Lion Electric Isn't a Concept Company, Buy NGA SPAC Stock for Solid EV Exposure

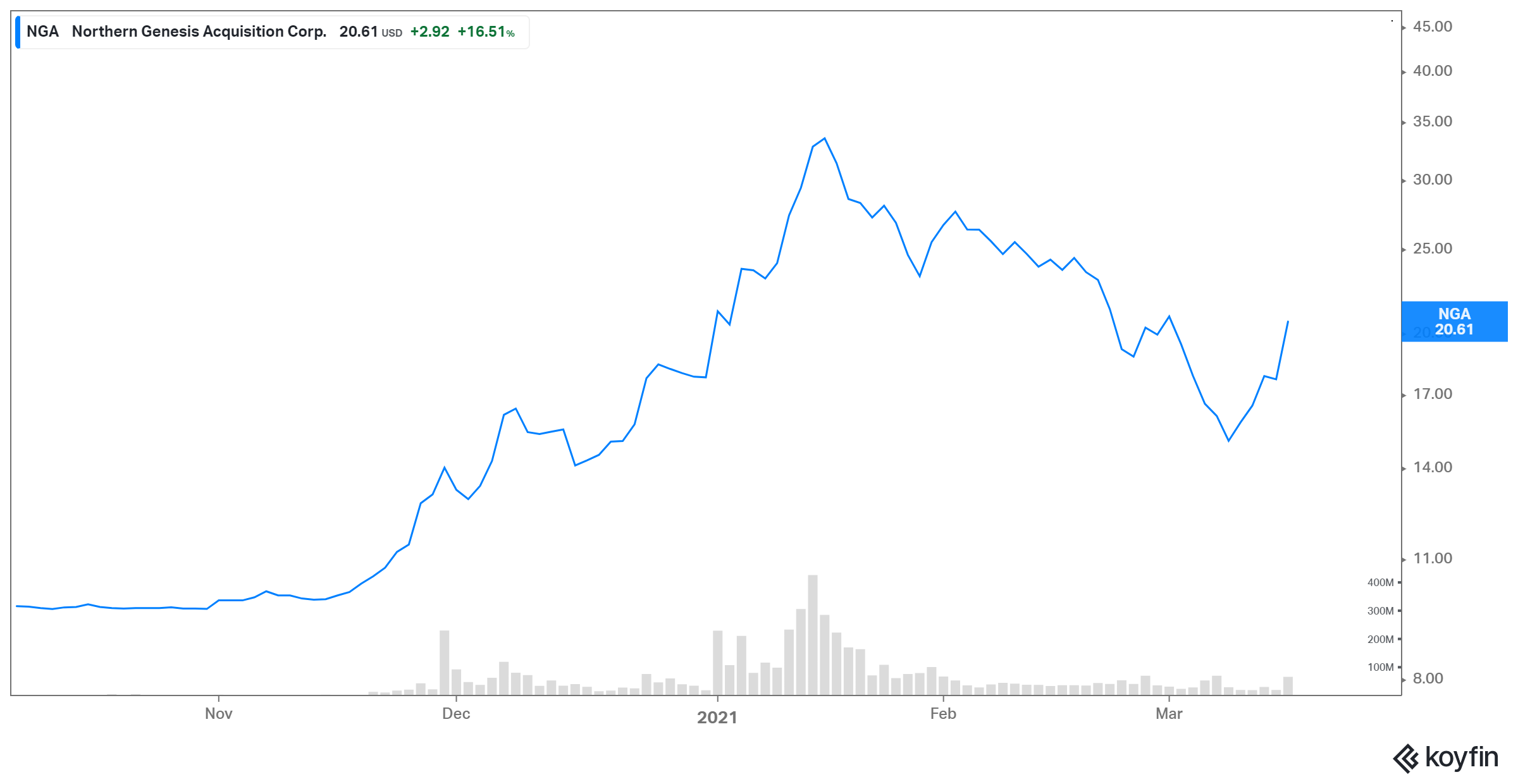

NGA SPAC stock surged on March 15 as Lion Electric announced the construction of a battery factory in Canada. What is NGA SPAC stock’s forecast?

March 16 2021, Published 9:10 a.m. ET

On November 30, 2020, NGA (Northern Genesis Acquisition) SPAC announced that it will merge with Lion Electric. Lion Electric, an EV company founded in 2011, focuses on creating commercial EVs, like buses. Based in Canada, the company's portfolio includes all-electric school buses, public transport buses, and semi-trucks.

On March 15, NGA SPAC stock surged by more than 16 percent due to a major announcement from Lion Electric. What is NGA SPAC stock’s forecast?

NGA-Lion Electric merger date

While both of the companies expect the merger to close during the first quarter of 2021, a definite date hasn't been set. The deal already has unanimous support from both companies boards of directors. After the deal closes, the combined company will trade on the NYSE under the ticker symbol “LEV.”

Lion Electric's valuation

According to the transaction, Lion Electric will receive $500 million in cash to pursue its growth strategy. The cash includes $320 million held in trust by NGA. The deal implies a market value of $1.9 billion and an enterprise value of $1.5 billion. However, based on the current market price of $20.61 for NGA stock, the market cap is close to $4 billion and the EV is about $3.6 billion. At this EV and the company’s estimated 2023 revenues, the EV-to-sales ratio is 2.6 times.

Lion Electric versus Arrival

One of the closest peers to Lion Electric is Arrival, which is a London-based EV company focused on manufacturing electric vans and buses. It's also set to go public through a reverse merger sometime in the first quarter of 2021. According to Arrival’s presentation, its pro forma EV at the SPAC's current market price comes out to be $15.98 billion. This implies EV to 2023 estimated sales multiple of 3.1 times.

While Lion has nearly 300 vehicles on the road, Arrival expects to start producing its first vehicle in the fourth quarter of 2021.

NGA SPAC's stock forecast

On March 15, NGA SPAC stock surged by more than 16 percent on a major announcement from Lion Electric. Lion Electric announced that it plans to produce its own battery packs and modules at its new factory in Quebec, starting in 2023. The Canadian government is also supporting Lion Electric. Canadian Prime Minister Justin Trudeau revealed on March 15 that the federal and provincial governments will invest $100 million Canadian dollars into the battery factory.

The announcement is positive for the company's short-term and long-term prospects. This factory will help Lion Electric bring down the cost of battery production and enable it to scale its production higher due to the stable availability of battery packs, which isn't the case for many of its peers. The Canadian government’s support behind the company is a very big positive and already establishes its superiority to many of its peers.

Lion Electric has agreed to reserve enough production capacity to deliver 500 trucks each year to Amazon through 2025. If Amazon likes the trucks and places an order to deliver 500 trucks each year, this could turn out to be a significant deal for a start-up company. Amazon also has the choice to acquire a 15.8 percent stake in Lion Electric.

The company’s vehicles are already on road, which puts it in lead compared to its peers who don’t have a single vehicle on the road yet. Another major support for NGA stock comes from Lion Electric’s lower valuation compared to its peers. The estimates are for the future and are vulnerable to a lot of risks, but all of the EV companies face risks.