What Are Robinhood's Day Trading Rules?

Robinhood day trade limits are important to observe if you want to avoid severe restrictions on your account.

Oct. 27 2020, Updated 8:20 a.m. ET

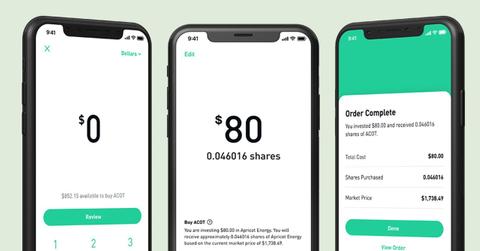

Robinhood attracts professional and novice investors thanks to its commission-free trading and features like the ability to purchase fractional shares. Many investors are also drawn to Robinhood because they can buy pre-IPO stocks and automatically reinvest dividends or set up a recurring investment plan.

Is day trading available on Robinhood? What are Robinhood’s day trade limits and how do they apply? First, day trading is an investing strategy where you buy and sell the same stocks within the same trading day. Day trading can be a great way to make some quick money with actively traded stocks or in a volatile market.

What are Robinhood’s day trade rules?

If you make four or more day trades on Robinhood, you will be labeled as a pattern day trader. You will be subject to Robinhood’s pattern day trading limits. If you are labeled as a pattern day trader, Robinhood will block you from executing a day trade for 90 days. In order to get around Robinhood's day trading restriction, you need to have at least $25,000 in your account.

Violating Robinhood’s day trade rules can have serious consequences on your account. For example, if you have been labeled as a pattern day trader and you continue to make day trades with an account below $25,000, Robinhood will hit you with more restrictions. Robinhood could block you from buying any securities on the platform for 90 days. Robinhood says that its day trade rules protect investors from taking on too much risk.

Does Robinhood limit day trading?

Robinhood limits investors to three day trades in a five-day trading period. If you observe Robinhood’s day trading limits, you can day trade on the platform without any problem. However, exceeding the three day trades limit will result in Robinhood flagging you as a pattern day trader and place restrictions on your account. Since day trades restrictions are a regulatory matter, they apply across all of the brokers and not just Robinhood.

Can you day trade on Robinhood without $25,000?

Robinhood’s $25,000 account minimum requirement applies if you exceed the three day trades limit. You can day trade on Robinhood without $25,000 as long as you keep your trades within the limit.

Robinhood’s day trading limits don’t apply to a cash account. Instead, the limits apply to Robinhood Instant and Robinhood Gold accounts since they are margin accounts. Investors on a cash account can day trade on Robinhood without $25,000 and as frequently as they want.

You can avoid Robinhood’s day trading limits by downgrading your Instant or Gold account to a cash account. However, downgrading to a cash account will result in you losing instant deposit and instant settlement benefits available to Robinhood margin accounts.

Robinhood pre-market and after-market trading

You can start trading on Robinhood 30 minutes before the markets open. Investors can continue trading on Robinhood up to two hours after the closing bell. Robinhood gives investors an extra two and a half hours of trading. You can avoid Robinhood's day trade limits by taking advantage of extended trading hours to gain extra time to close trades.