LIDAR Leader Innoviz Is Poised to Go Public Soon Through Blank Check Merger

Innoviz is going public soon through the SPAC route. When is the Innoviz SPAC merger and at what price is the company going public?

Dec. 17 2020, Updated 8:56 a.m. ET

Innoviz Technologies, a LiDAR technology leader, plans to merge with a SPAC, Collective Growth Corporation, soon to go public. Innoviz will likely raise $350 million in gross proceeds through the merger.

SPACs have emerged as a popular route for companies to go public in 2020. When is the Innoviz SPAC merger? At what valuation is Innoviz going public? What are other popular LiDAR stocks?

Innoviz LiDAR

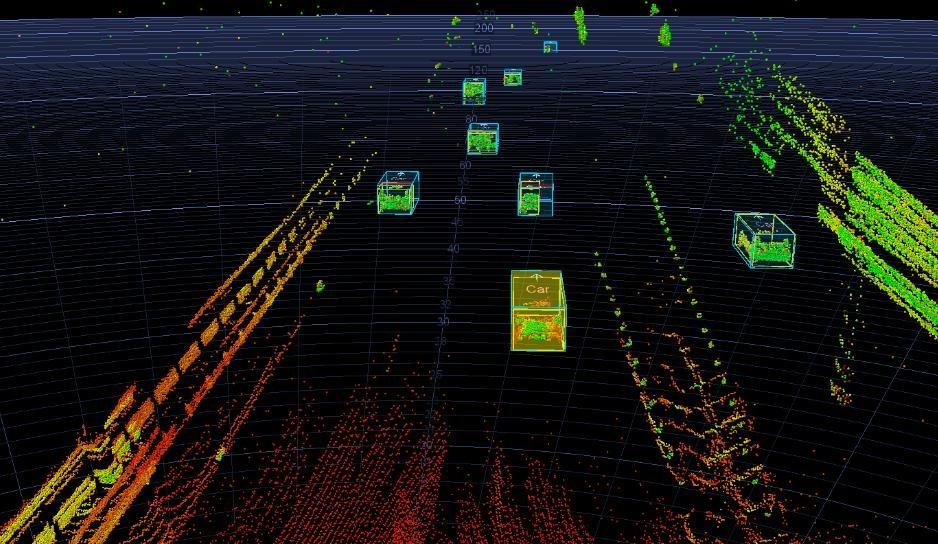

Innoviz Technologies is an Israel-based technology leader of LiDAR (light detection and ranging) sensors and perception software. LiDAR is a way for self-driving cars and robots to use lasers to detect objects. These types of sensors enable the mass production of autonomous vehicles.

The company was founded in 2016 by a group of Israeli Intelligence Corps veterans from Unit 81, which is the most prestigious technological unit in the Israeli Defense Forces. Along with its mobility tech partner, Magna International, Innoviz was the first to bring a high-end LiDAR to the market, which also met the stringent requirements of automotive OEMs, robo-taxis companies, and Tier 1 suppliers.

Innoviz Technologies’ SPAC merger

On Dec. 11, Innoviz announced that it will merge with Collective Growth Corporation, a SPAC, to become a publicly listed company. The transaction is being sponsored by Antara Capital LP and Perception Capital Partners. The deal will provide nearly $350 million in gross proceeds to the company. The merger is comprised of $150 million of cash held in Collective Growth’s trust and $200 million fully committed ordinary share PIPE (private investment in a public company) at $10 per share led by Antara Capital and includes strategic investments from Magna International.

The company is expected to be listed on Nasdaq under the ticker symbol "INVZ." The transaction will likely close in the first quarter of 2021. All Innoviz shareholders will retain 100 percent of their shareholding in the public company. Collectively, the company's investors, including Zohar Zisapel and venture capital funds Vertex, Magma, and Softbank Korea, will own 71 percent of the merged company. The PIPE investors will hold 14 percent and the public, through the SPAC, will hold 11 percent. Another 4 percent will be held by the SPAC’s sponsors.

What is Innoviz’s valuation?

If the transaction is approved by Collective Growth shareholders, Innoviz will have a valuation of $1.4 billion post-money. The valuation is significantly higher than Innoviz’s last valuation of $600 million when it raised funding in June 2019. Innoviz’s two competitors, Luminar and Velodyne, also went public through the SPAC route.

What are some popular LiDAR stocks?

In 2020, the companies that are associated with EVs or autonomous vehicles have been very popular. LiDAR stocks are definitely a popular group of stocks. LiDAR stocks have been gaining increased popularity for their critical association with autonomous vehicles. Luminar is one such LiDAR stock. Luminar went public through the SPAC route on Dec. 3. The stock almost doubled in value immediately after listing.

Velodyne is also popular LiDAR stock. The company went public through a reverse merger on Sept. 30. Velodyne has a first-mover advantage in the LiDAR-sensor category.

AEVA is another LiDAR company that's expected to go public through the SPAC route soon. Two Apple engineers started the company and it's backed by Porsche SE. AEVA's post-deal market valuation is expected to be $2.1 billion.