Is Wendy's Going Private? Potential Deal Could Change WEN Stock’s Fate

The largest shareholder of Wendy's fast food chain is exploring a potential merger or acquisition. Will WEN stock go private as a result?

May 25 2022, Published 12:37 p.m. ET

American fast-food chain Wendy’s (WEN) could be poised for a future beyond meme stock status. The company’s largest shareholder, billionaire Nelson Peltz’s hedge fund Trian Partners, is exploring a potential merger or acquisition.

As a result, WEN stock could potentially go private, which means shareholders will receive a cash buyout at a premium. Here’s the outlook as Trian and Wendy’s mull over a potential deal.

Trian announces a possible deal with Wendy’s.

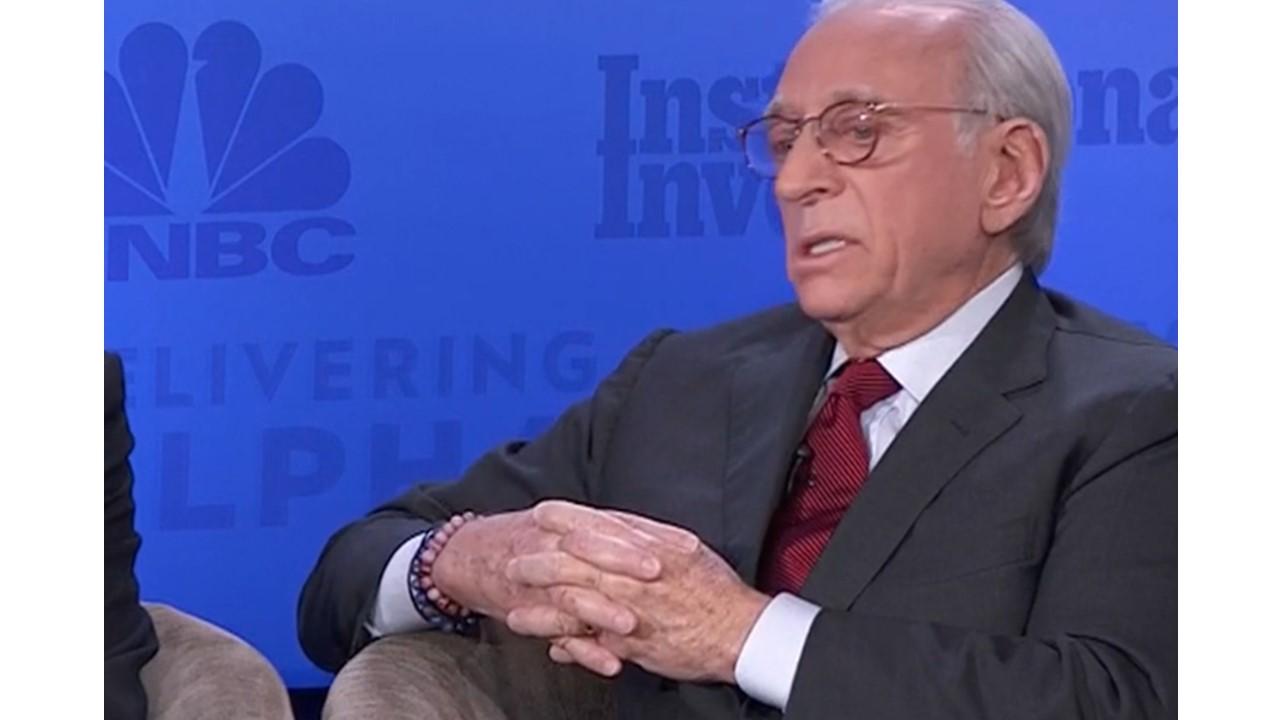

Trian Partners CEO Nelson Peltz

Hedge fund Trian Partners, founded by Nelson Peltz (who boasts a $1.7 billion net worth), is considering buying or merging with Wendy’s. Trian owns a collective 19.4 percent stake in the publicly traded fast-food company, making it the largest shareholder.

In Trian’s recent filing with the SEC, the hedge fund said it believes it can “generate or enhance shareholder value.” Trian added, “Such a potential transaction could include an acquisition, business combination (such as a merger, consolidation, tender offer or similar transaction) or other transaction that would result in the acquisition of control of the Company.”

Wendy’s stock soars on the news.

WEN stock is way up on the news that Trian is considering officially taking the fast-food company under its wing. The shares jumped more than 10 percent overnight by mid-day on May 25.

Still, WEN is down 12.2 percent YTD and 24.99 percent in the last 12 months. In mid-2021, Wendy’s joined meme stock staples like AMC Entertainment (AMC) and Bed Bath & Beyond (BBBY) by surging on speculative predictions. However, the pumps didn't last. Wendy’s percentage of shorted stocks is just 3.86 percent on May 25, so there isn't the risk of a short squeeze.

If Trian does proceed with a Wendy’s merger, acquisition, or major restructuring of some kind, it could change the fate of WEN stock and its shareholders.

Trian has been a Wendy’s investor since the hedge fund’s birth in 2005. Wendy’s launched in 1969 and its founder, Dave Thomas, died in 2002. Having been public since 1982, WEN stock has been through numerous ups and downs, though it has had difficulty exceeding expectations over the last few years.

Will WEN stock go private?

If Trian completes a full or majority acquisition of Wendy’s, then WEN stock will likely go from public to private. That explains, in part, the major rally of WEN stock amid the Trian news. When a private firm buys out a public company, they typically offer to buy out shareholders at a premium stock price that’s higher than the stock’s most recent value at the time of the deal.

If this happens, WEN shareholders will likely make out well. However, no deal is set in stone and Trian may decide not to pursue an acquisition that would take Wendy’s private.

Wendy’s has 7,000 fast-food restaurants across the world (including franchises). Its recent performance is up, with same-store sales growing 2.4 percent in the first quarter of 2022. Still, analysts are skeptical about its performance. In April, BMO Capital Markets downgraded WEN stock from a target price of $28 to just $22. Wendy’s stock is trading at $18.34 shortly after 12 p.m. EST on May 25.