Fusion Energy Companies Are Popping Up—Will We See Stocks Soon?

Stock market enthusiasts are taking notice of fusion energy companies. When will they be able to invest? Here's what investors can expect.

July 28 2021, Published 1:54 p.m. ET

A large-scale shift to renewable energy is looking us straight in the face, and there's no escaping. Fusion energy is on the frontlines, despite the fact that it isn't commercially available yet. However, many view nuclear fusion energy as the benchmark for what clean, renewable energy should be, and they're banking on a fusion future.

Naturally, the stock market and Reddit are taking notice. When will fusion energy stocks be available to investors? Will we see the stocks in 2021?

What Reddit users are saying about fusion energy

The "Nuclear Fusion" subreddit is ripe with optimism, but posts within the subreddit definitely contradict one another at times. Users share resources from governmental departments working on fusion energy as well as individual or startup engineers working to find a solution to fusion's biggest obstacles.

Startups like NearStar Fusion Inc. and Tokamak Energy are getting some buzz on this Reddit feed. Surely WallStreetBets users are crossing over to take a peek in hopes that one of these hyped-up companies will go public for investors to capitalize on.

Will we see fusion energy stocks in 2021?

Don't expect to see fusion energy stocks this year or next year. In April 2021, U.S. scientists introduced a new fusion reactor concept. The estimates for fusion energy timelines have shrunk at a fairly slow pace over the years.

According to WHYY, "If scientists can figure out a way to reliably produce and sustain nuclear fusion on Earth using elements commonly found in ocean water, virtually unlimited energy could be available at the push of a button—all without the risk of harmful carbon emissions from burning fossil fuels, the variability of wind and solar power, and the potential of meltdowns and radioactive waste from nuclear fission."

Some estimates say that we're still a decade out, but this is bound to change. For decades, the joke went that nuclear fusion energy is and will always be 30 years away.

Private fusion energy startups to watch

According to ITER, a multi-governmental collaboration on fusion energy, "Fusion, the nuclear reaction that powers the sun and the stars, is a potential source of safe, non-carbon emitting and virtually limitless energy. Harnessing fusion's power is the goal of ITER, which has been designed as the key experimental step between today's fusion research machines and tomorrow's fusion power plants."

Countries that back ITER (which means "the way" in Latin) include the U.S., China, the European Union, India, Japan, Korea, and Russia. However, private companies aren't waiting for the government to make leaps and bounds.

Part of investing in the stock market is learning to look ahead. That means familiarizing yourself with powerful, growth-oriented startups. These are the companies that could IPO in the future if their concepts work in the real world. It's best to have a general understanding of any industry before investing, especially with an industry as experimental as fusion.

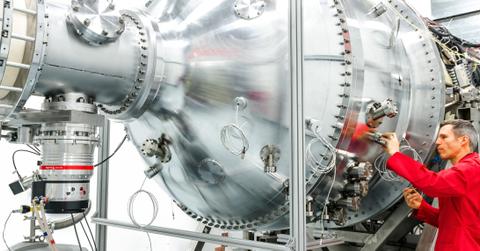

Commonwealth Fusion Systems was born in an MIT research lab. The company launched a nuclear fusion reactor project in Massachusetts.

TAE Technologies just raised $280 million to build its next device. General Fusion is a Canadian company with a viable prototype expected sometime this decade.

The private sector is helping public companies develop more than 100 experimental fusion reactors. However, the U.S. continues to prioritize wind and solar. As a larger percentage of energy transitions to renewable sources, fusion could help fill the gap (if engineers can get it to work at scale, that is).