Will U.S. Steel Stocks Finally 'Thrive' Under a Biden Presidency?

U.S. steel stocks didn't "thrive" under Trump's presidency, despite his claims. Can the sector return to glory with a Biden presidency?

Jan. 20 2021, Updated 7:50 a.m. ET

During his 2016 election campaign, Donald Trump talked about reviving the U.S. manufacturing sector. His administration took several measures to address the challenges faced by the domestic steel industry, including imposing Section 232 tariffs on imports. In 2019, Trump claimed that the U.S. steel industry was “thriving” under his watch, but that wasn’t the case. What will a Biden presidency mean for the sector?

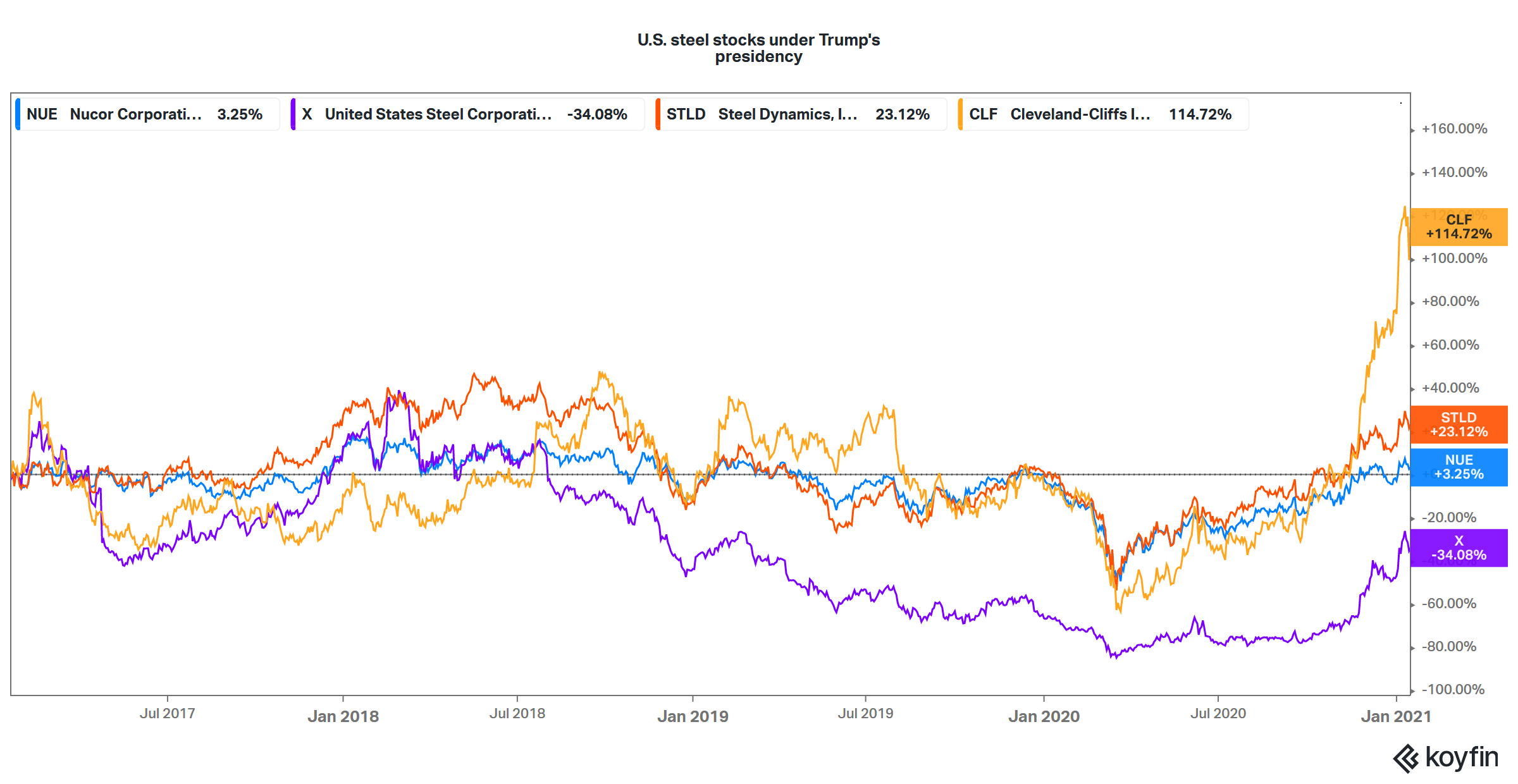

Over the last couple of months, commodity prices have been strong, boosting U.S. steel stocks. However, despite all the support Trump had for the industry, U.S. steel stocks didn't perform well during his presidency.

U.S. steel stocks struggled during Trump’s presidency

U.S. Steel Corporation (X) stock lost over 34 percent during Trump’s presidency, and Nucor (NUE) gained just 4 percent. Although Steel Dynamics rose 23 percent, it still underperformed the S&P 500 by a wide margin. Cleveland-Cliffs (CLF) stock was an exception and doubled. That said, CLF was initially an iron ore producer and has acquired steel operations only over the last year.

How Trump’s policies impacted the U.S. steel industry

Trump’s Section 232 tariffs put barriers on imports and addressed a longstanding issue in the U.S. steel industry. However, the tariffs didn't help much in the end, as the ensuing trade war played a part in global metal prices crashing. Meanwhile, Trump’s much-touted infrastructure investments to boost demand didn't really take off.

Will Biden keep Trump’s Section 232 tariffs?

Joe Biden has indicated that he's in no hurry to waive the tariffs on China that the Trump administration put in place. Unlike Trump, he intends to make allies before devising a U.S. trade policy for China.

However, the Section 232 tariffs have put Biden in a difficult position. As China isn't a major steel and aluminum exporter to the U.S., the tariffs ended up having more impact on friendly trading partners such as Canada, India, Japan, and Germany.

Earlier this month, steel unions and industry players urged Biden not to repeal the Section 232 tariffs. Biden will have to weigh his options, balancing the domestic industry's expectations with those of U.S. trading partners.

What will a Biden presidency mean for the U.S. steel industry?

Biden has vowed to offer more stimulus, which could be beneficial for the U.S. economy in the short term. If the administration scales up infrastructure investments, they could propel the demand for steel, aluminum, and copper.

Also, by toning down its aggressive trade policy toward China, the U.S. could boost sentiment in the metals and mining sector. This sentiment, along with strong momentum in the global economy, could drive the U.S. steel industry in 2021.