How Do Rich People Avoid Taxes? Secrets of the Wealthy

The not-so-secret part about being rich is avoiding a ton of taxes. In many cases, it’s totally legal. Here’s how rich people lower their tax bills.

April 29 2022, Published 2:56 p.m. ET

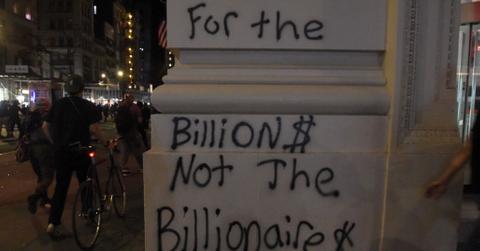

Seeing how much of your hard-earned money gets taken by taxes can be painful, even if you support higher tax policy. In contrast, seeing how little taxes the wealthy pay can feel infuriating, especially for the nearly 90 percent of American households making $200,000 or less. How do rich people do it?

In many cases, rich people find legal loopholes to avoid taxes, like funneling money through corporations and maintaining wealth in unsold equity. Here’s a deeper look into how the upper class trims their tax bill.

How much do wealthy Americans save on taxes each year?

Members of the Walton family (L-R) Rob, Alice, and Jim of Walmart Inc.

According to a 2021 report from the U.S. Department of the Treasury, the highest echelon of wealthy Americans are seriously minimizing their true tax rate. In fact, the ultra-rich in America's top one percent save an estimated $163 billion annually in taxes each year.

This money, which the Treasury refers to as “lost revenue,” is equivalent to taxes paid by the lowest-earning 90 percent of taxpayers. The Treasury adds, “The tax gap can be a major source of inequity.”

This data is a key influence for Biden’s proposed billionaire’s tax, which requests a 20-percent minimum tax on households with $100+ million net worth.

Common tactics rich people use to avoid paying taxes:

One key method rich people use to avoid taxes in the U.S. is asset-based lending, or borrowing from your own portfolio. Wealthy individuals will literally take a loan out against themself to eliminate capital gains taxes. This is a portfolio loan, and the Internal Revenue Service (IRS) does not tax them.

Generational wealth is even more ingrained. Wealthy people can hold assets without realizing gains until they die and pass those assets on to their kin. When this happens with large amounts of property, rich families can avoid major capital gains taxes.

Equity compensation is a major driver in keeping taxable income low. Rich people balance out any capital gains taxes with capital losses from other investments that lost value at the time of sale. The practice of tax-loss harvesting is key here.

Rich people's accountants are skilled in avoiding transferring wealth taxes.

Transferring wealth can incite major taxes. Typically, this comes in the form of federal estate or gift taxes, which can amount to a whopping 40 percent. However, there are ways around this.

The lower threshold for taxation on gifts and estate transfers is $11.7 million for individuals and $23.4 million for married couples filing jointly. In 2025, these limits will reduce to $6 million and $12 million, respectively. Until then, rich people can bestow multiple gifts below the threshold without having it docked from their lifetime exemption and potentially incurring a 40-percent tax hit.

As you can imagine, rich people will be making making many gifts below the higher threshold until it decreases in a few years.

Are rich people generous—or just avoiding taxes?

Charitable donations through philanthropic causes can decrease taxes for rich people. Looking to people like Bill Gates and MacKenzie Scott, the philanthropy is undeniable, and so is the tax break.