Here Are the Most Overvalued Housing Markets in the U.S. in 2022

The housing market has inflated steadily since the start of the COVID-19 pandemic. What U.S. areas have the most overvalued housing markets?

June 1 2022, Published 1:45 p.m. ET

The cost of living has increased 8.3 percent over the year ending in May, according to the Bureau of Labor Statistics. During the same period, income has grown just 4.8 percent. That alone makes getting by difficult for average Americans, but add the largely overvalued housing market into the mix and you’ve got real trouble.

The prices of for-sale homes in the U.S. have soared about 20.6 percent in the last year. While the inflated real estate sector doesn't show typical signs of a housing bubble, experts say the upward pressure is bound to burst. These overvalued housing markets are some of the worst in the U.S. in 2022, but also the likeliest to decrease as the market cools.

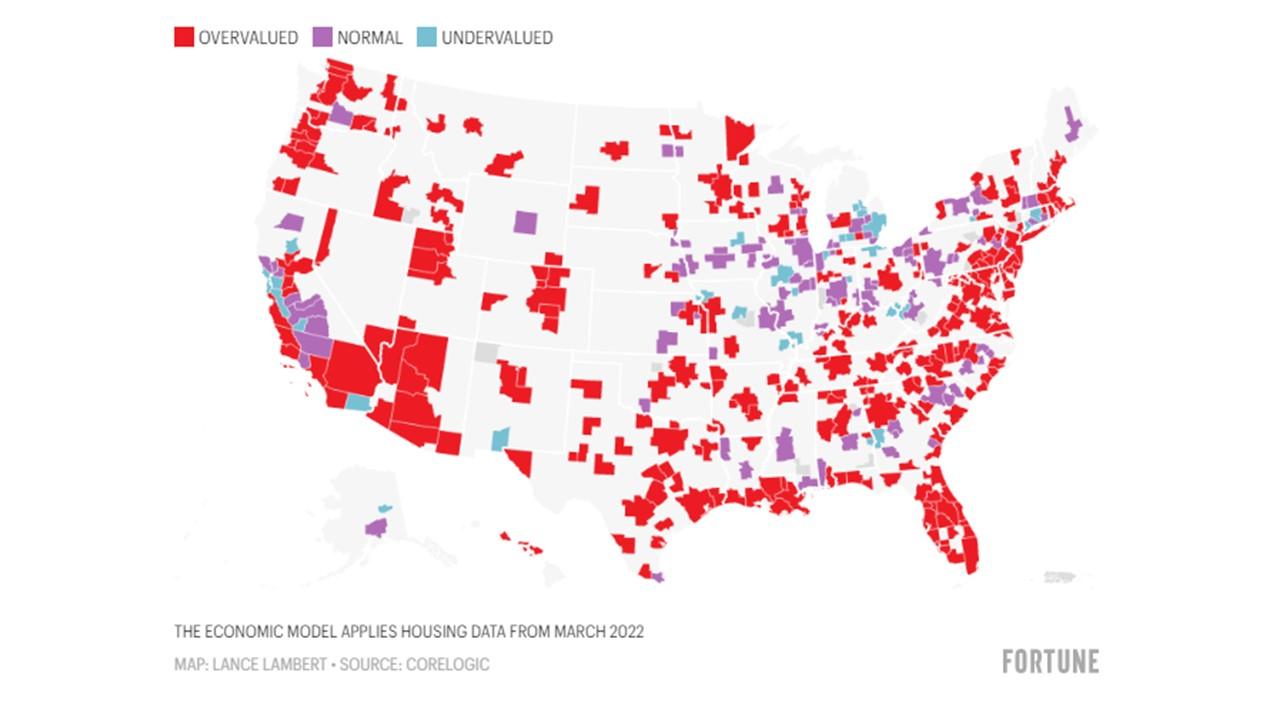

Most U.S. housing markets are overvalued, multiple data firms say.

Data analyst CoreLogic shared research stating that 67.9 percent of U.S. regional housing markets are overvalued. This is a mild increase from the firm’s previous month estimates. To be clear, the data is from March when prices were still steadily rising. More timely data suggests a cooling-off period and that we’re potentially past the peak.

Moody’s Analytics says 96 percent of U.S. regional housing markets are overvalued compared to residents’ incomes. Plus, 38 percent of housing markets are overvalued by at least a quarter of their actual value, the firm reports.

Mark Zandi, the chief economist at Moody’s, says the economy can't support these prices and something must give. As mortgage interest rates fluctuate higher and home sales decrease in real time, the available supply of homes is on the rise. However, it may take time for prices to catch up by trending down.

These are the most overvalued housing markets in the U.S., according to an economist.

Zandi cites the following 10 regions as the most overvalued in the U.S.:

1. Boise, Idaho: Median sale price of $529,250, up 12.8 percent YoY

2. Colorado Springs, Colo.: Median sale price of $465,000, up 13.4 percent YoY

3. Las Vegas, Nev.: Median sale price of $433,000, up 30 percent YoY

4. Coeur d’Alene, Idaho: Median sale price of $675,000, up 39.9 percent YoY

5. Tampa, Fla.: Median sale price of $390,000, up 21.9 percent YoY

6. Atlanta, Ga.: Median sale price of $425,500, up 13.5 percent YoY

7. Fort Collins, Colo.: Median sale price of $552,000, up 20 percent YoY

8. Sherman, Texas: Median sale price of $287,000, up 17.1 percent YoY

9. Jacksonville, Fla.: Median sale price of $300,000, up 21.8 percent YoY

10. Idaho Falls, Idaho: Median sale price of $375,000, up 36.4 percent YoY

Because these regions are reportedly the most overvalued housing markets, they’re also in a position to decrease. If incomes can't sustain the current values, the markets will have no choice but to cool at some point. Zandi calls these “juiced-up” areas and says that prices could drop 5 percent–10 percent this year in the most overvalued regions. Real estate relief could be en route for homebuyers.