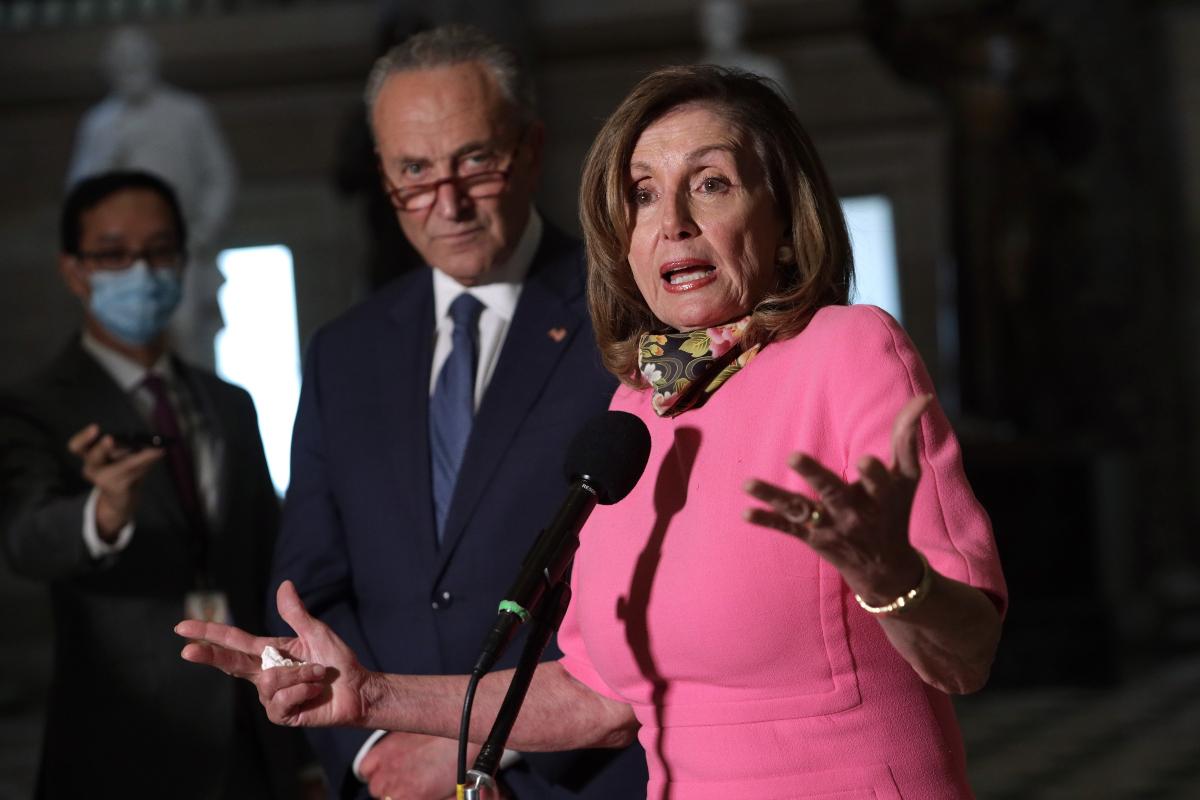

'Conflicted Congress': Nancy Pelosi’s Husband Adds More Big Tech Companies

Nancy Pelosi's portfolio gets a lot of attention given some of the profitable trades. Here's the latest update on Pelosi's portfolio.

June 7 2022, Updated 11:33 a.m. ET

In an explosive report titled “Conflicted Congress,” Business Insider noted that several lawmakers and congressional staffers are violating the Obama Era STOCK (The Stop Trading on Congressional Knowledge) Act. House Speaker Nancy Pelosi's stock trades (along with her husband Paul Pelosi) have been at the center of the controversy. Several social media handles have been tracking her portfolio and compared her trades to that of legendary value investor Warren Buffett.

The Business Insider report classifies Pelosi’s stock trades as borderline, which means that they merit more scrutiny. The report rated 13 members of Congress on the “danger list.”

Several lawmakers' stock trades should invite more scrutiny.

Incidentally, while Pelosi and her husband’s trades get oversized attention and Republicans have been attacking her for the traders, the Business Insider report found that lawmakers' stock trades also need more scrutiny across the party lines.

If anything, there are more Republicans on the “danger” and “borderline” lists and fewer of them on the “solid list,” which includes lawmakers with a clean record.

Here's the latest update on Nancy Pelosi's portfolio.

In her most recent periodic transaction report, Pelosi disclosed that her husband bought Apple call options for between $500,001 and $1 million on May 13. On May 24, he bought more call options between $250,001 and $500,000. The options have a strike price of $80 and will expire in 2023.

Paul purchased between $300,000 and $600,000 worth of Microsoft call options on May 24. These have a strike price of $180 and will expire on June 16, 2023. All of these call options are deep in the money. Traders buy call options when they're bullish on the underlying.

Nancy Pelosi has defended her trades.

Pelosi has defended trading in individual stocks by lawmakers pointing to “free markets” and a “free-market economy.” Many lawmakers, including some Democrats like Alexandria Ocasio-Cortez, have objected to her comments.

Some of the Twitter accounts tracking Pelosi’s portfolio have been banned. A popular handle has shifted to Gab. Incidentally, there has been a rise in social media channels that support conservative voices.

How's Nancy Pelosi's portfolio tracked?

According to the law, Pelosi has to report her and her family's stock trades within 45 days. A lot of her trades have been in options, which are a leveraged play on the underlying stock.

Pelosi and her husband have made some very profitable trades, which has raised eyebrows. The New York Post reported in January that the couple made a profit of $30 million by trading in U.S. tech stocks. Citing insiders, the report also alleged that Pelosi had "slow-walked" efforts to regulate big tech.

Big tech companies have been facing a lot of heat from lawmakers over their alleged monopolies. Usually, lawmakers were bipartisan in grilling big tech companies even as nothing concrete came out from the hearings.

Nancy Pelosi is getting compared to Warren Buffett.

Many of the people against Pelosi have been comparing her with Buffett and Nostradamus. There's a pun intended here and many people think that she has been misusing her position to make these trades. Pelosi has maintained that she has been reporting all of her trades.

It can't be denied that most lawmakers, especially high-ranking ones like Pelosi, are privy to a lot of information that at least retail traders aren't aware of. There could also be instances of conflict of interest. For example, Pelosi has a lot of big tech companies in her portfolio.

You can invest like Nancy Pelosi.

According to Unusual Whales, Pelosi's portfolio was the sixth best performing among all U.S. lawmakers in 2021. Republican Congressman Austin Scott's portfolio was the best performing among all members of Congress.

Unusual Whales keeps a track of Pelosi's portfolio and WallStreetBets founder Jaime Rogozinski launched an ETF to mimic Pelosi's trades. The portfolio is rebalanced based on the data compiled by Unusual Whales.

The ETF is called the Insider Portfolio ETF and trades under the ticker symbol "INSDR" on the MERJ Exchange. Commenting on the ETF, Rogozinski said, "If you are not blessed with the financial savviness of the U.S. Congress members, the world of investing can be inaccessible and intimidating to the novice investors we know as constituents."

He added, "In these turbulent economic times, not only Americans but the entire global community can look to our national leadership forunparalleled investing advice, and it’s never been easier with the introduction of our Insider Portfolio."

Meanwhile, the ETF wouldn't mimic Pelosi and her husband's trades. First, the ETF would only invest in stocks and not derivatives, which have been the preferred instrument for the couple. Second, a considerable time passes before the trades are made public.

Rogozinski admitted that the ETF might not mimic Pelosi's portfolio. But, he believes investors would still be making good returns by following her trades.