What's Driving the Wild Rally in GameStop (GME) Stock?

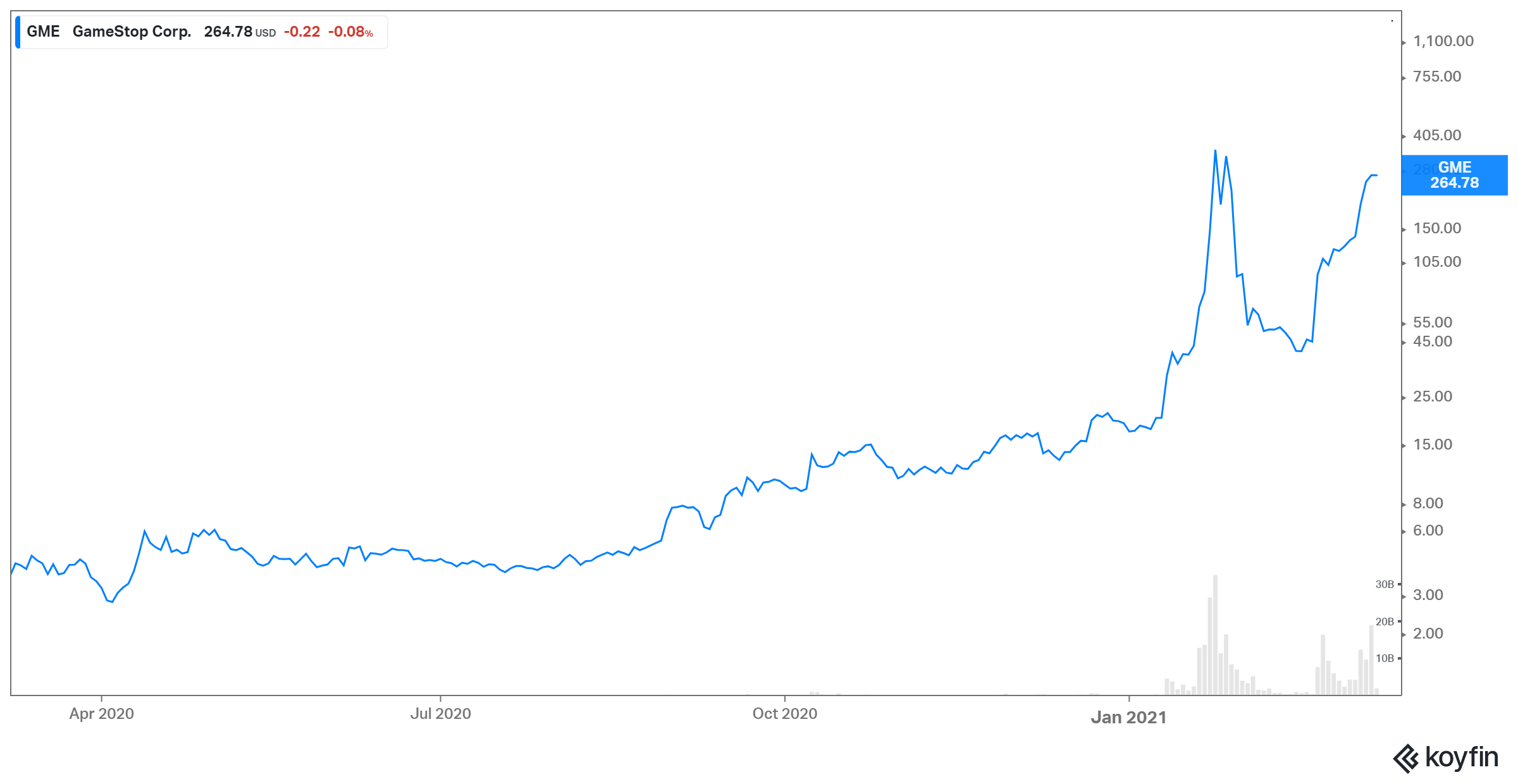

Game Stop stock has doubled in less than five trading days. Is the GameStop (GME) stock short squeeze to blame for the stock’s recent rally?

March 11 2021, Published 11:34 a.m. ET

To someone who hasn't been following GameStop stock’s journey, the price movement on March 10 won't seem unusual. After all, the stock was up just 7.3 percent for the day at the close. However, if you followed the trading in the stock on the day, you would know that something deeper was going on with the stock.

After opening, GME stock surged by nearly 29 percent to reach the high of $347. The stock dropped by 43 percent to $198 within 30 minutes. It fought back again and closed at $246.9. During the volatile trading, the stock was halted seven times. So, what caused such huge volatility in GME stock? Was it driven by another GameStop stock short squeeze?

GameStop's short interest

GME stock has rallied by 113 percent in just the last five trading days. The rally witnessed in GameStop stock in January was undeniably accelerated by a short squeeze. Reddit Group WallStreetBets users started buying the stock in unison. GME was a classic short squeeze candidate with almost 140 percent short interest (shorted shares as a percentage of float) at one point. While a short interest of above 100 percent is rare, it isn't impossible or unheard of.

Since then, the short interest in the stock has come down significantly. For example, Melvin Capital lost over half of its value in January 2021 and eventually closed the short position. Other big shorts were also forced to cover their positions. According to Market Beat, the short interest as of Feb. 26 was 26.06 percent. According to Ihor Dusaniwsky of S3 Partners, the short interest was 25.38 percent of the float.

Is a short squeeze happening in GME stock?

Since the short interest in GME stock has fallen down significantly, the recent price action in the stock probably hasn't been driven by a short squeeze. Part of what drove the fundamental rally in GME stock was Ryan Cohen taking a role at the company, which would drive its transition to e-commerce. Cohen, who successfully led Chewy, took 10 percent interest in GME in September 2020 and joined its board in February.

According to Yahoo Finance, S3 Partners said that the recent surge in GameStop shares hasn't coincided with an increase in the short interest, as it did during the last episode in late January. This rally lacks “any sort of short squeeze behavior.”

Is a short squeeze still possible in GME stock?

Does that mean that a short squeeze isn't possible in GME stock? That might not entirely be the case. Dusaniwsky of S3 Partners tweeted that “$GME is still in a moderate short squeeze as shorts continue to slowly close their positions, I still see it as a short squeeze candidate.” While a short interest between 30 percent and 40 percent is generally seen as high short interest, GME’s interest of nearly 25 percent is still high to initiate a short squeeze if the prices are driven higher sufficiently.

Most shorted stocks

The most shorted stocks in the U.S. include International Flavors & Fragrances, Du Pont de Nemours, Amazon, AstraZeneca, and Carnival, according to S3 Partners. The other most shorted stocks include National Beverage, Tanger Factory Outlet, Ligand Pharmaceuticals, and Fulgent Genetics.

Is WallStreetBets pumping GME stock again?

We can’t be sure that WallStreetBets is the one that is pumping GME stock. However, they definitely seem to be part of the equation. One Reddit user named jbver wrote in a post, “Still time to hop on board GME… final preparations are in place before lift off but the gate is still open!” While the trigger came from Cohen’s increased involvement with the company, which is expected to turn the stock around, the momentum took over to drive the stock even more.

While the recent price action in the stock might have been positive, there doesn’t seem to be much of a difference in the company’s prospects from a few months ago to justify the rally. Therefore, it wouldn't be wise to bet on the stock just based on the recent momentum.