With Christie’s and Sotheby’s Both Private, No Major Auction House Is Publicly Traded

Is Christie’s publicly traded? The auction house grabbed investors' attention with its historic Beeple sale on Nov. 9, 2021.

Nov. 9 2021, Published 11:52 a.m. ET

Christie’s was in the limelight on Nov. 9, 2021, as the famed auction house put HUMAN ONE, the first physical artwork by famed NFT artist Beeple, on the auction block. The 7-foot multimedia sculpture, depicting an astronaut walking across sci-fi landscapes, is expected to get $15 million, according to The Wall Street Journal. However, whereas you can invest in HUMAN ONE and other artworks Christie’s sells, you can’t invest in the auction house itself: Christie’s isn’t publicly traded.

In fact, as of 2019, when a French billionaire acquired Sotheby’s, no major auction house has been public, according to Art World Insights. It also reported that during the two decades that Christie’s was a private company and Sotheby’s wasn’t, Christie’s had more flexibility than its rival. Here’s the backstory.

Christie’s was a public company from 1973 to 1998

According to Forbes, Christie’s was a public company listed on the London Stock Exchange from 1973 to 1998, when French businessman François Pinault acquired the company and took it private.

Pinault, an art collector and the founder of luxury group Kering and investment company Groupe Artémis—and, incidentally, the father-in-law of Hollywood actress Salma Hayek—initially purchased 29.1 percent of Christie’s for $243.2 million in May 1998. Two weeks later, he announced his intention to purchase the rest of the company in a deal that valued Christie’s at $1.2 billion.

As The New York Times reported at the time, the sale marked the first time in the British company’s two-century history that it would be owned by a Frenchman. It also put Christie’s in league with Pinault’s other holdings at the time, which included French department store Printemps, luggage brand Samsonite, and sneaker brand Converse. “There is significant potential for Christie’s as a private business as the trade in works of art continues to grow around the world,” Pinault said in a statement upon the acquisition.

Christopher M. Davidge, Christie’s CEO at the time, said that Pinault’s acquisition offer represented “good value” for the auction house’s shareholders. “Francois Pinault is a long-standing client of Christie’s, and the involvement of Artemis, his holding company, will enhance our ability to provide financial flexibility for our clients,” he added.

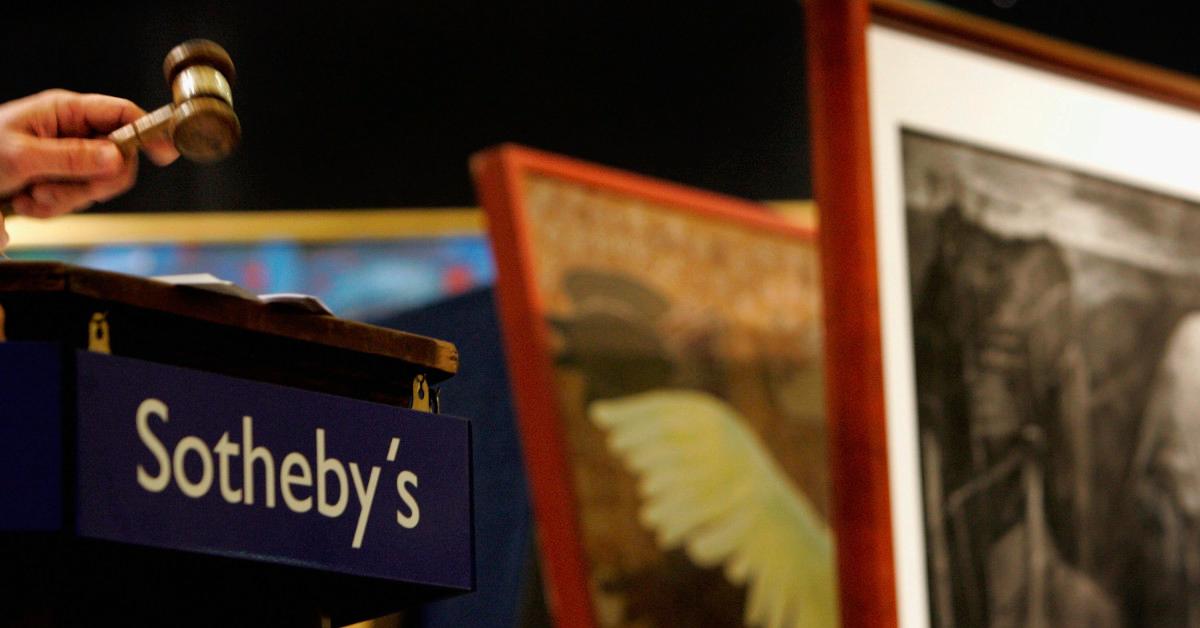

Sotheby’s was public from 1988 to 2019

Sotheby’s was a public company for longer and more recently than competitor Christie’s. American businessman A. Alfred Taubman bought Sotheby’s in 1983 and took it public in 1988, according to Forbes. The company traded on the NYSE under the ticker symbol "BID".

Patrick Drahi, a French-Israeli media and telecom businessman, purchased Sotheby’s in 2019 in a deal valued at $3.7 billion. Upon the closing of the acquisition later that year, Sotheby’s went private, ending its tenure as the oldest company traded on the NYSE, according to The Art Newspaper.

“[Drahi] has a long-term view and shares our brand vision for great client service and employing innovation to enhance the value of the company for clients and employees,” Tad Smith, then-CEO of Sotheby’s, said in a statement. “This acquisition will provide Sotheby’s with the opportunity to accelerate the successful program of growth initiatives of the past several years in a more flexible private environment,” he added.