VTI Versus VOO ETF: Tax Efficiency, Explained

What's the difference between VTI and VOO ETFs, and which one is more tax efficient? Keep reading for everything that investors need to know.

May 3 2021, Published 11:29 a.m. ET

Choosing a comprehensive ETF can often feel overwhelming, especially when you're aiming for maximum returns over your lifetime. Take President Biden's proposed capital gains tax increase for the wealthy and you might wonder how each ETF impacts your taxes as well. Let's consider two of Vanguard's most popular ETFs—VTI and VOO.

On the surface, VTI and VOO have similar returns. However, tax efficiency plays a key role in which ETF is right for you.

The difference between VOO and VTI ETF

VOO is the Vanguard 500 Index Fund ETF. This fund tracks the S&P 500, which is a market-capitalization-weighted index made up of large-cap companies.

VTI is the Vanguard Total Stock Market Index Fund ETF, which tracks the CRSP US Total Market Index. This index includes companies with various capitalizations (from small to large) and diversifies investing style with the inclusion of growth and value stocks.

What redditors have to say about the VTI versus VOO ETFs

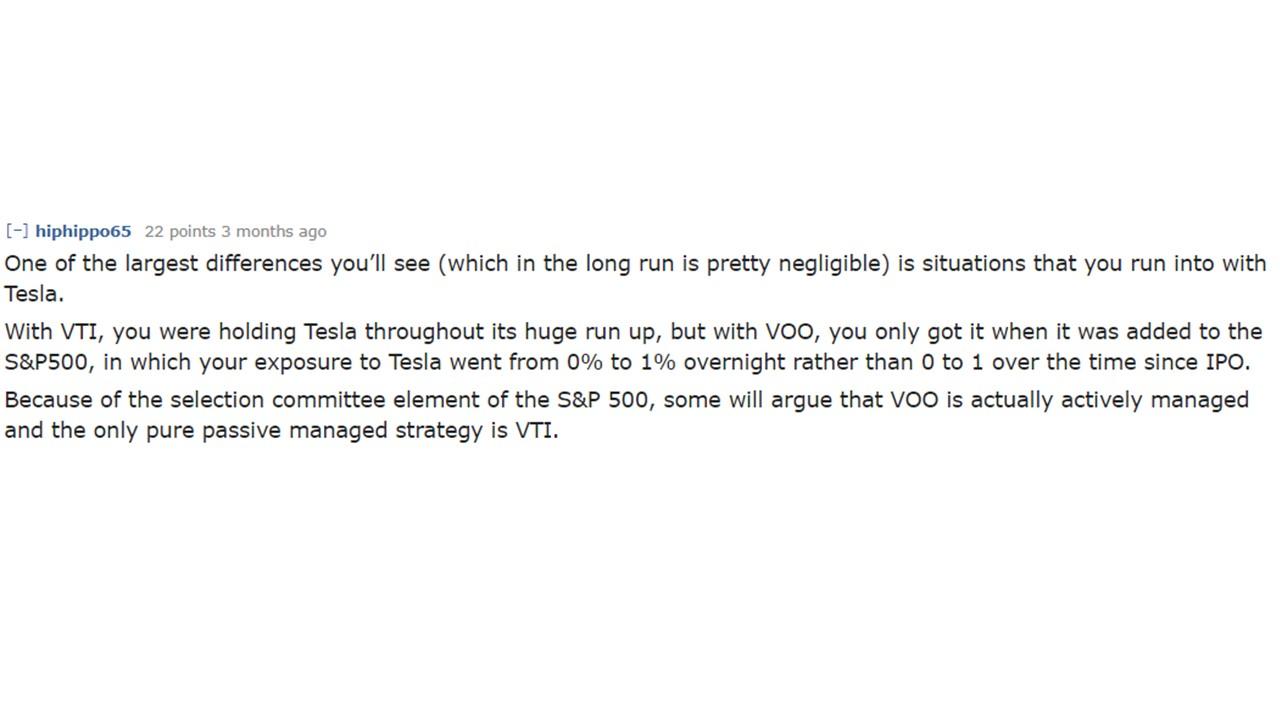

According to the subreddit Bogleheads (made up of fans of "low-cost, tax-efficient, long-term" passive indexing), there are slight differences in taxation between VTI and VOO.

Based on the fact that VTI maintains total market inclusion, many users say that it's more passive than the S&P 500-tracking VOO. Usually, funds with a more passive approach to investing have lower fees and higher tax incentives.

A breakdown of dividends and tax efficiency in VTI versus VOO

The precise tax implications for any investment depend on your tax bracket. However, VTI has a slightly lower QDI (Qualified Dividend Income) than VOO. The 2020 QDI for VOO was 100 percent, while it was 96.01 percent for VTI.

QDI is the percent of dividends subject to a lower tax rate than ordinary income, which makes them more tax efficient than non-qualified dividends.

Non-qualified dividends are often deemed QBI (Qualified Business Income), which are 80 percent taxable at the full rate.

As an example, you might be in a 22 percent income tax bracket, which means you'll pay 15 percent on QDI and 17.6 percent on non-qualified QBI. It's a marginal difference but one worth looking into if you're planning on investing heavily.

Performance differences in VTI versus VOO are marginal

VOO has returned 104.29 percent over the last five years. YTD, the shares are up 13.69 percent.

VTI has returned 107.84 percent over the last five years. YTD, the shares are up 13.72 percent.

A few percentage points can make a big difference in terms of capital (especially when considering compounding investments from reinvested dividends). However, the difference in performance won't make or break an investor.

Is VTI or VOO better?

In terms of diversity, VTI has a hold on things. It's also historically slightly more tax-efficient, mainly because there isn't the S&P 500 vetting process involved. As an investor, determining whether you should buy the VTI or VOO ETF depends on your belief in the large-cap sector (VOO's strong suit) compared to your need for diversity and passivity (where VTI shines).