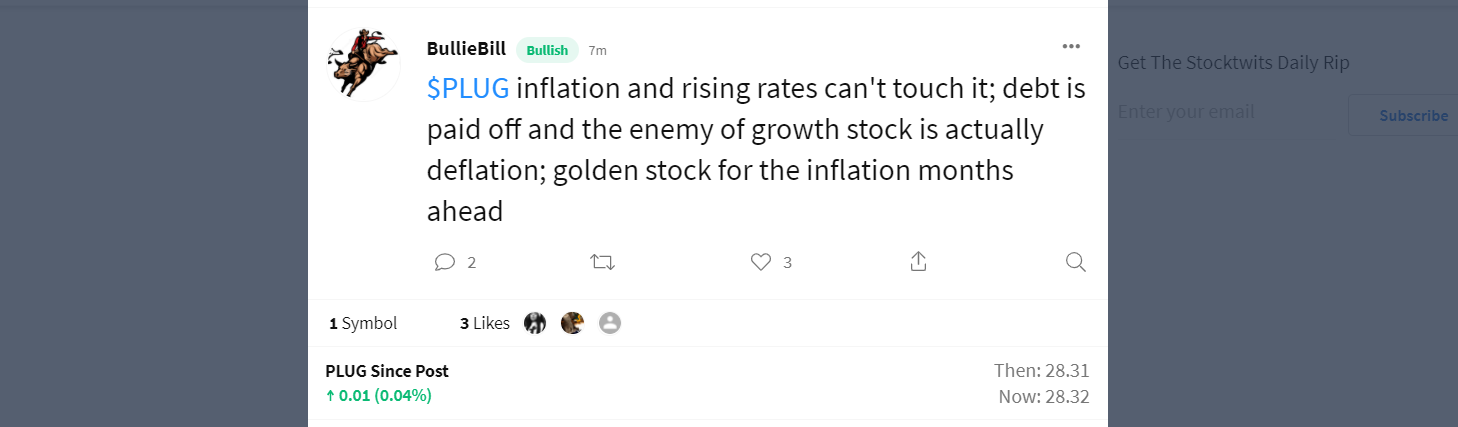

One investor has faith that PLUG will be fine since it paid off its debt in January. Inflation could be good for the growth stock in the long term.

Others are adding to their investment during the downswing, which is a practice often referred to as "buying the dip." There aren't any guarantees that a dip will recuperate, but investors are depending on their due diligence and intuition to guide them.

As for whether or not PLUG stock is a solid investment, there's potential, but it isn't set in stone. Analyze your risk tolerance to determine if the stock is right for you. You can always rebalance your portfolio to make space for investments that require you to take a bigger leap.