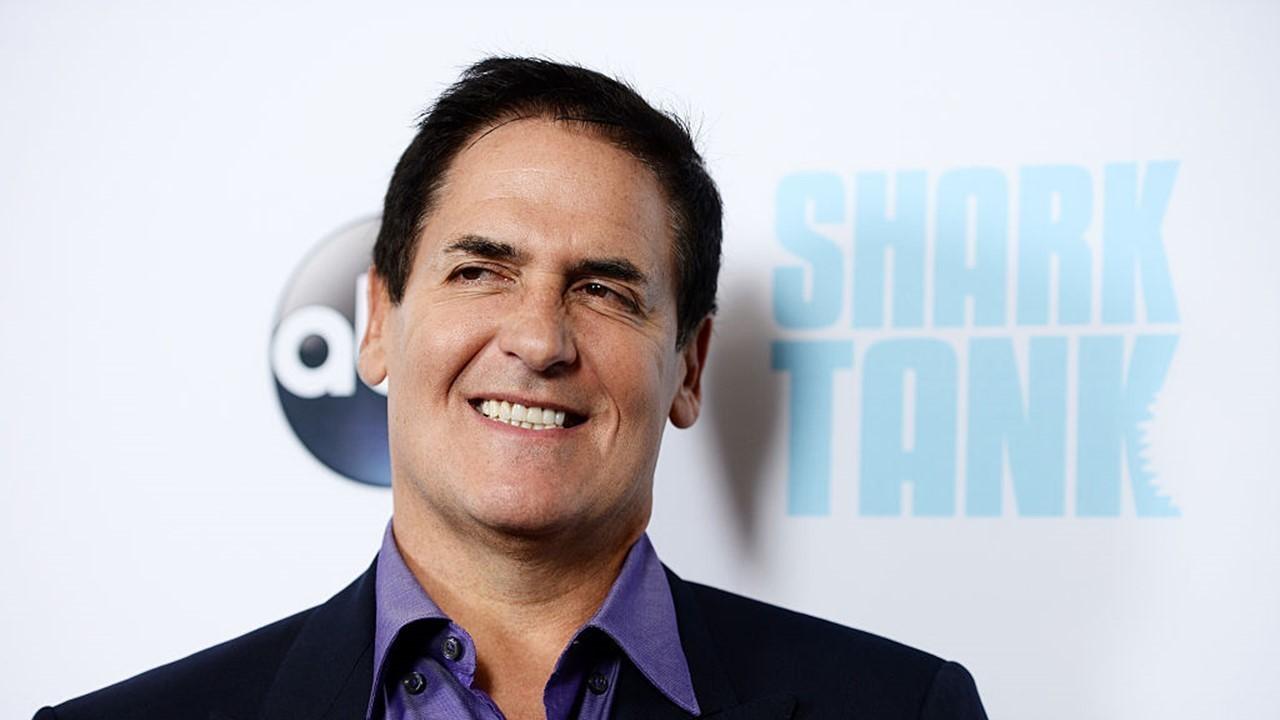

Mark Cuban’s Crypto Loss Leads to Calls for Regulation

Mark Cuban lost money on the Titan token cryptocurrency crash this week, which has led to calls for more crypto regulation.

June 18 2021, Published 2:21 p.m. ET

Billionaire investor and Dallas Mavericks owner Mark Cuban talked up certain cryptocurrencies this past week. Unfortunately for the Shark Tank star, the performance of one of his crypto holdings didn’t hold under pressure.

Earlier in the week, Cuban posted an article on his blog in which he discusses the Titan token, a type of cryptocurrency, as well as another cryptocurrency called Quickswap. His comments regarding Titan were positive on June 13, but on June 16, Titan crashed to essentially zero value.

What happened to the Titan token?

In Cuban’s blog post, he wrote quite a bit about DeFi (decentralized finance) and explained that he was a Liquidity Provider (LP) for both Titan and Quickswap cryptocurrencies. Referring to his holdings there, he noted, “As long as I keep making a good return, I will keep my money invested.”

Cuban said that his return for being an LP for Titan and Quickswap was to receive 100 percent of the fees for those tokens because he was the only LP in that pool.

The day Cuban’s post went live, Titan was trading at $29 and suddenly the market flooded with buyers investing in Titan tokens. Within three days, Titan skyrocketed to a high of $65, at which point the excessive tokens in the market caused investors to start selling. By 7:26 p.m. E.T on June 16, Titan had dropped to $0.000000024 and became nearly worthless.

How much money did Mark Cuban lose on crypto?

Cuban, with a $4.4 billion net worth as estimated by Forbes, didn’t specify how much money he lost due to the Titan price drop. However, he did tell Bloomberg that the crash was frustrating.

Cuban blamed himself for the lost money but said that as a percentage of his crypto holdings, the impact was fairly small. He said that DeFi, or decentralized finance, is “all about revenue and math and I was too lazy to do the math to determine what the key metrics were,” according to Yahoo Finance.

Mark Cuban's thoughts on stablecoin

In a letter to Bloomberg on June 17 (reported by Bitcoin.com), Cuban addressed his Titan token losses and claimed that a possible lesson to learn from its crash is a need for deeper regulation of decentralized finance.

Cuban said, “There should be regulation to define what a stablecoin is and what collateralization is acceptable.” In the letter, he also speculated on whether risks of certain coins should be “clearly defined” whenever there isn't one-to-one collateralization.

However, some people don't have any sympathy for Cuban or his situation. David Schawel, the CIO of Family Management Corporation, commented on a Twitter post about Cuban’s loss. He said, “I have a hard time when people admit they were lazy in due diligence but then blame lack of regulation.”

One might also notice the irony of Cuban’s calling for more regulations after comments in his blog post from June 13 in which he criticized regulators.

He said no one has majority control in DeFi organizations “because of the ABSOLUTE STUPIDITY of our regulators forcing some of the most impactful and innovative entrepreneurs of this generation to foreign countries to run their businesses.”