Humacyte Is the Next Biotech Company to Join SPAC Train for IPO

Humacyte is taking the back door public with SPAC company Alpha Healthcare Acquisition Corp. What can investors expect?

May 11 2021, Published 12:02 p.m. ET

Biotechnical engineering brand Humacyte is taking a SPAC to the public market. The company is known for its commercially produced bioengineered human tissue. The blank-check IPO deal will purportedly help the company extend its reach.

Humacyte is joining forces with Alpha Healthcare Acquisition Corp. (NASDAQ:AHAC) in the reverse merger deal.

What to know about Humacyte

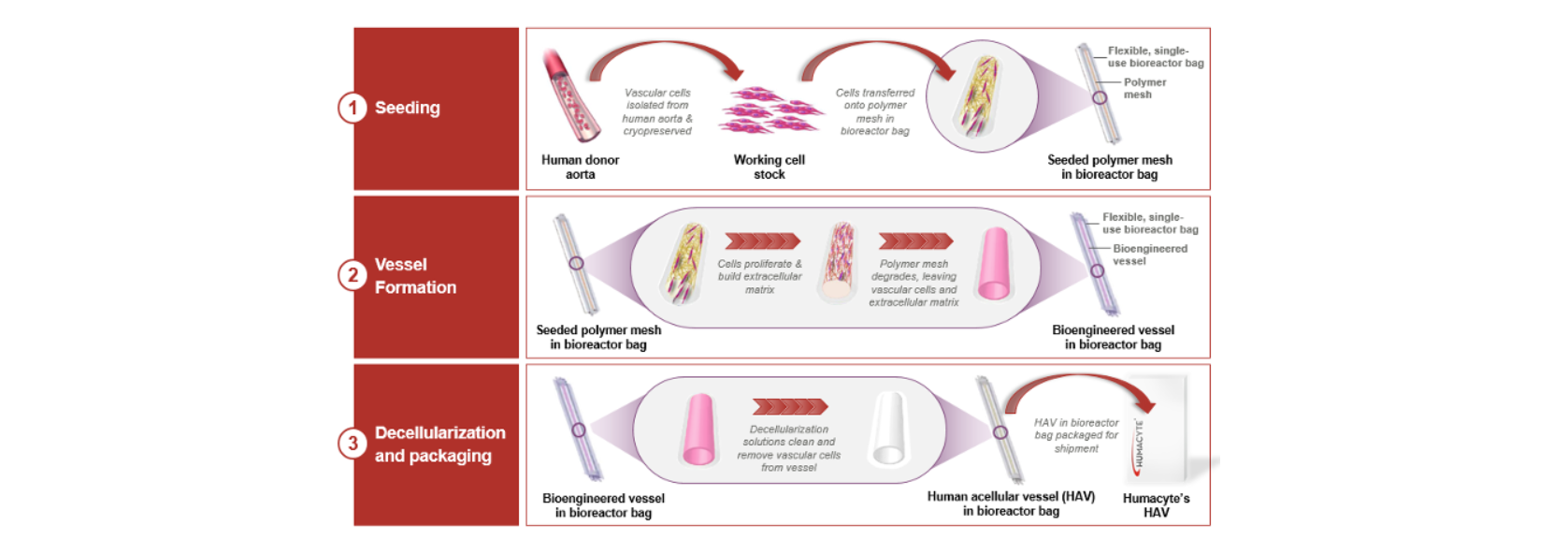

Humacyte's key product is something called an HAV (human acellular vessel). According to the company's website, this tool is a "regenerative vascular prosthesis" that's designed to repair and rebuild blood vessels wherever and whenever the patient requires it. The most interesting fact about the HAV is that it's universally applicable, which means that it can be implanted in any patient.

Humacyte is based in Durham, N.C., and has strong ivy league ties, particularly with Yale and Duke universities.

Details of the Humacyte SPAC IPO deal

The reverse merger of Humacyte by AHAC is valued at $1.1 billion. This includes $175 million in committed financing by the blank-check firm. They have also secured a $50 million senior commercial loan from Silicon Valley Bank, most of which will be available after meeting certain milestones in business and clinical research.

Once the deal is finalized, AHAC stock will switch to Humacyte Inc. with the ticker symbol "HUMA." The stock will remain on the Nasdaq Exchange.

How will Humacyte stock fare in the market?

Humacyte is a female-led operation (CEO Laura Niklason founded the company in 2004). This gives it an edge in the impact sector for gender-lens investing. Niklason will remain CEO after the deal.

While the biotech sector is currently dipping along with the broad tech sector, it's an industry with lots of potential for forward momentum. Any company that partakes in clinical research will see a major delay in profit, but an early investment in a promising company could pay off. Even before the SPAC deal went down, Humacyte boasted a $450 million valuation following an institutional investment round.

Should you buy AHAC stock ahead of the Humacyte merger?

Investors can purchase AHAC stock now before the "HUMA" ticker lands on the Nasdaq. Shares are currently trading below the $10 mark, which could mean slight returns shortly after Humacyte goes public (that's expected to happen soon).

There's a risk in investing in SPAC stocks before the merger is finalized. For one, the SPAC deal could be called off. Also, the value of the stock could decrease after you purchase it, much like a traditional IPO. Humacyte isn't expected to rake in quick profits and FDA approval is still far out, so an early SPAC investment of this kind is definitely worth diligently researching.

On the plus side, AHAC was founded in 2020 and snagged Humacyte as a target extremely quickly. SPACs were once viewed to be in a lower echelon than traditional IPOs, but that notion is changing, and many successful companies are opting to take this route. Humacyte has a good key product and the potential for expansion is strong, which could make an AHAC investment worth your while in the long term.