Understanding Option Greeks Can Help You Success at Options Trading

When trading options, many investors need option Greeks explained. This brief overview will help even novice investors understand what delta, gamma, theta, and vega mean.

April 9 2021, Published 7:50 a.m. ET

If you’ve ever traded options, chances are you’ve heard the terms “Greeks” being used. However, you may not entirely understand what they mean or what they can do for you and your investing strategy.

The good news is you’re not alone. We’re going to explain just what option Greeks are and how they can help you better understand and evaluate the value of an options contract and whether it’s a good investment for you.

What are option Greeks?

In terms of options, Greeks help investors determine the value of an options contract by measuring various factors. Using theoretical options pricing models, investors can use Greeks, such as Delta, Gamma, Theta, Vega, and Rho, to calculate how drastically these factors will affect the price. By understanding Greeks, investors can better determine what options to trade and when to trade them.

Diving into each Greek in more detail, you can learn how each one can help you calculate the value of your options contracts.

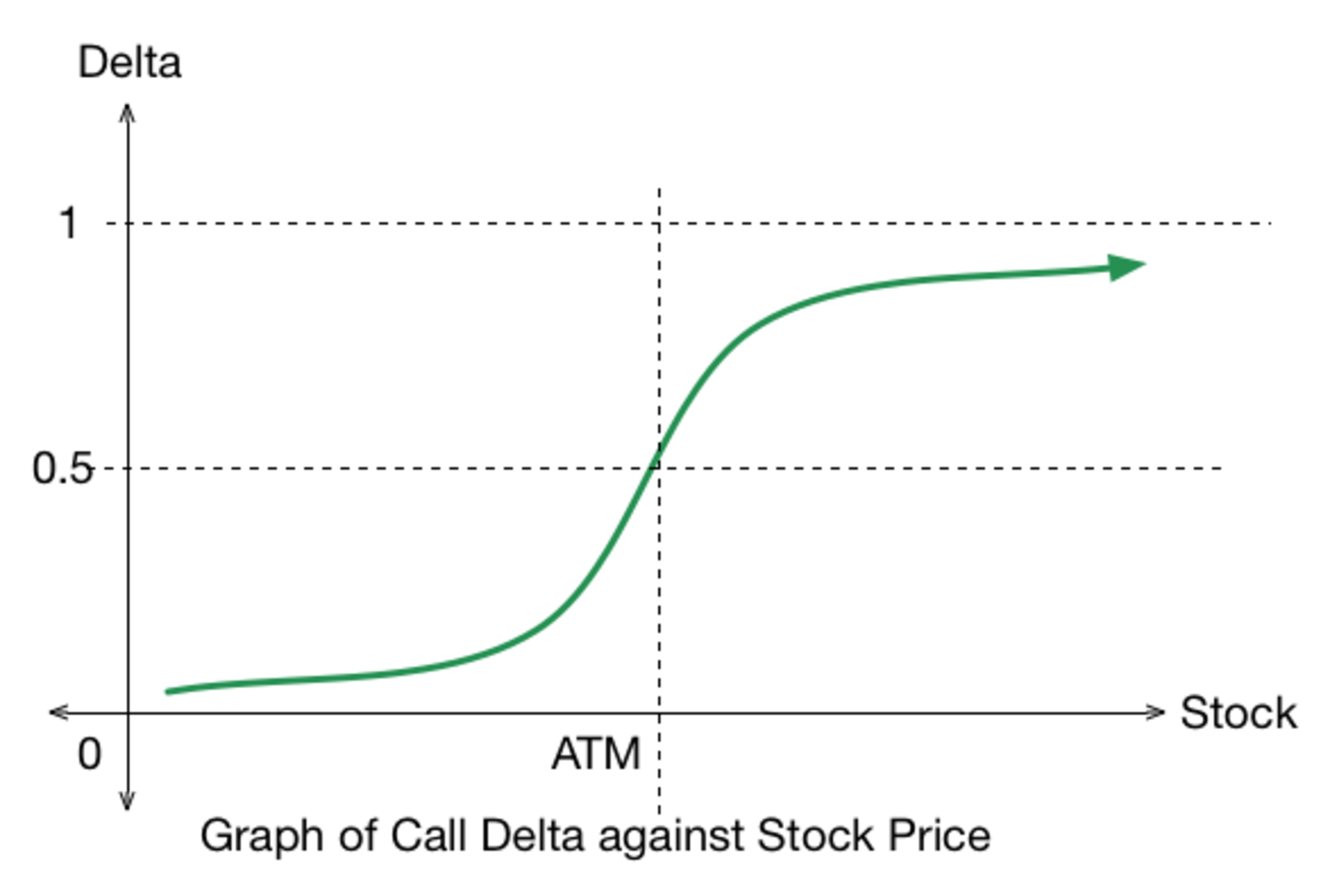

Use Delta to determine price change.

Delta measures how much the price of an option is expected to change per every $1 change in the underlying security or index cost. Using a calculated ratio, investors can determine the correlating change of the option’s price per $1 change in the asset.

For example, a Delta of 0.80 means that the price of the option will change $0.80, plus or minus, for every $1 move in the price of that particular stock or index.

A Delta of 0.80 essentially means the option has about an 80 percent chance of expiring in the money.

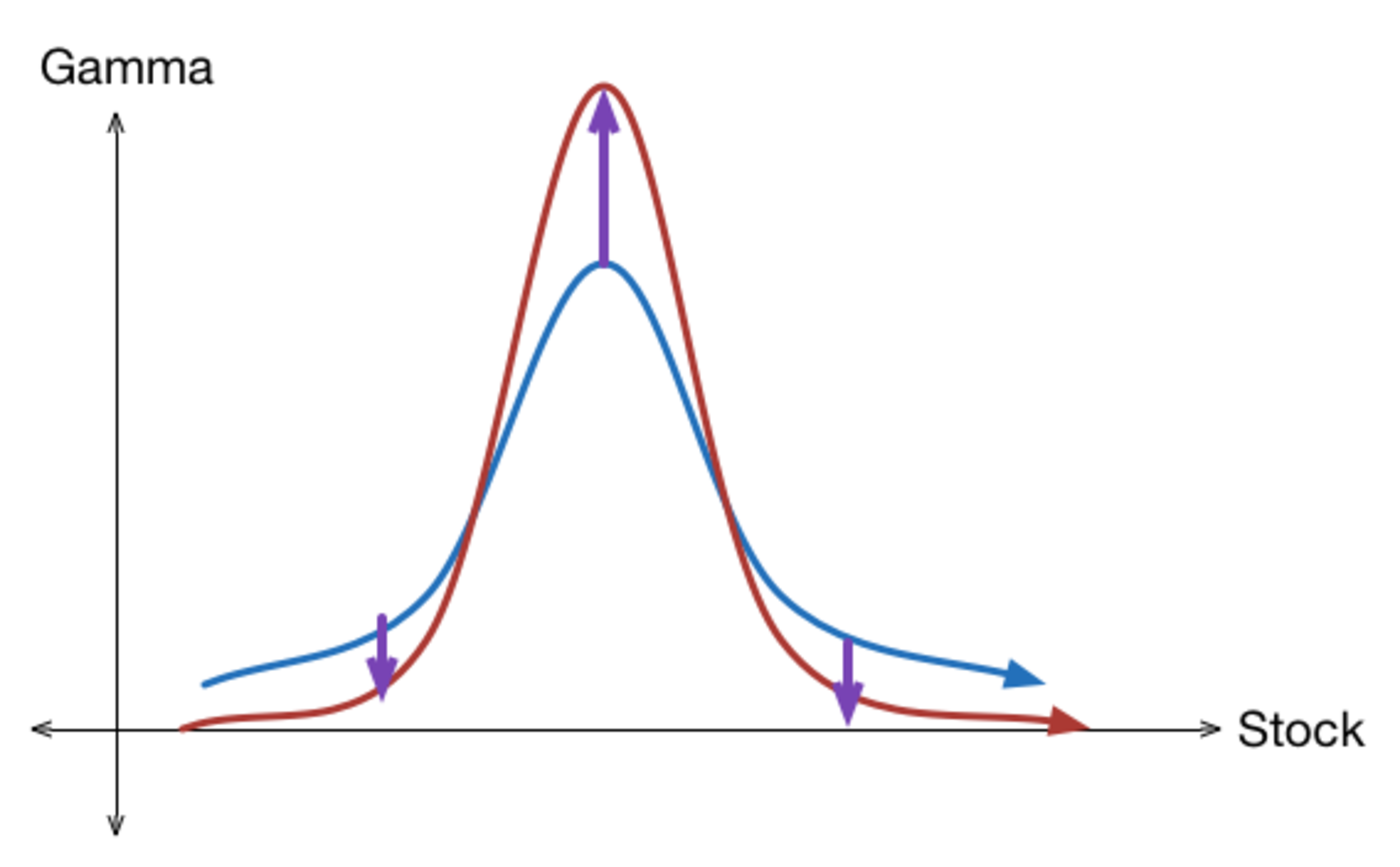

Use Gamma to gauge the rate of change of Delta.

Gamma is used to determine the rate of change in the Delta per $1 change in the price of the underlying stock. Since the Delta is only valid for a given moment in time, the option’s Gamma will help calculate how much the option’s Delta will likely change.

When a stock moves by $1, the Delta moves in sync according to its value. The previous Delta is no longer accurate. The Delta will then move closer to 1.00 as it is closer to the money.

The Gamma then represents the change in value from the previous Delta to the current Delta. A small Gamma represents an abrupt change in valuation, and a large Gamma indicates a rapid change in Delta.

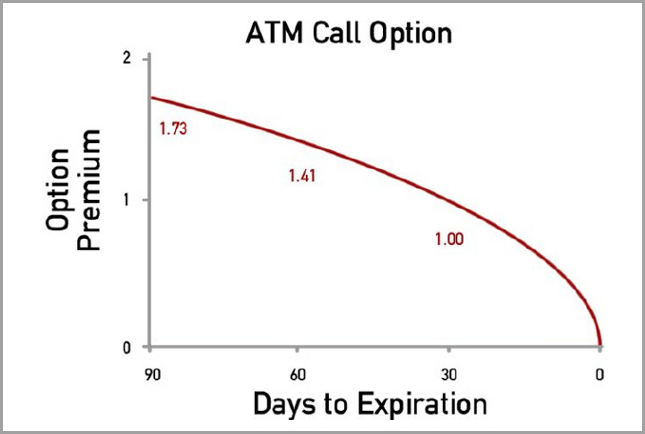

Theta measures the change in price by time.

Theta measures the change in the price of an option each day it gets closer to expiration. Essentially, Theta helps calculate how much the price of an option should decrease as the contract nears the end.

Because options lose value as the contract nears expiration, Theta can help determine how much the price will drop each day.

Vega makes sense of market volatility.

While Vega is not an actual Greek letter, it can help you estimate how much an option’s price will move when the underlying security or index increases or decreases in volatility.

Overlooking Vega can cause you to overpay for an option. Aim to purchase options whose Vega is below average and sell when Vega is above normal levels.

Rho correlates to interest rates.

Rho measures the predicted change in the price of an option with each whole percentage point change in interest rates. Rho tells you how much the price should rise or fall if the risk-free interest rate of the U.S. Treasury bills increases or decreases.

Rho is generally not as consequential in determining the price of an option. However, it should be considered if interest rates are expected to change.