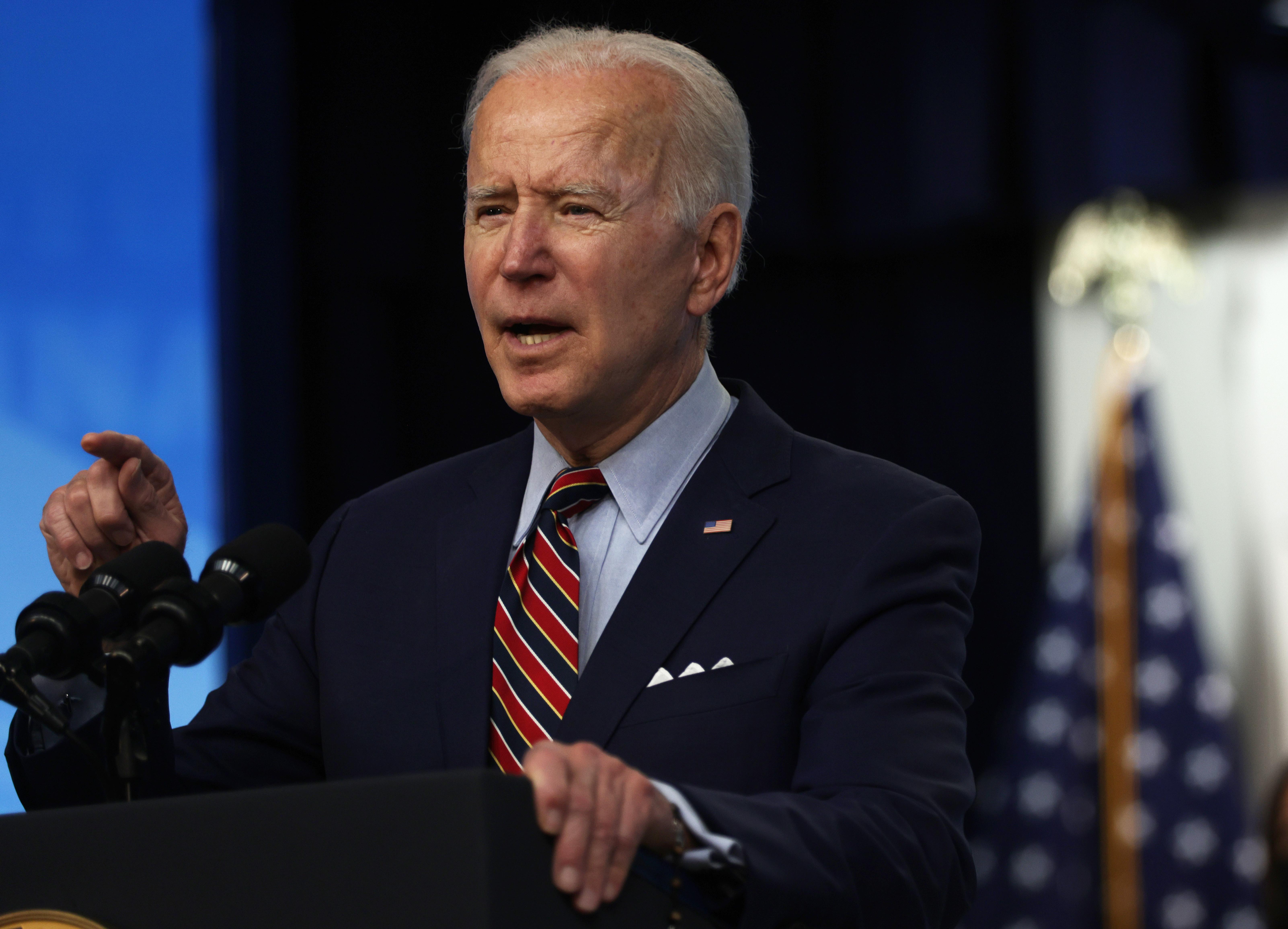

How Doubling Capital Gains Tax for the Wealthy Fits Into President Biden's Spending Plan

Which Americans would have to pay more in capital gains tax if President Biden's plan goes through, and where would the money go?

April 22 2021, Published 3:33 p.m. ET

In less than 100 days in office, President Joe Biden has pushed vaccine distribution, launched government-wide initiatives to address racial inequality, and began reversing the Muslim ban. Now, he's hoping to increase capital gains taxes for wealthy individuals making $1 million or more per year.

What does that mean for investors, and how might we see Biden's proposed boost in capital gains taxes put to use?

Biden's capital gains tax increase would only affect the wealthy.

As part of the upcoming Americans Family Plan, Biden wants to include an increase in capital gains tax rates for individuals who make $1 million or more annually. This is specifically for long-term capital gains that are held for a year or more. Long-term gains are typically taxed at a much lower rate than short-term gains, which are taxed according to federal ordinary income tax brackets.

At the proposed rate, someone making at least $1 million could pay as much as 39.6 percent in capital gains taxes. Then there's the investment income surtax, which would bring the total tax rate to 43.4 percent.

This is more than double the maximum existing long-term capital gains tax rate of 20 percent. With this change, there wouldn't be much of a difference between investing for the short or long term for those with very high earnings.

Those making more than $496,601 per year but less than $1 million will retain their 20 percent long-term capital gains tax rate whether or not the proposed increase goes through.

Combined with state levies, high-earning investors could be paying more than half of their returns in taxes. It could potentially eliminate the reward that accompanies holding stocks for the long term, but it could also increase investing from the bottom up.

The taxes would go toward social spending programs.

What does Biden hope to spend these additional taxes on? The American Families Plan has not yet come to light, though it's expected to be worth $1 trillion and funded by wealthy investors. It's a different beast from his infrastructure plan, dubbed the American Jobs Plan, which is funded by increased corporate taxes.

The American Families Plan could support the expanded child tax credit as well as other spending on children and education. Most likely, the goal would be to lift families out of poverty and pave the way for future innovators.

When will Biden reveal more about the capital gains tax plan?

Biden is expected to divulge the plan's details next week. He will propose increased federal tax rates for wealthy investors as well as plans for supporting families in the coming years, well beyond the pandemic.

Investors are not happy with the news

Unsurprisingly, investors are jumping ship in the market today. The Dow Jones Industrial Average is down 260 points or 0.77 percent as of 3:00 p.m. while the S&P 500 index is down about 30 points or 0.72 percent. Meanwhile, the Nasdaq Composite Index is down 104 points, or 0.74 percent.