Jim Cramer Never Quit Saving, Even When He Was Homeless

What did Jim Cramer do at Goldman Sachs? Read more about his career history, his personal highs and lows, and his philosophy about saving money.

July 2 2021, Published 12:33 p.m. ET

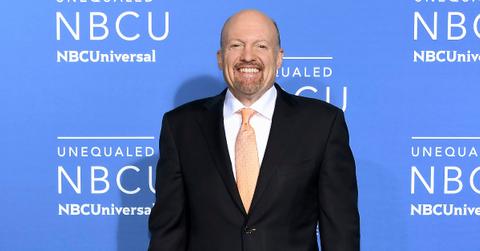

You likely know that CNBC's Jim Cramer is the host of Mad Money and the cohost of Squawk on the Street. You might even know that he worked at sales and trading at Goldman Sachs in the 1980s and that he co-founded TheStreet.com.

But you might not know that Cramer didn’t always have “mad money.” In fact, early in his career, Cramer was living out of his car. During that rough patch, though, Cramer was saving money via the Fidelity Magellan Fund (FMAGX)—having opened the account on his father’s advice—as he said on CNBC in 2014.

Cramer started saving money during high school.

Cramer grew up in Philadelphia, Penn., and he started putting money away during his high-school job. “I saved as I bussed tables at the old [restaurant] Block and Cleaver, which of course we called the Block and Cleavage because we were hilariously stupid back then,” he said on CNBC.

The future financial expert then got a job selling soda and ice cream at Veterans Stadium, home of the Philadelphia Phillies baseball team. He paid off other vendors so he could have exclusivity in his sections of the stadium. “I made fortunes… except the one time they gave me only strawberry ice cream,” he quipped.

Jim Cramer almost didn’t get his diploma from Harvard.

Cramer attended Harvard University and became editor-in-chief of The Harvard Crimson. However, the school’s administration temporarily withheld his diploma after he reported on alleged elitism in the history department. “My parents were crying,” Cramer told Bloomberg in 2005. “It was horrible.”

Cramer “never quit saving,” even when he was homeless.

After Harvard, Cramer worked as a reporter for the Los Angeles Herald Examiner. During that time, a thief broke into his apartment and didn't leave him with anything. The event started a “terrible but thrilling” six-month stint of Cramer living in his car, as he said on CNBC.

During that time, Cramer was still investing money in the Fidelity Magellan Fund. “I still never quit saving,” he told viewers. “I remember cashing my paycheck every other week and then writing a check, yes, to Fidelity Magellan Fund. … How poor was I, yet still putting money away.”

Cramer went to law school but became an investment adviser and hedge fund manager instead.

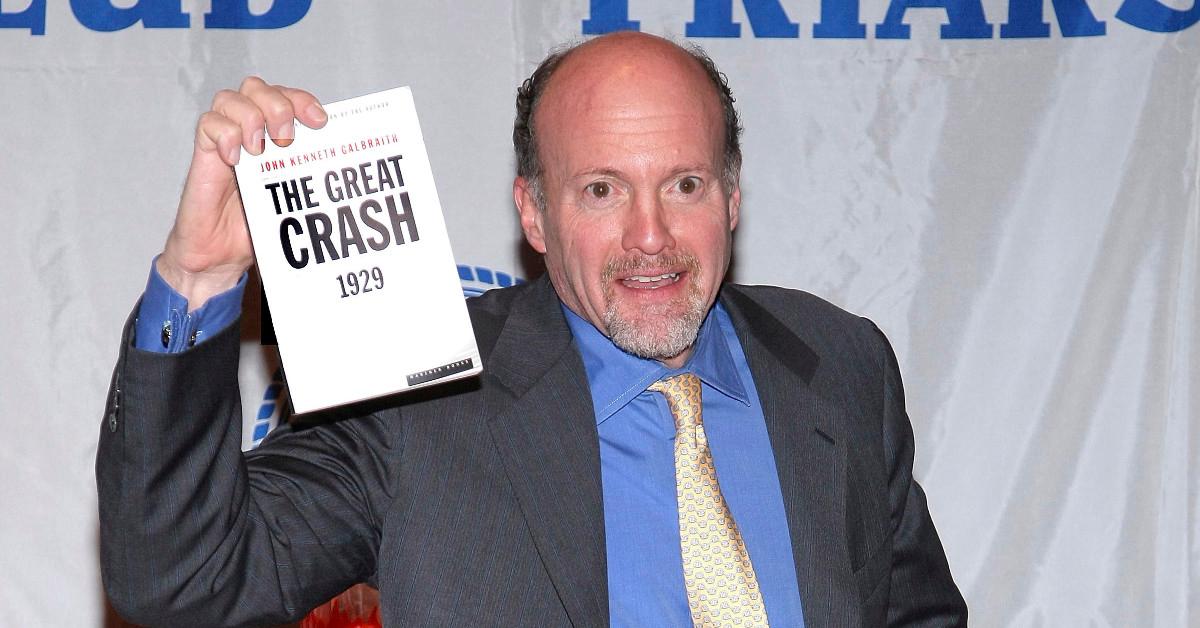

At his father’s insistence, Cramer applied to and attended law school at Harvard, but he often cut classes to watch the Financial News Network, and that’s what reignited his childhood fascination with the stock market. “It was unbelievable,” he told Bloomberg. “This was it for me. I knew it.”

Cramer used his paychecks and his academic loans to invest money in the market, and he even left stock tips on his answering machine greeting. After he earned $150,000 profit on a Harvard professor’s $500,000 check, Cramer landed a job at Goldman Sachs, where he was a “broker to the ultra rich” for three years, according to Bloomberg.

In 1987, Cramer started the hedge fund eventually known as Cramer Berkowitz. During his 14 years at the hedge fund, his compounded rate of return after all fees was 24 percent, including a 36-percent-plus year in 2000, according to his CNBC bio.