Outlook for Under Armour (UAA) Stock Following Profitable Quarter

Amid a transition to premium apparel, the earnings for Under Armour (UAA) stock respond. What does the forecast look like and should you invest?

Aug. 3 2021, Published 12:24 p.m. ET

Amid a transition from discount to premium offerings, Under Armour Inc. (NYSE:UAA) is relishing in renewed earnings vigor. The company's results for the second quarter of 2021 surpassed the expectations and the stock responded positively.

How long will the energy last for UAA stock? Should investors buy for the long term or hold out until the company is undervalued again?

According to earnings results, Under Armour made it through the COVID-19 pandemic relatively unscathed.

UAA stock is still riding the earnings wave with shares seeing a 5.83 percent boost on Aug. 3. The rise in market value is thanks to Under Armour's second-quarter earnings, which it reported the same morning before the market opened.

The revenue hit $1.4 billion, which is a major YoY increase of 91 percent. The apparel, footwear, and accessories revenue all rose, with apparel revenue growing the most by 105 percent to $874 million.

Prior to the earnings report, analysts agreed that UAA would bring in an EPS of $0.06. Instead, Under Armour stock managed to bring the adjusted diluted EPS to $0.24. The EPS was 400 percent higher than analysts' expectations, which is precisely why UAA stock responded so well in pre-market and morning trading hours.

Will the rally last for Under Armour (UAA) stock?

In the short term, earnings rallies can be profitable, but it's difficult to get in at the morning bell. Investors partaking in pre-market trading are poised to achieve the highest returns in these situations, a feat that's difficult if not impossible to achieve for individual retail investors.

Prior to the earnings report, UAA stock was undervalued at $21.13 per share. As of mid-morning on Aug. 3, the stock is trading at a market value of $22.28.

Most of Under Armour's success came from the company's steadfast transition away from discounted products and toward premium, full-price offerings (much like Nike and Lululemon, both of which are vying for public market attention).

Analysts expect UAA stock to see a median growth of 14 percent over the next 12 months. This rate of growth would put the security in line with market-wide expectations. It isn't spectacular, but it's profitable. If Under Armour continues to outpace the expectations, the shares could reach as high as $36.00, which is a 61 percent boost from the current market value.

UAA stock is up 131.85 percent on a trailing 12-month basis. There's bound to be a correction in the near future, and investors might want to get in at a good time to maximize returns.

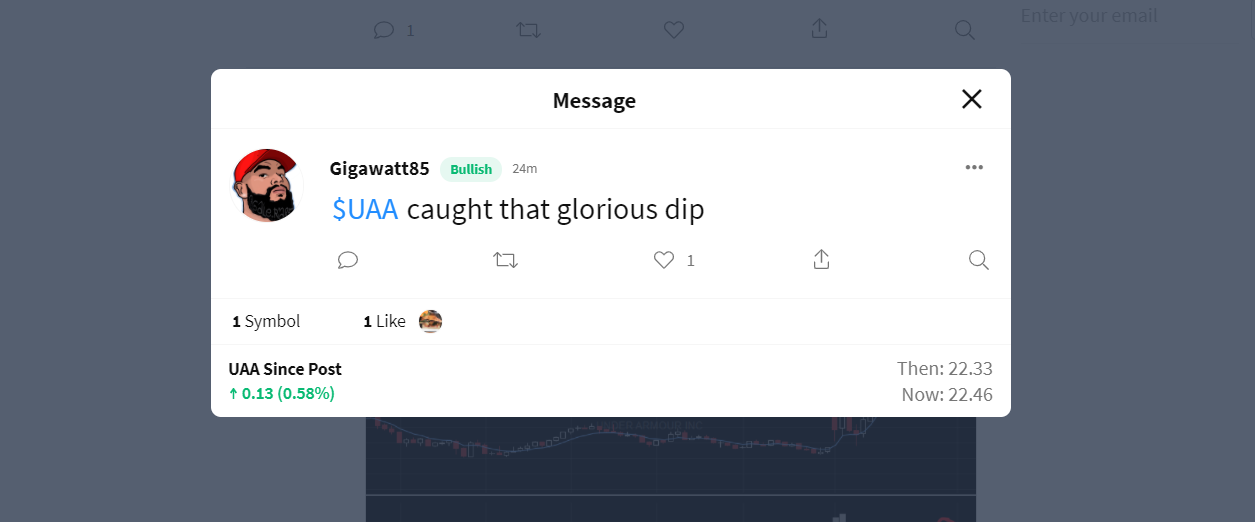

What investors are saying about UAA stock

Chit-chat about Under Armour stock is fluttering across the web. Many people are talking about the fact that Under Armour is looking toward revenue growth in the 20th percentile range over the course of 2021—an increase from previous estimations in the teens.

Other day and swing traders are eyeing quick dips for short-term gains, the likes of which could also cater to longer-term investors. Ultimately, UAA stock looks like a buy for the long term, but timing is everything in a quick-moving stock market.