Is VIX a Good Hedge? What to Know About the 'Fear Indicator'

Known colloquially as the fear indicator, is CBOE's Volatility Index, or VIX, a good hedge?

May 25 2021, Published 3:06 p.m. ET

One index in particular has a way of highlighting times of financial stress. VIX, the ticker for the Chicago Board Options Exchange's CBOE Volatility Index, was designed to help predict market volatility. Rooted in S&P 500 options, is the "fear indicator" a good hedge.

A lot goes into this analysis of VIX as a market indicator and hedging tool, including options calls, market sentiment, and historical data.

What to know about VIX as a volatility indicator

VIX was designed to predict volatility in the short-term. Many investors use the index to time their entrances and exits in the market. Since VIX tracks options contracts on the S&P 500 index, it's easy to see whether sentiment is leaning toward puts (indicating more volatility) or calls (indicating growth).

VIX isn't a fool-proof method, but it didn't get its nickname—the fear indicator— for nothing.

One investing theory, contrarian investing, suggests to mirror the VIX. Typically, a higher VIX index means more panic and thus more selling. Meanwhile, a lower VIX index would induce more buying. However, contrarians say doing the reverse is more impactful based on historical data.

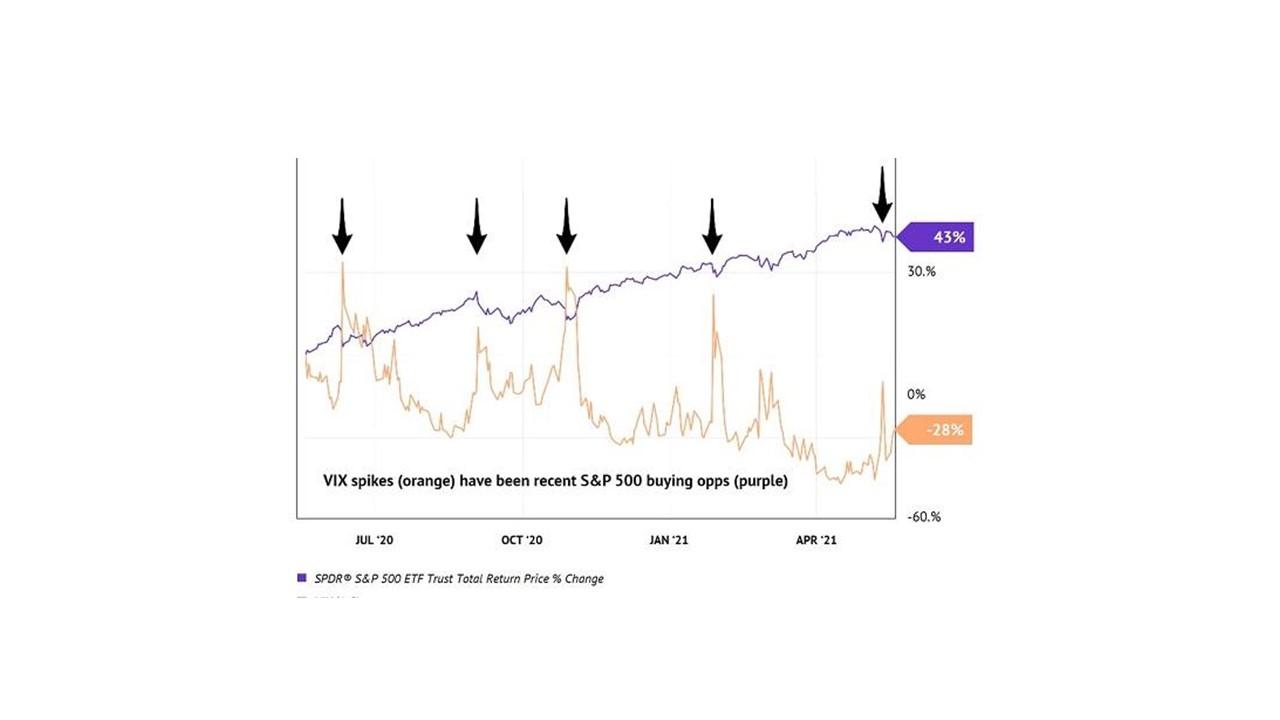

In this chart from Nasdaq, buying on the fear looks like the way to go. During these periods, the S&P 500 would dip while the VIX index rose. The S&P 500 then saw a value ascent.

Contrarian investing isn't always the preferred method. After all, if a company has a good earnings report paired with positive market news, it's fair to suggest someone should buy in before they miss the opportunity.

However, when dealing with the overall market in the form of the S&P 500, it makes sense.

What is means to use VIX as a hedge

Using VIX to hedge your portfolio means purchasing VIX options to protect against a market crash. This involves buying near-term VIX calls or puts, both of which are slightly out-of-the-money.

You can also rely on VIX calls ahead of predicted bear markets to hedge against downturns.

The upside to using VIX as a hedge

You can use VIX derivatives like options, futures, and ETPs as a hedge, though it gets progressively more complex down the line. Most people start with options.

The fear factor associated with VIX gives insight into potential market moves, which helps people determine their next trade.

The risk involved in hedging with VIX

This type of hedge is not 100 percent firm in protecting your portfolio. It requires a lot of attention and time given the multi-faceted options protocol. Plus, no VIX derivative fully reflects the pure index. VIX derivatives are also designed to decay over time so this is a very short-term and actively involved tactic.

The moral of the story is that hedging with VIX must be done correctly in order to work. It's also not certain, so this hedge shouldn't be a loner in your strategy.