Could SoFi Stock Rise Even Further?

SoFi stock had a strong stock market debut through its SPAC merger with IPOE. Could it rise even further?

June 2 2021, Published 9:58 a.m. ET

SoFi Technologies (SOFI) stock soared on its debut. Its SPAC merger with Chamath Palihapitiya-led Social Capital Hedosophia (IPOE) valued SoFi (Social Finance) at $8.65 billion.

The deal was well received by IPOE shareholders, with the stock surging to an all-time high of $28 after the SoFi merger announcement. SoFi offers a diverse range of financial services, from student loans to home loans and stock trading. Its competitors include Robinhood, PayPal (PYPL), Square (SQ), Acorns, and Webull.

Why did SoFi stock soar on its listing?

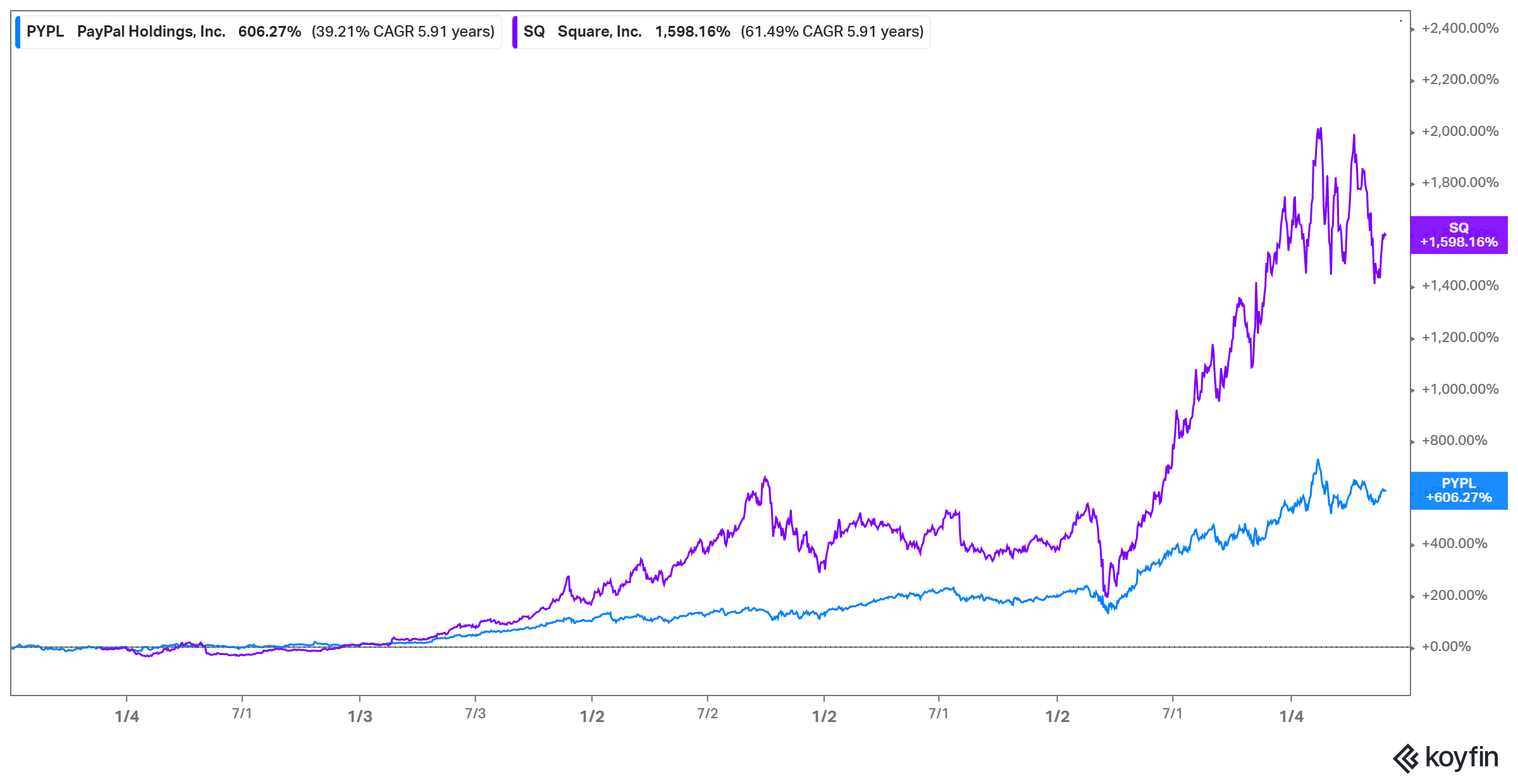

SoFi shares rose 12 percent on their first day of trading on Jun. 1, and closed at $22.65. The stock was still climbing in premarket trading on Jun. 2. Many investors see SoFi as the next PayPal or Square, which have rewarded investors handsomely. PayPal stock has returned more than 600 percent since its IPO, while Square stock has gained 1,600 percent.

SoFi’s expert board and executive team led by Anthony Noto have also boosted investors' confidence in the stock. The company’s strong financial results before the SPAC merger closed and its bullish outlook helped its stock as well.

In the first quarter, the company’s adjusted net revenue rose more than 150 percent year-over-year to $216 million, beating its internal projection of $190 million–$195 million. It also reported adjusted EBITDA of $4.1 million despite a $5 million loss being expected. SoFi forecasts revenue of $980 million and adjusted EBITDA of $27 million in 2021.

Is SoFi stock expected to rise further?

SoFi CEO Noto says the company has a competitive advantage because of its broad suite of products. Not only is SoFi positioned to lock customers in its ecosystem, but it can also learn from how customers use its products to improve their experience and offer additional products.

SoFi wants to operate a national bank, and recently acquired a small community bank called Golden Pacific Bancorp to speed up that process. Operating a bank will help lower SoFi’s funding costs, as it can use customer deposits to make loans. Additionally, the bank will enable the company to offer competitive interest rates to savings account customers.

In the IPOE SPAC merger, SoFi raised $2.4 billion. It plans to spend the money on expanding its suite of products and geographical reach. SoFi’s goal is to become a one-stop shop for money services—a platform where people come to save, borrow, invest, and spend. Among SoFi's new products to expand investors’ access to the stock market is IPO investing.

What's the prediction for SoFi stock?

Wall Street is only beginning to rate SoFi stock. Oppenheimer has initiated coverage with a "buy" rating and price target of $25, which implies a 10 percent upside from the stock’s last closing price.

Is SoFi stock a good buy?

The pandemic has sped up the shift to digital financial services, and that bodes well for SoFi. Even after its strong debut, SoFi stock is still 12 percent below its all-time high, suggesting a decent upside.