Is Sprout Mortgage Closed? Non-QM Lenders Feel the Pain

Sprout Mortgage has reportedly closed and laid off its employees. What’s wrong with non-QM lenders and why are they shutting down?

July 7 2022, Published 8:27 a.m. ET

According to reports, Sprout Mortgage has closed and laid off its employees. The company is among the fastest-growing non-QM (qualified mortgage) originators. In June, First Guaranty Mortgage Company, which was backed by PIMCO, the global investment management company with assets of over $2 trillion, also shut down. What’s wrong with non-QM lenders and why are they shutting down?

First, it's important to understand non-QM lenders. Traditional mortgage lenders, which include banks as well as large mortgage companies, have strict criteria for borrowers. They take into account the borrowers’ earnings, current debt levels, the term of the loan, as well as the overall profile before approving the loan.

Non-QM lenders come to the rescue of non-qualified borrowers

Non-QM lending isn't the same as subprime lending. In the latter, people with bad or low credit are extended the loans. However, non-QM fill the gap left behind by traditional mortgage lenders. So say, if you are a retiree or a foreign national, while a bank might not approve your mortgage, a non-QM lender might.

Also, a lot of people are asset-rich but cash poor. While they have accumulated several assets, they don’t have much recurring income which banks take into account before approving a mortgage. Such borrowers also find solace in non-QM lenders.

First Guaranty Mortgage Company filed for bankruptcy.

On June 30, First Guaranty Mortgage Company filed for Chapter 11 bankruptcy. It said, “The chapter 11 filing was necessitated by significant operating losses and cash flow challenges experienced by the Company due to unforeseen historical adverse market conditions for the mortgage lending industry, including unanticipated market volatility.”

The company pointed to the troubles in the mortgage refinance market as well as the weak mortgage purchase market. It also blamed the lack of home inventory as well as affordability issues. U.S. housing affordability is running at all-time lows as house prices have climbed over the last two years without a commensurate increase in average wages.

Is Sprout Mortgage closing?

While several media outlets have reported that Sprout Mortgage is shutting down, the company hasn’t officially confirmed the news. Some of the employees who were informed that they are being laid off in the conference call on July 6 are also posting about the layoffs on social media.

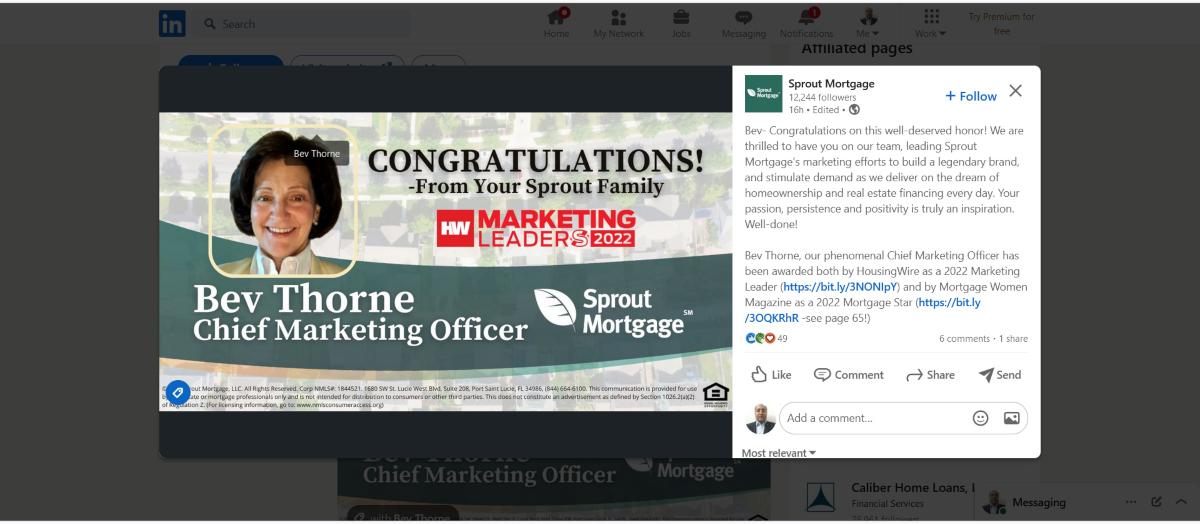

However, on its LinkedIn profile on July 6, Sprout Mortgage celebrated the HousingWire 2022 Marketing Leaders award received by its chief marketing officer Bev Thorne. In April, Shea Pallante, the president of Sprout Mortgage, told HousingWire that it prefers to “focus our efforts on maximizing production during any changing rate environment. We’re confident that the non-QM sector — and Sprout in particular — will not only ride out the turbulence but outperform expected growth rates.” HousingWire had chronicled the issues facing non-QM lenders.

What’s wrong with the U.S. mortgage market?

U.S. mortgage rates, which fell to their all-time lows in 2021, have since climbed to multi-month highs amid the Federal Reserve’s rate hikes. The U.S. Central Bank has raised rates by 150 basis points in 2022 and the dot plot calls for another 175 basis point rate hike by the end of 2022.

The refinancing market, which was strong in 2021 amid record-low rates, has particularly taken a beating as not many are looking to refinance at these rates. The U.S. housing market has also weakened amid recession fears.

Overall, it has been a perfect storm for mortgage lenders and even the larger players like Wells Fargo have been laying off employees. As for non-QM lenders, the going gets particularly tough during periods of economic turmoil like we are currently witnessing.