Drizly Gains Ground in On-Demand Alcohol, Gets Acquired by Uber

Drizly is America’s largest on-demand alcohol marketplace. Is Drizly a publicly-traded company? What can investors expect after the Uber acquisition?

Feb. 3 2021, Published 1:55 p.m. ET

Drizly provides on-demand alcohol delivery in the U.S. The company operates in over 1,400 cities across many U.S. states. Is Drizly a publicly-traded company?

On Feb. 2, Uber announced that it reached an agreement to acquire Drizly for approximately $1.1 billion. The deal should close in the first half of 2021. The move could help drive people to use Uber’s app more frequently.

Drizly isn't a publicly-traded company

Drizly isn't listed on any public stock exchange yet. Since it's still a privately held company, retail investors can't buy or sell shares of the company.

Drizly is popular for ordering alcohol

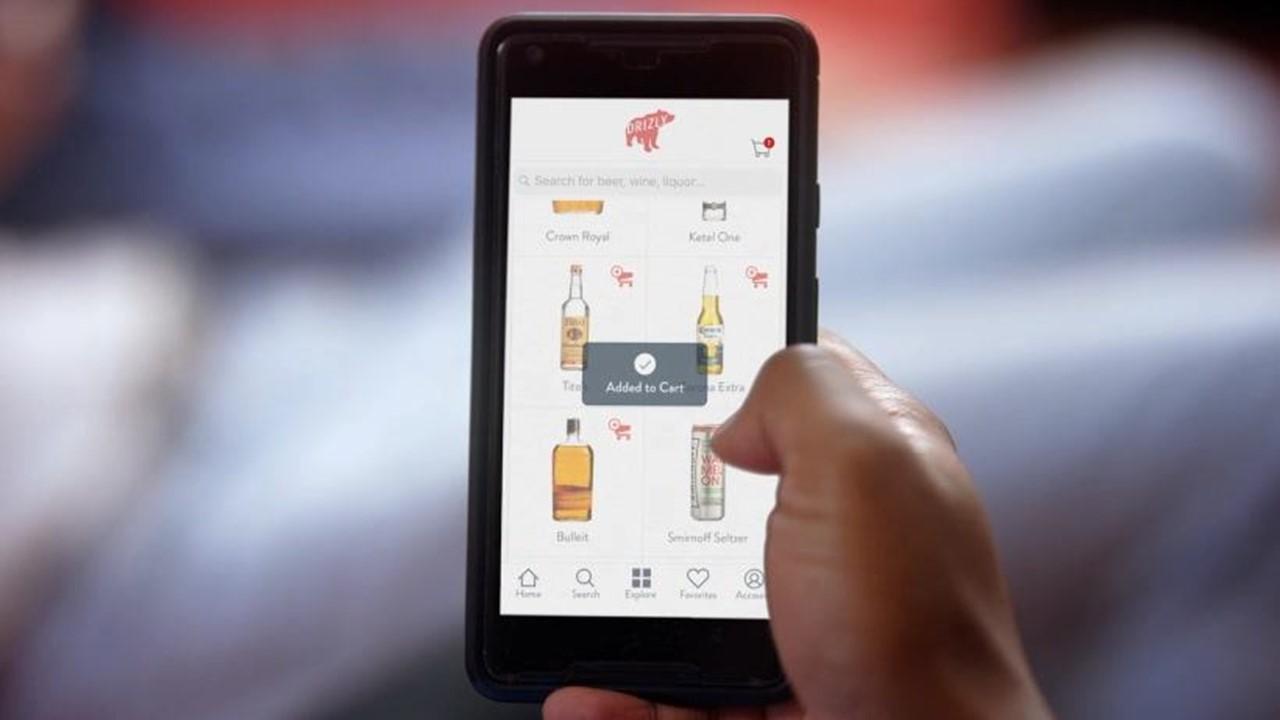

Drizly was founded in 2012 by Nick Rellas, Justin Robinson, and Spencer Frazier. The company allows users to order alcohol directly and get it delivered from local liquor retailers through a mobile app or website. Initially, the service launched in the greater Boston area before expanding to Los Angeles, New York, and Chicago.

Drizly has raised about $120 million in funding over nine rounds. The company’s latest raise was a $50 million Series C round led by Avenir Growth Capital in August 2020. Series A/B investors include Polaris Partners, Cava Capital, Fairhaven Capital Partners, Suffolk Equity Partners, and First Beverage Group. Angel investors include Lars Albright, Ty Danco, Walt Doyle, and Fred Shilmover.

How Drizly makes money

Drizly collaborates with local liquor retailers to bring their inventory online. The company is a pure-play marketplace and the execution of delivery is undertaken by retail partners. Delivery usually takes 30–60 minutes. The company charges a $5 delivery fee on behalf of store partners and a $1.99 service fee on each order. In terms of merchant fees, Drizly has multiple pricing systems based on where the store is located, including dollars per order, percentage of sale, and tiered licensing fee schedule.

In 2020, Drizly reported sales growth of 350 percent YoY. The company’s average order size also grew by about 30 percent, while its retailer network doubled. Drizly predicts that its online sales will constitute 20 percent of the total annual alcohol segment of $120 billion within the next five years. In 2021, the total market opportunity for online alcohol sales in the U.S. will likely be $1.2 billion. Drizly faces competition from Saucey, MiniBar, and Favor.

In 2020, Drizly was a victim of a data breach. The breach revealed sensitive data from nearly 2.5 million customer accounts, including email addresses, delivery addresses, and birth dates.

Uber agrees to acquire Drizly

On Feb. 2, Uber agreed to acquire Drizly for about $1.1 billion in a stock and cash deal. Uber anticipates that over 90 percent of the consideration will be through Uber’s common stock, while the balance will be paid in cash. The transaction should close in the first half of 2021. The deal is subject to regulatory approvals and other customary closing conditions. Following the completion of the acquisition, Uber plans to maintain Drizly as a separate app while integrating the alcohol delivery feature into the Uber Eats platform.