What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans?

A proposal to tax unrealized gains is being considered in the Senate. This would eliminate wealthy individuals' ability to defer taxation on assets.

Sept. 30 2021, Published 10:40 a.m. ET

A proposal on the table in the U.S. Senate is an attempt by Democrats to impose more tax on ultra-wealthy Americans. Senator Ron Wyden, a Democrat from Oregon, has presented a proposal that would tax billionaires such as Warren Buffett on unrealized gains from their assets.

Currently, the tax code stipulates that unrealized capital gains aren't taxable income. What this means is that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset. This policy has enabled the wealthiest of Americans to grow wealthier by minimizing their tax obligations.

What are capital gains?

Put broadly, capital gains are simply the profit from the sale of an asset. These are “realized” gains, unlike gains achieved prior to sale. These may apply to anything that increases in value from the time an investor acquires it to the time they sell it. U.S. tax laws currently provide tax rates for capital gains on assets held for one year or less, or longer than one year.

Investors may also incur capital losses, which is when an asset declines in value from the time of purchase to the time of sale.

What would taxing unrealized gains change?

If the bill put forward by Senator Wyden passes, it would end the “step-up in basis,” or the means by which heirs can inherit assets from wealthy individuals and only pay tax on the gains realized since the original owner’s death. This has long been a strategy for the wealthy to grow wealthier by holding assets and financing their lifestyles through borrowing.

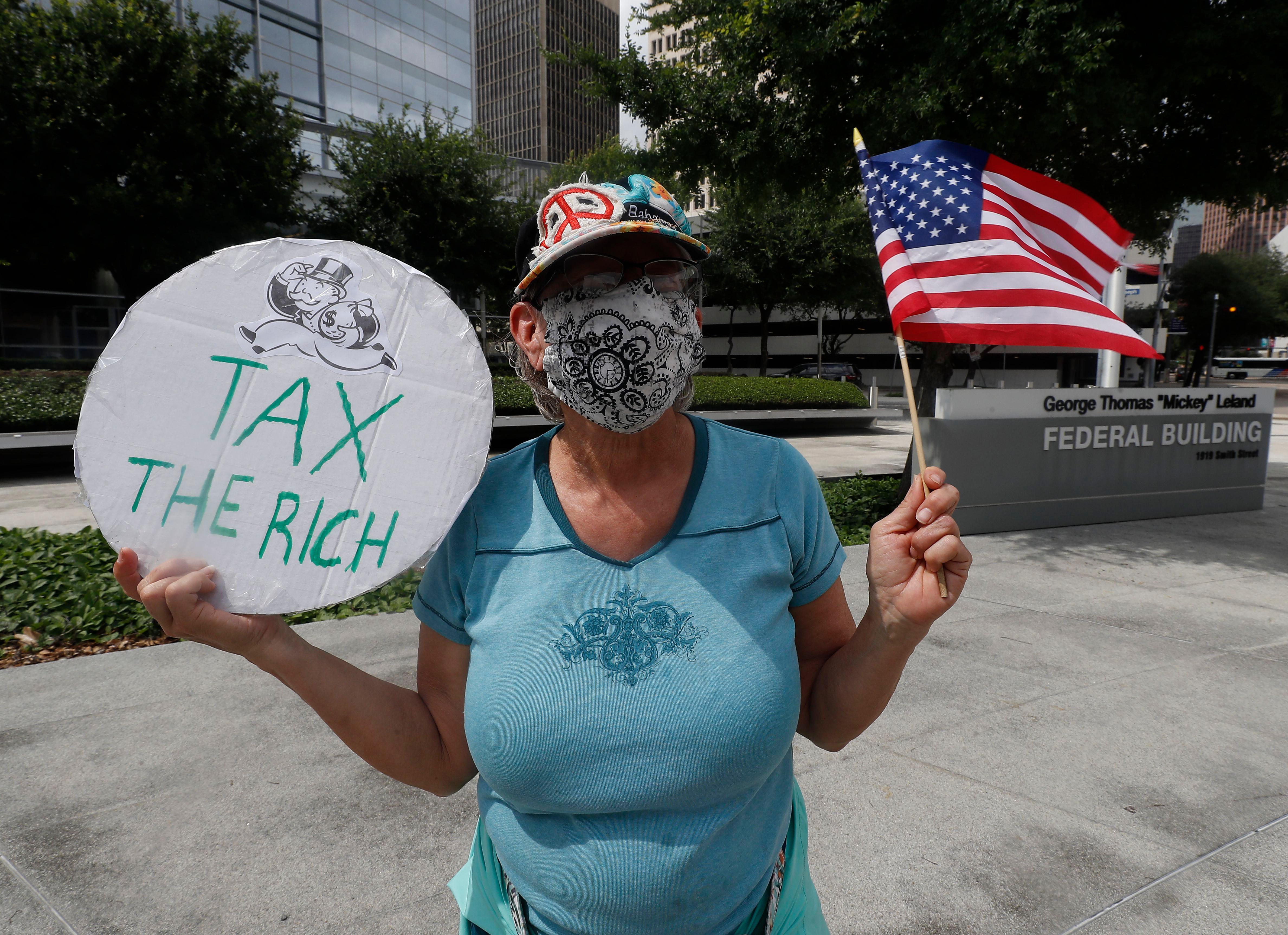

The new proposal would tax unrealized capital gains, meaning that the wealthy would no longer be able to defer tax payments on gains made each year. If the proposal were to pass, billionaires would be the ones directly impacted. Many politicians have been working to ensure fairer taxation for billionaires, or getting them to pay their “fair share.”

According to The Wall Street Journal, Senator Wyden’s proposal would impact just a few hundred Americans who have significant wealth, such as Jeff Bezos. Several people have taken to Twitter to question that.

The proposal hasn’t specified the amount of revenue that changing this tax policy would bring in. However, tax professors and Biden administration officials Lily Batchelder and David Kamin estimated in 2019 that a similar proposal targeting the top 0.1 percent of American households would raise about $750 million in ten years, reports The Wall Street Journal.

The Institute on Taxation and Economic Policy explained that current tax policy enables wealthy people to defer tax for years while growing their wealth more quickly than middle-class individuals can. Although unrealized gains are seen as “paper” gains, they generate significant income for the wealthy in ways unavailable to the general public.

In addition, capital gains tax rates are lower than those for regular income. A proposed House Ways and Means bill suggests raising capital gains tax rates to a maximum of 28 percent, still lower than the top rate for income tax.

According to The Wall Street Journal, enforcing taxation of unrealized gains could be tricky for the IRS, stated Andrew Moylan of the National Taxpayers Union Foundation. This is partly due to the difficulty of assigning value to illiquid assets.