Why Takung Art Is a Good NFT Stock for Bargain Hunters

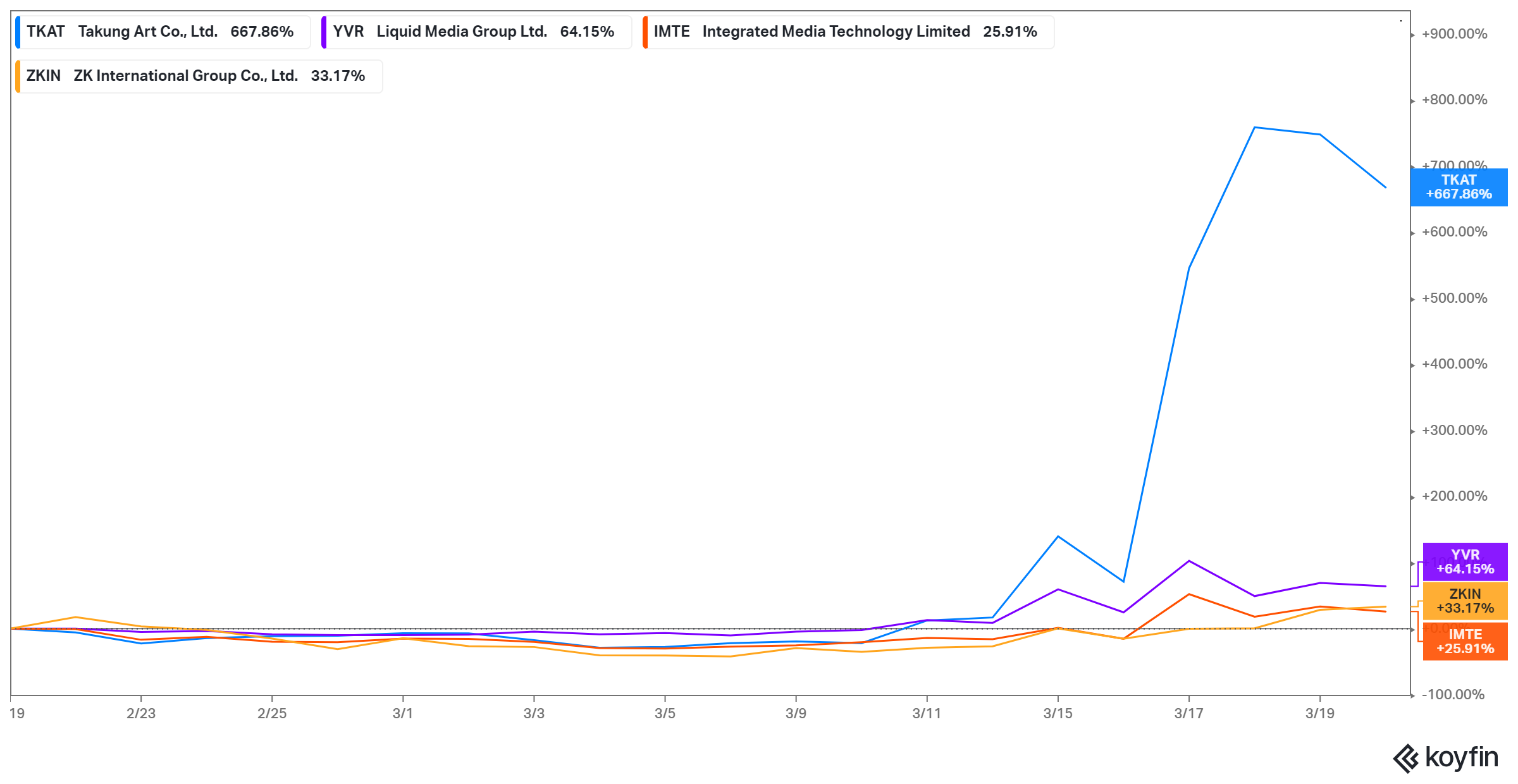

Takung Art (TKAT) stock has soared due to NFT potential. Bargain hunters seeking a discount entry point might like TKAT stock now.

March 22 2021, Updated 10:53 a.m. ET

Hong Kong-based Takung Art operates a digital platform for trading artwork. TKAT stock has soared lately due to issues related to NFTs (non-fungible tokens). TKAT stock costs about $30 apiece after gaining nearly 2,000 percent YTD. Is TKAT stock still a good buy?

The technology also inspired Twitter (TWTR) and Square (SQ) CEO Jack Dorsey to auction his first-ever tweet authored in 2006. The tweet auction attracted bids of as much as $2.5 million. Dorsey planned to donate the proceeds from the tweet sale in the form of bitcoin to a charity called Give Directly.

Some investors speculate that Takung Art will adopt NFT technology to enhance its art trading platform, which could lead to better sales and profit for the company. As Takung’s financials improve, investors think that TKAT stock will keep rising.

Takung Art's stock news

NFT speculations sent TKAT stock soaring after a popular digital artwork sold for millions of dollars. A Beeple art sold last week for a whopping $70 million, which increased the interest in NFT stocks. For example, TKAT stock gained more than 625 percent in the past week.

Takung Art's stock forecast

With Takung Art stock gaining more than 2,200 percent in the past three months, investors wonder if it will keep rising. TKAT stock has soared on the digital NFT-enabled digital art sale boom. It doesn’t look like the NFT excitement is going to die down soon, so Takung shares could continue to climb.

However, when a stock rises too fast, some investors will try to take early profits, which can put downward pressure on the stock price. That's something investors should be aware of when handling Takung shares.

Other NFT stocks like Takung Art

Investors expect companies in the creative and entertainment industries to benefit from NFT technology. Besides Takung, here are some other companies whose stocks have soared amid the NFT frenzy.

- Liquid Media Group (YVR)

- Integrated Media Technology (IMTE)

- Jiayin Group (JFIN)

- Hall of Fame Resort & Entertainment (HOFV)

- ZK International Group (ZKIN)

Liquid Media Group is a videogame company. Investors think that it could adopt NFT technology to potentially make its business more profitable. YVR stock has gained more than 60 percent in the past month and more than doubled YTD. At $3.30 per share now, the penny stock trades more than 24 below its recent high.

Integrated Media Technology is a virtual reality company. Investors see potential in IMTE tapping into NFT to make its business more profitable, which would provide catalysts for the stock to rise higher. IMTE stock has gained about 40 percent in the past month and has risen nearly 90 percent YTD. At $7.37 per share currently, IMTE stock has retreated more than 40 percent from its recent peak.

Jiayin is a Chinese fintech company that offers personal loans. It has also been caught up in the NFT frenzy. JFIN stock has gained 40 percent in the past month and has climbed about 170 percent YTD. At little more than $8 per share now, JFIN has pulled back more than 70 percent from its recent high.

Hall of Fame Resort & Entertainment stock has gained more than 50 percent in the past month and has returned 225 percent for investors YTD. Investors have flocked to HOFV stock lately due to the NFT potential. For those seeking bargain opportunities, HOFV stock’s nearly 70 percent pullback from recent peaks offers an incentive to enter at a discount.

Pipe maker ZK International Group has also emerged as an exciting NFT stock. Recently, the company announced that it plans to set up an NFT marketplace through its xSigma subsidiary. ZKIN stock has climbed more than 40 percent in the past month and has soared 330 percent YTD.

Are NFT stocks a good investment?

Both NFT and cryptocurrencies are based on blockchain technology. When they started, cryptocurrencies looked like a joke and many people mocked them as an investment. Now, people are making money with them. For example, bitcoin's price has increased about 100 percent YTD to more than $57,000.

Forecasts show that bitcoin's price could double again by the summer to $115,000. Ethereum is also soaring and price predictions point to more upside potential. Penny cryptocurrencies like dogecoin have also made good money for investors considering its more than 1,100 percent rise YTD.

Seeing how cryptocurrencies have become hot investments, some people speculate that NFTs will also take off, which has led to the rush to NFT stocks. It’s interesting that celebrities like Tesla CEO Elon Musk and Twitter boss Jack Dorsey who have helped fuel the interest in cryptocurrencies are also talking about NFT.

Takung Art stock looks like a buy.

Takung is among the companies that could benefit from NFT technology. At this point, its involvement with NFT is merely speculation. While NFT could generate an added advantage for Takung, there are two reasons you might want to buy TKAT stock now.

First, the artwork industry has bright prospects and Takung is in a position to benefit from it. Also, TKAT stock has retreated from its peaks. The stock is a discount entry opportunity for bargain hunters. At about $30 per share currently, TKAT stock has pulled back 27 percent from its recent high.